FINRA’s advertising rules set the ground rules for how broker-dealers and other regulated firms communicate to the public. With new marketing channels emerging and investors expecting greater transparency, firms cannot afford to treat these rules as an afterthought.

Whether you’re managing a traditional brokerage or building a cutting-edge fintech platform, these guidelines shape how you can promote your products, explain your services, and communicate with customers, without crossing regulatory lines.

In this article, we will cover what FINRA advertising rules include, who they apply to, and the steps needed to mitigate regulatory risks in marketing compliance. We will also walk through the core standards, highlight common high-risk areas, and review the latest updates from FINRA that every firm should keep in mind.

What Are FINRA Advertising Rules?

Think of FINRA’s advertising rules as a playbook. They guide how financial firms communicate and share information with the public by setting boundaries around what they can say, how they say it, and where they say it.

To really understand them, you should start with the basics: where the rules come from, which firms they apply to, and how regulators enforce them day to day.

Overview of Rule 2210 and Why It Matters

At the center of these requirements is FINRA Rule 2210. This rule lays out the standards for how broker-dealers and their teams present themselves to the public. It also covers a wide range of communications, including print ads, websites, emails, social media, and mobile apps.

The goal is straightforward: protect investors. To achieve that, communications should be fair, balanced, and not misleading. In practice, this means showing risks along with potential benefits, avoiding unrealistic promises, and giving enough context so people can make informed choices.

For fintech firms, Rule 2210 is especially important. New products like hybrid brokerages, crypto platforms, and app-based trading tools bring their own marketing challenges. And under this rule, even something as short as a tagline or an app store description may be treated as advertising.

Which Firms and Communications Are Subject to These Rules

Any firm that is a FINRA member, including broker-dealers and fintech companies engaged in securities activities, has to follow Rule 2210. It does not matter how big the firm is, what kind of business model it uses, or what its marketing approach looks like. If the firm communicates with the public to promote its products or services, those messages fall under the rule.

The coverage is wide. It includes direct outreach to clients, public-facing content, and even materials created by third parties if the firm decides to use or share them. For instance, if a broker-dealer hires a marketing agency to run a social media campaign, the firm is still responsible for making sure every post follows FINRA’s standards.

This responsibility applies to both retail and institutional audiences. The key difference is that the rules are stricter for retail communications. For example, projecting performance is not currently allowed. That is why correctly identifying the audience is so important, along with following the right steps for review, approval, and recordkeeping before any content is published.

Role of FINRA and SEC Oversight

Regulator | Primary Role | Key Role/Focus | Scope of Oversight |

|---|---|---|---|

FINRA | Day-to-day regulator for broker-dealer advertising | FINRA Rule 2210 – requires communications to be fair, balanced, and not misleading | Broker-dealers and their marketing materials |

SEC | Sets a broader securities advertising framework | Federal securities laws & specific rules for offerings and investment company materials | Registered offerings, mutual funds, investment companies |

BOTH | Ensure investor protection and fair communication | Combination of FINRA Rule 2210 + SEC advertising rules | Products that involve both securities and investment companies (e.g., mutual funds, structured notes, hybrid products) |

FINRA is the primary regulator when it comes to advertising by broker-dealers. But it’s not the only one. Its authority works alongside the US Securities and Exchange Commission (SEC), which sets the bigger picture for securities laws.

FINRA enforces Rule 2210 and checks whether a firm’s communications are fair, neutral, and accurate. The SEC, on the other hand, focuses on broader advertising rules, especially for registered offerings and investment company materials. Some products, like mutual funds or structured notes, should follow both sets of rules. In those cases, one piece of marketing may need to pass two different reviews before it can go out.

For firms that offer a mix of products, such as securities combined with crypto or other assets, this overlap can get complicated. Ultimately, a clear understanding of who regulates which product can help compliance teams know which rules apply, when filings are required, and how to plan reviews so both regulators are satisfied.

What Counts as “Advertising” Under Rule 2210

Under Rule 2210, advertising means more than paid promotions. It covers almost any communication with the public that could shape how investors view a firm or its products. Here’s a closer look at what falls under this category and why it matters.

Retail Communications vs. Correspondence vs. Institutional

Rule 2210 uses the term “communications with the public” to describe what many firms think of as advertising. This category includes more than just paid promotions. It covers nearly any content a firm distributes that could influence an investor’s decision or perception of the firm.

You should also note that the rules for review, filing, and recordkeeping can change depending on the type of communication.

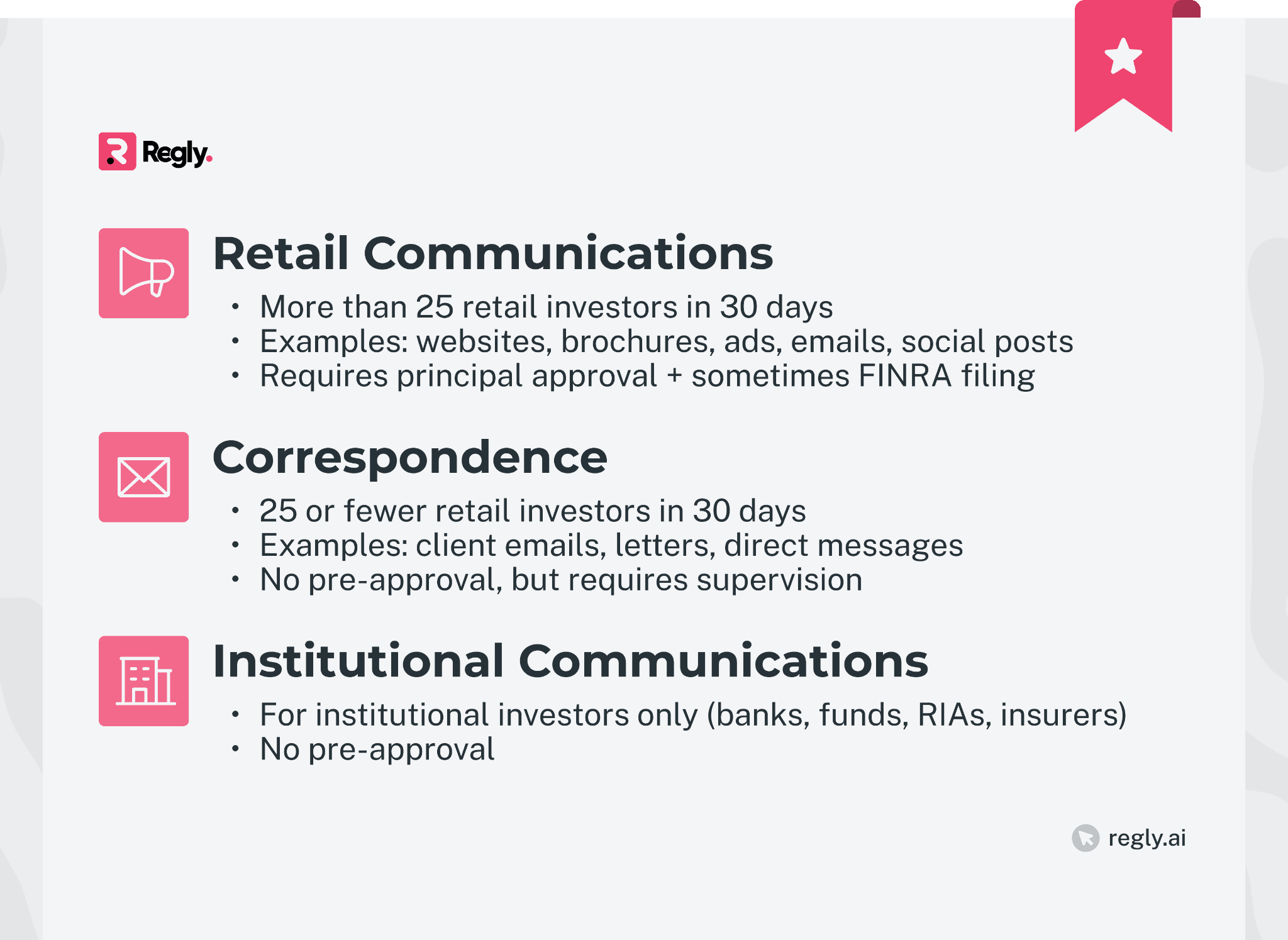

Retail Communications

Retail communications are any written or electronic messages sent to more than 25 retail investors within a 30-day period. FINRA defines a “retail investor” as anyone who does not qualify as an institutional investor. In other words, this category is broad and covers most consumer-facing marketing and client materials.

What does that look like in practice? Think websites, brochures, marketing emails, investor presentations, paid ads, and social media posts. Even short formats like banner ads or push notifications can fall into this group if they promote a product, service, or investment opportunity.

Because these messages reach a wide audience that may be less experienced, they come under the most scrutiny. That is why FINRA generally requires principal approval before firms engage in retail communications. In some cases, firms should also file them with FINRA either before or shortly after launch.

To help manage these reviews more efficiently, many firms use regtech software such as Regly’s marketing compliance tool, which flags potential compliance risks, speeds up approvals, and keeps an audit-ready archive in one place.

Correspondence

Correspondence refers to written or electronic communications sent to 25 or fewer retail investors within 30 days. Unlike retail communications, it is more personal and often used for one-to-one or small-group interactions.

Typical examples include client emails, direct messages, or letters responding to specific questions. These communications usually do not require principal approval before being sent. However, firms are still expected to supervise them in a way that keeps everything in line with Rule 2210’s content standards.

Supervision can take many forms, such as spot checks, automated monitoring, or periodic reviews of samples. Even without formal pre-approval, correspondence should still be fair and free of misleading statements.

That is why training staff is so important. Employees need to understand that the same rules against exaggeration or leaving out key facts apply here just as much as they do in retail communications.

Institutional Communications

Institutional communications include written or electronic messages shared only with institutional investors. FINRA includes in this group banks, investment companies, insurance firms, registered investment advisers, and certain high-net-worth individuals who meet specific criteria.

Since this audience is considered more financially sophisticated, these communications don’t face the same pre-approval requirements as retail materials. Instead, firms should create procedures to review them in a way that supports compliance with Rule 2210. This usually means periodic sampling and review rather than checking every single piece before it goes out.

Even though the oversight is lighter, the same principles apply. Institutional communications should still be free of misleading statements. Complex products, performance data, and risk disclosures also need to be presented clearly enough for institutional audiences to make well-informed evaluations.

Using Regly’s marketing compliance tool, compliance teams can flag risky claims faster, assign materials for review, and centralize principal approvals in one platform.

Static vs. Interactive Content

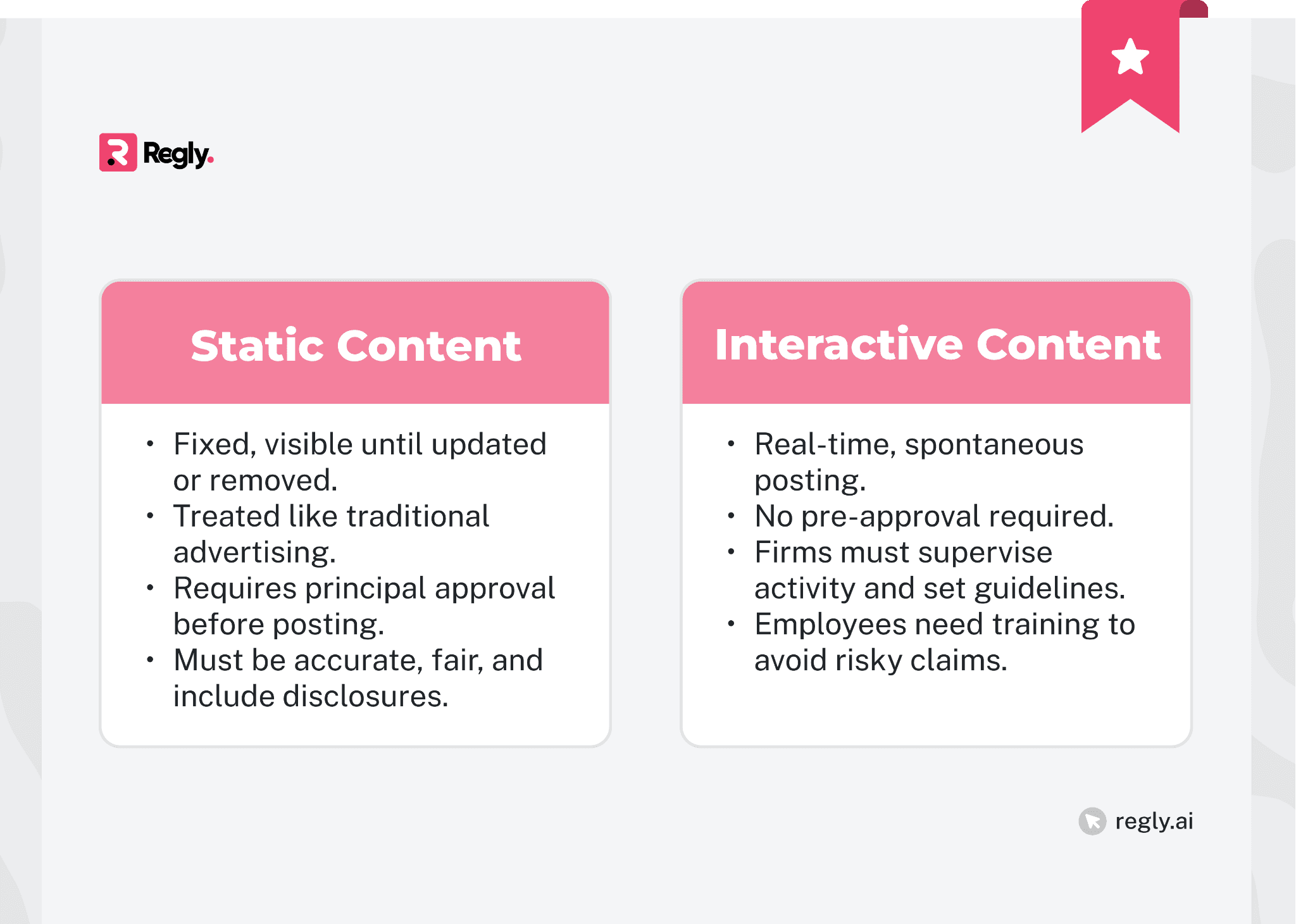

Rule 2210 groups some communications as either static or interactive. The difference matters because it changes how firms review, approve, and supervise the material.

Static Content

Static content is fixed and remains accessible until it is changed or removed. Examples include a firm’s website, a landing page, a PDF brochure, or a LinkedIn profile summary. Because this type of content can be viewed over and over, it usually requires principal approval before it is first published. Firms should take time to review it using tools like Regly Compliance for accuracy, clarity, and proper disclosures before making it public.

Interactive Content

Interactive content involves real-time communication. This could be replying to comments on social media, joining discussions in online forums, or sending instant messages during a webinar.

Unlike static content, interactive posts usually do not require pre-approval. However, they still need to be supervised and reviewed to mitigate regulatory risks. Many firms handle this by monitoring after posting, using keyword alerts, content sampling, or platform integrations to spot potential issues.

Examples of Covered Communications

Rule 2210 applies to far more than brochures or paid ads and often reaches everyday client communications and digital content. This broad scope is why firms should approach all outward-facing materials with a compliance mindset.

Websites and Landing Pages: Firm websites, investor portals, and landing pages are often the first stop for potential clients. Because of their visibility, these pages usually need pre-approval before going live. They should present information in a fair and balanced way, with proper disclosures for things like product descriptions, performance summaries, and educational resources.

Email and Newsletters: Marketing emails and newsletters sent to more than 25 retail investors in a 30-day period count as retail communications. These messages should go through compliance review to confirm they are accurate, clear, and include the necessary risk information. Even a single informational email can fall under oversight if it promotes an investment product or service.

Paid Media: Search engine ads, display banners, and sponsored content on third-party websites also fall under Rule 2210. Because these placements are so visible, they demand careful review. Claims should be accurate, risks clearly disclosed, and the message should make sense in the context where it appears.

Social Media Content: Posts on platforms like LinkedIn, X, Facebook, or Instagram often qualify as retail communications. Some of these are considered “static,” such as profile descriptions, pinned posts, or recurring campaign content, and they usually require pre-approval before going live. Other activity is more “interactive,” like replying to comments or posting in real time. These do not need pre-approval, but they still call for supervision once they are published.

Presentations, Webinars, and Pitch Decks: Materials used in sales presentations, investor webinars, or capital-raising meetings often highlight product features, performance details, or even disallowed projections. Because of this, firms should review them ahead of time to confirm they meet content standards, remove disallowed projections, and are appropriate for the intended audience.

Keeping up with the requirements of Rule 2210 can be challenging, especially when content spans multiple channels and formats. With Regly’s AI-powered marketing compliance software, you can review materials faster, flag risky language before it goes public, and keep a complete audit trail of approvals and disclosures. This unified approach supports smoother collaboration between marketing and compliance teams, with features designed to reduce compliance friction.

Core Rules and Approval Requirements Under FINRA 2210

Rule 2210 lays out standards for both what firms can say in their communications and the steps they should take before those communications go public. Knowing these rules helps in aligning marketing, sales, and investor-facing materials with regulatory requirements.

Truthfulness, Balance, and Disclosure Standards

Rule 2210 requires all communications to be fair, accurate, and never misleading. This applies not only to the content itself but also to the context in which it is presented. The goal is to give investors a clear and realistic picture, not a selectively positive one.

That is why firms need to present both sides. If a message highlights potential benefits, it should also explain the risks or limitations in plain terms. Leaving out important details can still mislead, even if the information provided is technically correct.

Disclosures are another key part of this standard. They should be easy to notice, written in straightforward language, and placed where the audience is most likely to see them. Most importantly, they should connect directly to the claims they explain. For instance, when a firm presents performance data, it should add the familiar reminder that “past performance is not indicative of future results,” along with any context needed to interpret the numbers.

Prohibited Language and Performance Claims

Rule 2210 sets clear boundaries on what firms can say in their advertising. Promises, exaggerations, or absolute statements are not allowed because they can mislead investors or set unrealistic expectations. Words like “guaranteed,” “no risk,” or “always profitable” should be avoided, since they suggest results no firm can truly deliver.

The rule also limits how firms present performance. Retail communications generally cannot include predictions, projections, or target returns. Even hypothetical scenarios can be risky if they look like forecasts. Historical performance may be used, but only if it comes with proper disclaimers, relevant time periods, and enough context for investors to understand the bigger picture. For example, highlighting a fund’s best year without showing weaker years would almost certainly be misleading.

When including performance data, make sure it’s rooted in complete and reliable sources. Comparisons with benchmarks or competitors should be fair, use consistent methods, and clearly identify where the numbers come from. The goal is to give investors useful information to make informed choices, not selective or speculative figures that only tell part of the story.

With Regly, firms can spot exaggerated language and keep disclosures tied to the claims they explain, all before content goes live.

Testimonials, Audience Suitability, Affiliate Identification

Rule 2210 allows firms to use testimonials in advertising, but only under strict conditions. Testimonials should be authentic, reflect the real experience of the person giving them, and include a clear disclaimer that results may vary and are not a promise of future performance. If someone is paid or given an incentive for their testimonial, that also needs to be disclosed in a way that is easy for the audience to notice.

Another key requirement is audience suitability. Communications should be written with the intended audience in mind, whether retail or institutional. This means choosing appropriate language, examples, and product details for the audience’s knowledge level and financial sophistication. Retail investors usually need simpler explanations and more visible risk disclosures than institutional investors.

Affiliate identification is also critical. If an advertisement mentions products or services from an affiliate, clearly state that relationship. This is especially important if the affiliate is not a FINRA member or if its products are not subject to the same investor protections. Regulators have taken action in cases where firms promoted both securities and crypto services without making these relationships obvious.

Principal Approval and Filing Timelines

Rule 2210 sets clear expectations for when advertising materials should be reviewed by a registered principal and, in some cases, filed with FINRA. These steps help confirm that communications meet content standards before they reach the public.

Principal Approval: Most retail communications need approval from a registered principal before first use. This includes websites, brochures, email campaigns, and social media posts that count as static content. The review should confirm that the material is accurate, complete, and contains all required disclosures.

Filing with FINRA: Some communications should also be submitted to FINRA in addition to internal review. New member firms face the strictest rules: during their first year, they should file all retail communications at least 10 business days before first use. Established firms still need to file certain product-specific ads, such as those promoting mutual funds, collateralized mortgage obligations (CMOs), security futures, and structured products. Firms can submit most of these filings within 10 business days after first use. However, more complex products, like options, require pre-use filing. In those cases, materials should be submitted to FINRA before going public.

Timelines and Workflow Management: Missing approval or filing deadlines can lead to regulatory problems. That is why firms benefit from having a structured workflow that tracks each piece of content from draft to approval to filing.

Social Media, Influencers, and Third-Party Content

Social media and third-party partnerships are great for connecting with investors, but they also bring higher compliance risks under Rule 2210. Any content that promotes a firm’s products or services, whether posted on an official account or shared by a partner, is held to the same advertising standards as traditional materials.

Personal vs. Business Use

FINRA makes a clear distinction between personal accounts used for private purposes and accounts used for business communications. Posts by a personal social media account that discuss the firm’s products, services, investment strategies, or market views are treated as business communications and should comply with Rule 2210.

This applies whether the activity is occasional or part of a planned outreach effort. Even a single post that promotes the firm’s offerings or comments on specific investments can trigger the same review, approval, and recordkeeping requirements that apply to official firm accounts.

To manage this risk, firms should create written policies that spell out when personal accounts can be used for business, what kinds of content are off-limits, and how posts will be captured and archived. Training employees is also essential. They need to know that even casual online activity can fall under regulatory review if it crosses into business topics.

Interactive vs. Static

FINRA views static and interactive social media content differently because of how each is created and consumed. Static content is fixed and stays visible until it is updated or removed. Interactive content, on the other hand, happens in real time and is often posted spontaneously.

Since static content functions much like traditional advertising, it usually requires principal approval before going live. The same standards apply here as in other ads: information should be accurate, presented fairly, and supported with the proper disclosures.

For interactive content, pre-approval is not typically required, but supervision is still expected. Firms should set clear procedures for how interactive posts are monitored, establish guidelines for tone and accuracy, and train employees to avoid risky claims or misleading language when engaging with the public.

Supervising Influencer Campaigns

When a firm works with influencers or third-party promoters, the content they share becomes the firm’s responsibility once it is paid for or adopted. Under Rule 2210, it does not matter whether the influencer is an industry expert or a lifestyle creator. If the post promotes the firm’s products or services, it should follow the same standards of fairness, accuracy, and clarity as any other advertisement.

Oversight begins before the campaign goes live. Firms should review influencer scripts, draft posts, or talking points to confirm they avoid prohibited claims, include the required disclosures, and give a clear picture of both risks and benefits. Any compensation should also be disclosed in a way that is obvious to the audience in the final post.

Monitoring continues after launch. Compliance teams should track live campaigns to catch posts that drift from approved language or introduce new claims. If an influencer continues posting independently after a campaign ends, the firm should decide whether those posts are still promotional and subject to review.

Adoption and Entanglement Risks

Under Rule 2210, a firm can still be responsible for content it did not create if it is considered to have “adopted” or become “entangled” in that content. Adoption happens when a firm endorses third-party material, such as by sharing, reposting, or even liking a social media post. Entanglement, on the other hand, occurs when the firm helps shape the content, even if someone else ultimately publishes it.

In both cases, the firm is accountable for making sure the content is accurate, clear, and includes the right disclosures. For instance, reposting a customer’s testimonial without adding disclaimers can create a violation, even if the customer wrote it independently.

To mitigate this risk, firms should create clear guidelines for how employees interact on social media and how they work with third parties. Compliance teams should also review any outside content the firm wants to share or reference and keep records of that review process.

Advertising Recordkeeping and Surveillance Obligations

Keeping accurate records of advertising is a core requirement under both SEC and FINRA rules. These obligations apply to every type of business communication, no matter the platform or format. Alongside this, the Rule also expects firms to monitor how they create, review, share, and store communications.

What Should Be Archived and Why

FINRA and SEC rules require firms to keep a complete record of business-related communications, including advertising materials, for a set retention period. This rule applies to every format, including digital, print, audio, and video, and covers both internal communications and final published versions.

Archiving serves two key purposes. First, it allows regulators to review a firm’s past communications during an exam or investigation. Second, it gives firms a way to demonstrate compliance by showing when they created materials, how they reviewed them, and the included disclosures.

Typical materials that should be archived include:

Retail communications such as brochures, websites, and social media posts

Correspondence and institutional communications connected to marketing or product promotion

Scripts and recordings for webinars, presentations, or advertisements

Paid media placements, along with related creative ads

Records should be stored in a format that prevents alteration or deletion during the retention period.

SEC Rule 17a-4 and FINRA Rule 4511

Two major rules set the standards for how long and in what format firms should keep advertising and business communications: SEC Rule 17a-4 and FINRA Rule 4511. Both are designed to preserve a complete, tamper-resistant record that firms can produce if regulators ask for it during an exam or investigation.

SEC Rule 17a-4 establishes the baseline for broker-dealers. It defines minimum retention periods, acceptable storage formats, and controls to prevent records from being altered or deleted. For advertising and correspondence, the typical retention period is three years, with the first two years kept in an easily accessible location. Records should preserve the original content and format, along with metadata such as the creation date and any changes.

FINRA Rule 4511 builds on these requirements. It directs firms to comply not only with SEC rules but also with any other laws that require longer retention. It also stresses that records should be accurate, complete, and preserved in a way that prevents loss or destruction for the full retention period.

For compliance teams, this means integrating recordkeeping into the marketing review process. It is not enough to save the final approved version. Drafts, approval notes, and any related disclosures should also be archived.

Surveillance Expectations and Documentation Practices

Recordkeeping and surveillance go hand in hand. FINRA expects firms to have supervisory systems that track how advertising is created, reviewed, and distributed. This means compliance teams should be able to follow a piece of content from its first draft through final publication, with a record of any changes along the way.

Effective surveillance has two parts. On the proactive side, firms can set clear approval workflows, train marketing and sales teams on content standards, and use tools like Regly that flag risky language before materials are published. On the reactive side, firms should sample communications, audit archived content, and investigate any issues that surface.

Documentation ties everything together. Firms should keep proof of principal approvals, copies of FINRA filing confirmations when required, notes from compliance reviews, and records of revisions made after approval. Having this complete paper or digital trail helps during exams and also shows regulators that the firm’s approach to compliance is structured and consistent.

Modern Communication Risks: AI, Messaging Apps, and Off-Channel Use

New technology has opened fresh ways for firms to connect with clients and the public. At the same time, it has created new compliance risks under Rule 2210. Messages sent through AI tools, encrypted apps, or other “off-channel” platforms are still considered business communications. That means they should follow the same advertising and recordkeeping rules as more traditional media. Without proper oversight, these channels can create gaps in supervision and documentation that could lead to regulatory issues.

AI-Generated Content Oversight

AI tools can help firms create marketing copy, social posts, and other client-facing materials more quickly. But they also bring new compliance risks under Rule 2210. The Rule holds AI-produced content to the same standards of fairness, accuracy, and clarity as anything written by hand. If AI output includes exaggerated claims, leaves out required risk disclosures, or uses misleading language, the responsibility still rests with the firm.

The best approach is to treat AI drafts like any other advertising material. They should move through the same review, approval, and recordkeeping steps before publication. This means checking that performance statements are backed by data, disclosures are clear and visible, and product references are complete.

Supervisory procedures should also highlight how AI fits into the marketing process. This might include approving which tools can be used, setting rules for how prompts are written, and documenting edits made to AI-generated drafts before they go live.

WhatsApp, SMS, and Platform Supervision

Business communication through apps like WhatsApp, SMS, or Telegram is subject to the same FINRA advertising and recordkeeping rules as email, websites, and social media. The challenge is that these platforms are built for privacy and convenience, which makes supervision and archiving more difficult.

If an associated person uses a messaging app to discuss products, services, or market views with a client, those messages count as business communications. They should be captured, stored for the required retention period, and reviewed for compliance. Failing to capture off-channel messages has been a frequent enforcement issue in recent years, leading to significant penalties.

To manage this risk, firms should define which platforms are approved for business use, put technology in place to capture and store communications, and provide regular training on when and how to use these tools. Policies should also clarify which platforms are not permitted, while compliance teams monitor for unauthorized activity.

Tools for Capture, Approval, and Surveillance

Off-channel communications are any business-related messages sent through platforms or devices that are not part of a firm’s approved and monitored systems. These can include personal email accounts, private messaging apps, or unapproved collaboration tools. When firms use these channels for discussions about products, services, or market activity, they are subject to the same FINRA advertising and recordkeeping requirements as approved platforms.

The main compliance challenge is that off-channel communications can bypass a firm’s capture and archiving processes. This creates blind spots in supervision and makes it harder to produce records during a regulatory exam or investigation. Regulators have issued significant fines in recent years for firms that failed to capture and retain this type of communication.

To mitigate this risk, firms should:

Define which platforms are approved for business communications

Use technology that automatically captures and stores messages from those platforms

Train staff on prohibited channels and the consequences of using them for business purposes

Periodically audit for unapproved communication methods to identify and address gaps

High-Risk Communication Areas Under FINRA Advertising Rules

Certain types of advertising are more likely to draw regulatory attention because they can easily mislead investors or leave out important details. FINRA regularly highlights these areas during exams and enforcement actions, which makes them a top priority for compliance teams to watch closely.

Crypto-Related Advertising and Affiliate Structure

Promoting crypto products and services comes with added compliance risks under FINRA’s advertising rules, especially when affiliates are involved. A common problem is investor confusion about which entity is actually providing the service and what protections apply. For example, a FINRA-member firm promoting crypto trading through an affiliate should clearly identify that affiliate and state whether it falls under FINRA oversight or protections like SIPC coverage.

This requirement applies across all advertising formats, from websites and social media to email campaigns and paid promotions. Disclosures should also be easy to find, written in plain language, and placed close to the claims they explain. Vague or buried disclaimers raise the risk of misleading investors and attracting regulatory attention.

When it comes to crypto-related materials, the need for careful review is even greater. Compliance teams should focus on how products are described, whether claims about security or protection are accurate, and whether risk disclosures are complete. If more than one entity is involved, the communication should make the relationship clear and explain any differences in regulatory status.

Options, Margin, and Complex Product Promotions

Advertising for options, margin accounts, and other complex products calls for extra care under FINRA’s rules. These products carry higher risks, which means communications should present both the potential benefits and the downsides in plain, easy-to-understand language. Highlighting only the upside is a fast track to regulatory scrutiny.

Take options trading as an example. An ad should spell out risks like the potential for significant losses, the need for active monitoring, and even the possibility of losing more than the initial investment. With margin accounts, disclosures should make it clear that borrowing to invest can amplify losses as well as gains. FINRA also expects firms to keep the language simple and avoid technical jargon that could confuse or mislead retail investors.

Because of these risks, complex product promotions require a strong review process. Principal approval is mandatory, and in many cases, firms should also file content with FINRA before or shortly after it is used. This is where the right tools can make a difference.

Gamified Mobile App Nudges and Investor Behavior

Gamified elements in trading apps, like confetti animations, push notifications, or achievement badges, have drawn close attention from regulators in recent years. Both FINRA and the SEC worry that these features can influence investor behavior in ways that may not serve their best interests. Under Rule 2210, any promotional material tied to these features should be reviewed for clarity, fairness, and suitability.

For instance, an app that sends congratulatory alerts for risky trades without highlighting potential downsides can give users a misleading impression. Even design choices, such as using bright visuals for gains and muted ones for losses, can be seen as biased promotion. When these elements show up in marketing materials or in-app communications, they are subject to the same standards as any other retail communication.

That’s why compliance reviews should look at more than just ad copy. Teams should also evaluate the design and user experience to spot where gamification might create misleading signals. Keeping records of these reviews and maintaining an audit trail for app content is critical.

What’s New in 2026: FINRA Updates to Advertising Rules

Several recent developments are shaping how firms approach advertising compliance under FINRA Rule 2210. While the core principles remain the same, regulators are experimenting with new processes and signaling fresh areas of scrutiny.

Pilot Program for Ad Submissions: FINRA has launched a pilot program that lets certain firms submit eligible ads through a revised review process. The aim is to shorten review timelines and provide clearer feedback. Participants still need principal approval and proper recordkeeping, but the pilot may point the way to more efficient filing in the future.

Proposed Exception for Institutional Projections: A rule change has been proposed that would let firms include forward-looking performance projections in materials for institutional investors. This change would not apply to retail communications and would come with strict conditions around methodology, disclosures, and supporting data. For firms that work with institutional audiences, it’s worth watching closely, since it could reshape how they approach marketing.

Enforcement Priorities: Regulators are paying closer attention to digital engagement. Mobile app designs, gamified features, and influencer-driven campaigns are being reviewed for fairness and accuracy. Enforcement activity is expected to rise in these areas, especially where interactive features might encourage risky behavior or downplay important disclosures.

With these changes on the horizon, firms may benefit from flexible tools that can adapt quickly. Regly’s marketing compliance software makes this easier by helping teams review materials, spot risks early, and keep audit-ready records in a collaborative platform.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.