Fintech companies thrive on speed, but rapid execution often leaves compliance lagging behind. Product and engineering teams aim to innovate, while compliance teams work to keep risk contained. This disconnect slows releases and creates gaps that regulators eventually notice.

A collaborative approach to compliance closes that gap, one that technology today can make easier. Modern compliance platforms centralize data, automate reviews, and connect departments in real time. For fintechs, this shift means fewer silos, stronger oversight, and faster, more coordinated execution.

This article explores how fintechs can use technology to break down the barriers that have long separated compliance from the rest of the business. It outlines the risks of siloed compliance, the tools that promote collaboration, and practical steps to build a compliance culture.

What “Collaborative Compliance” Really Means in Fintech

For many fintechs, compliance still feels like a separate function that happens after the product is built. Policies live in shared drives. Reviews happen over email. The result is compliance that reacts instead of guides.

Collaborative compliance shifts this mindset. It integrates compliance into how each team operates, so legal, product, marketing, and engineering collaborate on controls, documentation, and reporting inside a shared system.

At its core, this model treats compliance as an operational framework, not a static department. Every decision, from product design to campaign approval, passes through the same connected environment. That visibility helps teams catch issues early, track accountability, and keep records audit-ready without added bureaucracy.

In practice, this approach mirrors how regulators expect modern fintechs to function. Oversight isn’t about formality; it’s about traceability. A collaborative compliance system creates an environment where each team knows its role, information flows freely, and compliance becomes part of the company’s DNA rather than a periodic obligation.

Why Compliance Silos Still Exist and Why They’re Risky

In many fintechs, compliance still operates as a standalone department. Teams depend on email threads, shared folders, and spreadsheets to track reviews. Each group maintains its own records, creating inconsistent data, duplicate work, and unclear accountability.

This structure separates compliance from daily operations. Product and marketing move quickly, while compliance often joins late, after key decisions are made. The result is friction. Policies feel restrictive instead of practical, and teams view compliance as a final checkpoint rather than a partner in development.

Without a unified system, oversight weakens, and emerging risks go unnoticed. A collaborative compliance framework solves this by connecting oversight to product, customer, and operational data, giving teams shared visibility and faster coordination during audits or reviews.

Here are the key differences between traditional and collaborative compliance:

Traditional vs. Collaborative Compliance | ||

|---|---|---|

Aspect | Traditional Compliance | Collaborative Compliance |

Structure | A separate department reviews finished work | Integrated process across all teams |

Data Flow | Disconnected spreadsheets and emails | Centralized, real-time information |

Speed | Reviews happen after key decisions | Reviews embedded in daily workflows |

Accountability | Limited visibility into team actions | Shared ownership and clear audit trails |

Culture | Compliance is seen as a blocker | Compliance is viewed as a partner |

The Role of Technology in Breaking Down Silos

Technology plays a central role in modern compliance. For fintechs, the technological shift alone transforms compliance from a reactive process into a connected, data-driven function.

Here are reasons why technology may reduce silos when it comes to compliance:

Centralized Compliance Platforms and Workflow Automation

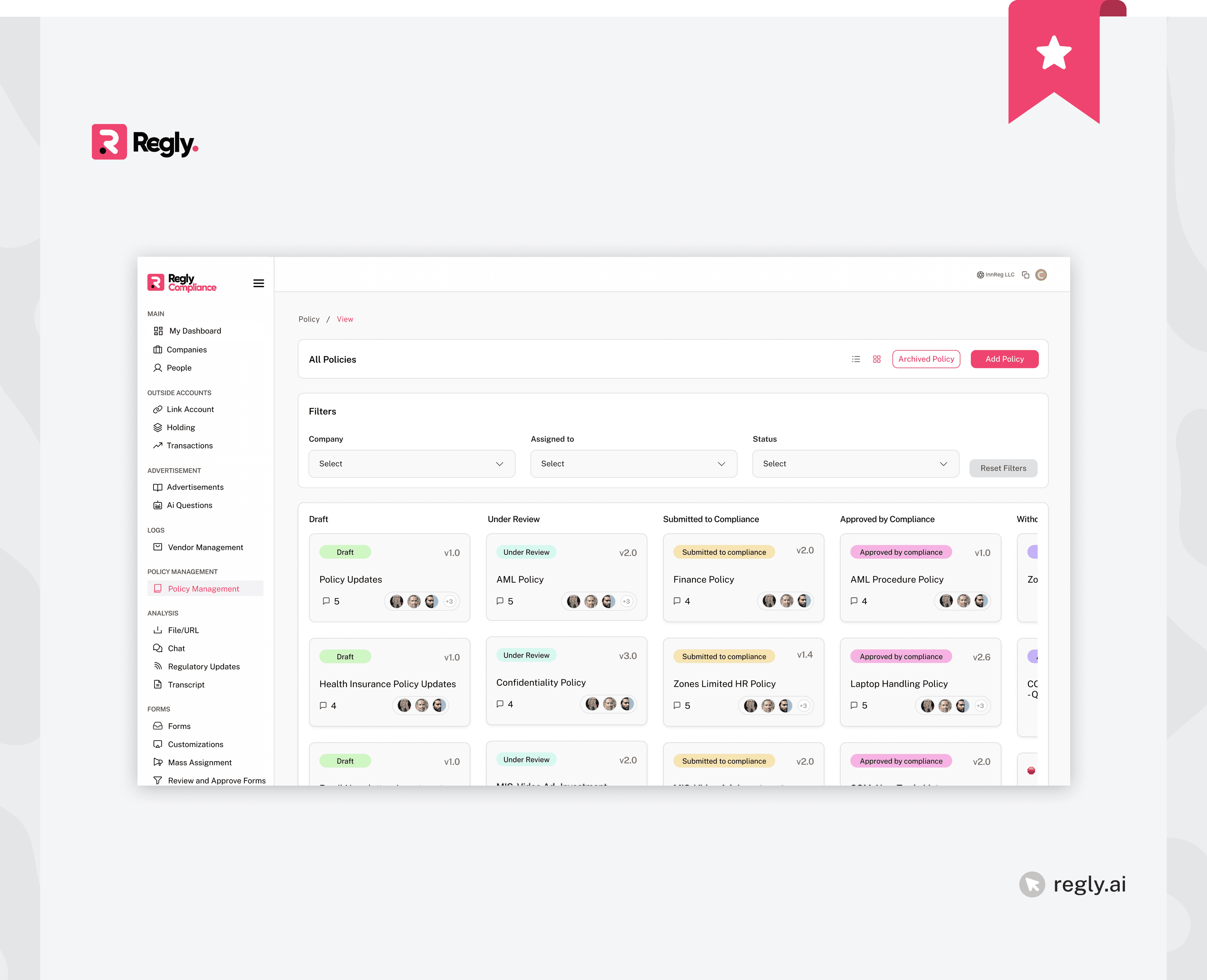

Oftentimes, fintechs are replacing manual reviews with automated compliance workflows that mirror how their teams already operate. Instead of juggling files and approvals through email, each department works in a shared platform that keeps information consistent and accessible.

Workflow automation assigns tasks, triggers reminders, and records outcomes as teams complete their part. This keeps reviews moving and builds an organized history of every compliance decision.

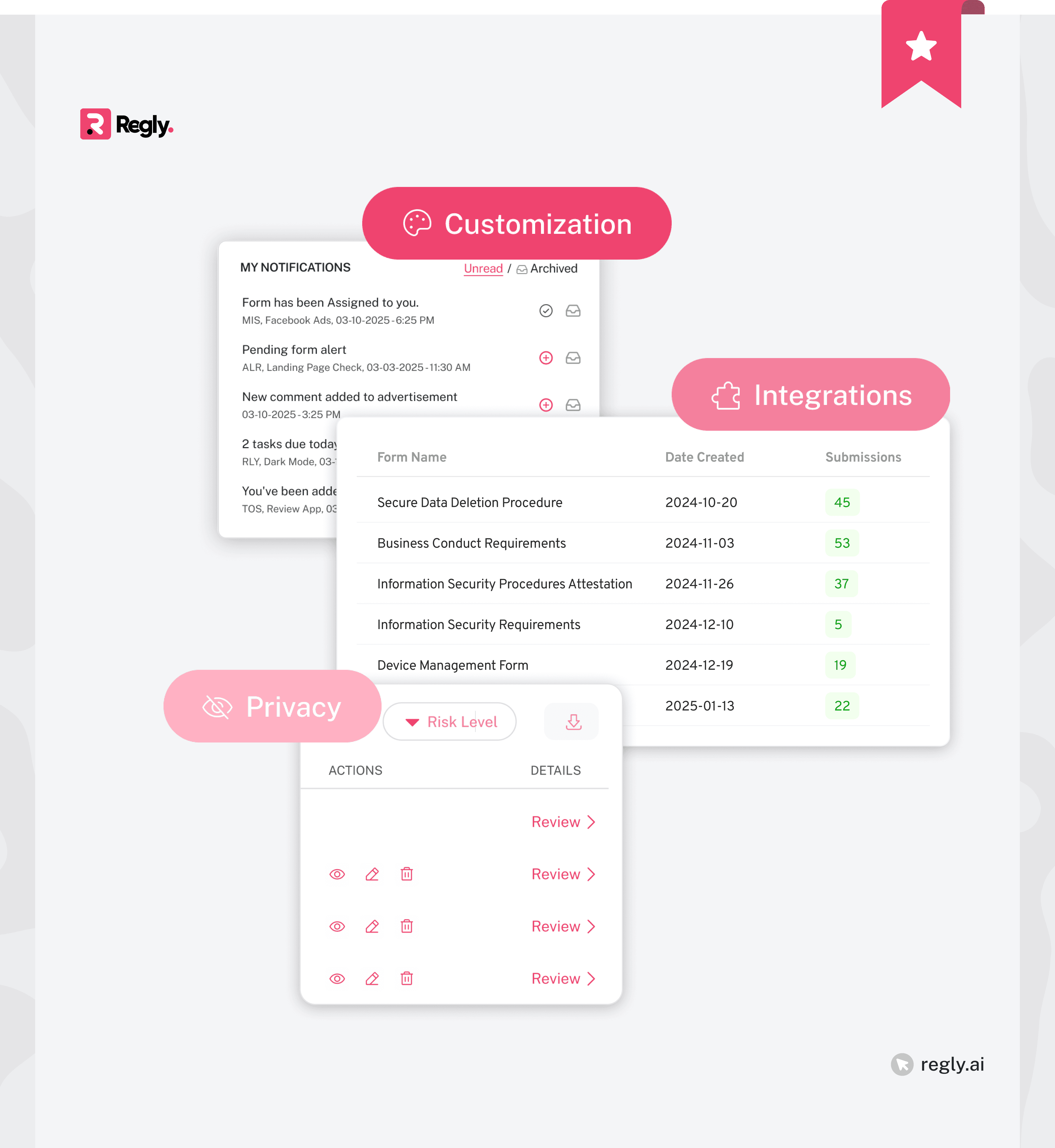

Regly’s employee compliance module applies these principles directly. It brings together data, documentation, and approvals in one connected system, helping teams stay aligned without losing control over review quality.

How AI and Automation Reduce Manual Bottlenecks

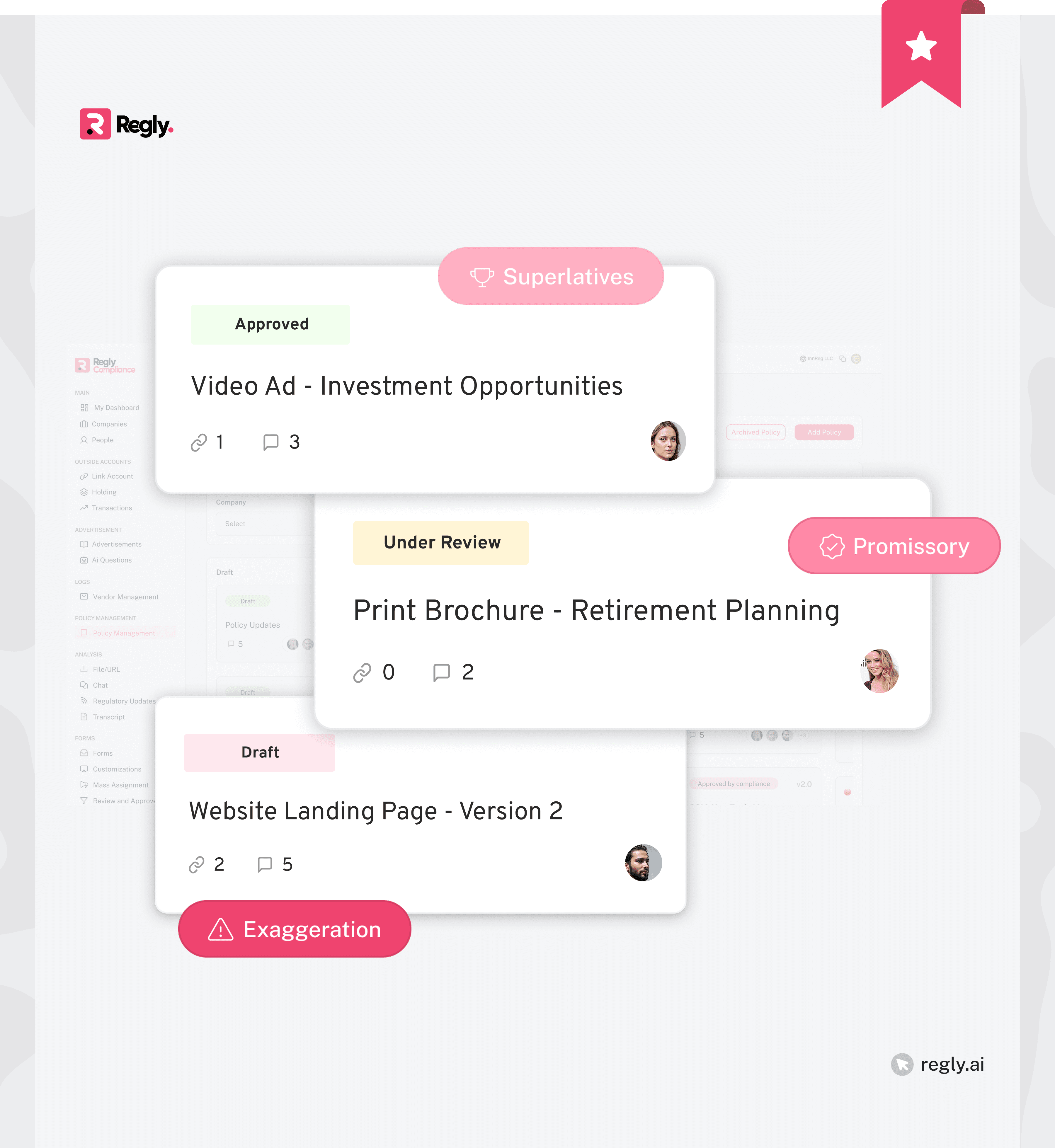

Manual compliance processes often stall when teams rely on human review for every step. AI-driven tools can scan documents, communications, and marketing materials to identify potential risks before they reach compliance desks.

Automation also reduces redundant effort. Instead of reviewing the same data across multiple systems, integrated tools pull information from core business sources.

Regly’s automated workflows apply these efficiencies directly to employee and operational compliance, reducing manual tracking while keeping oversight centralized.

Book a demo to learn more about how Regly’s automation features can help you improve your workflow.

Dashboards, Approval Flows, and Shared Audit Trails

Modern platforms can give compliance teams a real-time overview of operations. Dashboards can highlight open reviews, pending approvals, and training gaps. Automated approval flows move tasks from one reviewer to the next, keeping activity visible and reducing the chance of missed steps.

Audit trails then link every action, who reviewed what, when, and with what outcome, creating a transparent record for both internal management and external regulators.

When choosing a compliance software technology, fintechs can benefit most from a connected interface that provides automated record updates. This reduces friction between team tasks and gives compliance officers real-time visibility into ongoing activity.

Embedding Collaborative Compliance into Daily Operations

Compliance works best when it’s part of the daily workflow, not an afterthought. When teams use shared systems, oversight happens naturally within each department’s process.

This alignment allows compliance, product, marketing, and engineering to work toward the same goals instead of passing tasks between silos.

How Product, Engineering, and Marketing Teams Work With Compliance

Each function contributes differently to compliance, but collaboration keeps everything connected.

Product teams can embed control checks into the design and testing stages.

Engineering teams handle data tracking and system integration that support regulatory reporting.

Marketing teams route campaigns through built-in approval flows before release.

When these teams share the same environment, policies reflect real operations instead of theoretical procedures. Regly’s employee compliance and marketing compliance modules support this setup, linking review stages directly to each team’s workflow.

Real-Time Review and Approval Across Departments

Real-time review turns compliance into an active process. Tasks move from one reviewer to the next as soon as prior steps close, keeping progress visible. Notifications prompt action, while shared dashboards track every approval and revision.

With Regly’s connected review system (Employee Compliance), compliance teams can monitor activity across departments, identify bottlenecks, and maintain a continuous audit trail without slowing day-to-day work.

Building Compliance into the Product Lifecycle From Design to Launch

Embedding compliance early in product development prevents rework later. From concept to launch, each stage can include checkpoints for KYC, AML, disclosures, and marketing compliance. The earlier compliance is introduced, the fewer delays appear at release.

This approach helps fintechs design products that are compliant by structure, not adjustment. When oversight is woven into build cycles, compliance becomes a development partner, improving quality and reducing regulatory friction once the product reaches customers.

Communication and Recordkeeping: The Hidden Collaboration Risk

Internal communication has become one of the biggest compliance challenges in fintech.

Many teams jump between Slack, Teams, Zoom, and shared whiteboards throughout the day. Without proper controls, these scattered conversations can turn into compliance gaps where critical records disappear or never get captured in the first place.

SEC and FINRA Rules on Archiving All Business Communications

The SEC and FINRA require companies to keep all business communications in a secure, unalterable format. Rules 17a-4 and 4511 apply broadly, covering email, chat, conferencing tools, and shared digital workspaces used in business operations.

Failure to capture and supervise these records carries heavy consequences. Recent enforcement actions resulted in multi-billion-dollar fines tied to off-channel messaging.

The takeaway is clear: regulators now treat recordkeeping discipline as a measure of compliance maturity.

Why Chats, Whiteboards, and Collaboration Apps Fall Under Compliance

Modern work tools make collaboration faster, but they also expand the scope of what counts as a business record. Any platform where employees discuss or execute business activities can fall under compliance oversight. That means chat messages, video transcripts, and even digital whiteboard notes may need to be archived and retrievable during an audit.

Fintechs should partner with IT and compliance teams to map all communication channels in use. Once identified, approved tools should be connected to retention systems capable of archiving data automatically. This approach keeps compliance integrated without slowing collaboration.

Oversight Across Vendors and Partners

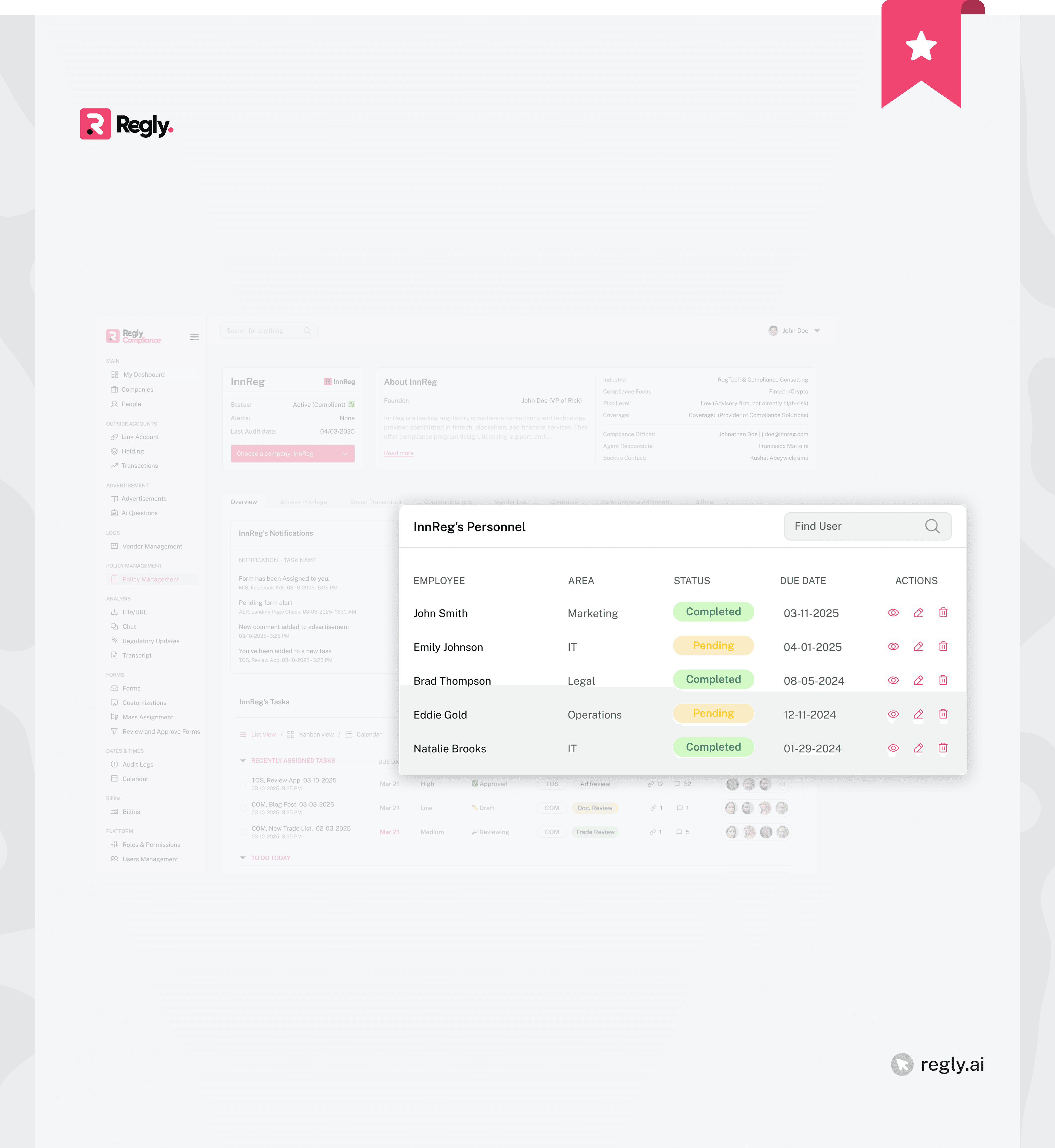

Third-party partnerships are part of almost every fintech model. BaaS platforms, KYC vendors, and processors extend capability but also add compliance risk. Regulators expect fintechs to manage that risk directly, as delegating work doesn’t transfer accountability.

Why “Outsourcing Compliance” Doesn’t Eliminate Responsibility

Regulators consistently remind firms that delegation does not equal exemption. When fintechs outsource core functions such as AML checks or fraud detection, they remain responsible for verifying that the vendor’s controls meet regulatory standards.

If a third-party system fails or misclassifies transactions, both the vendor and the fintech may be liable. This has been a recurring theme in enforcement actions involving fintech-bank partnerships, where oversight was documented but not operationally verified.

Maintaining Oversight of KYC/AML and Banking-as-a-Service Partners

Effective oversight begins with structure. Fintechs should maintain:

Documented review procedures for partner performance and risk metrics.

Access to relevant records and logs, including due diligence reports and audit summaries.

Regular testing of system integrations to confirm data flows and alerts function correctly.

Collaborative compliance technology helps manage this oversight in real time. Centralized dashboards can track vendor obligations, monitor open issues, and log each verification step for audit readiness.

Practical Controls for Vendor Collaboration

A structured vendor management process reduces uncertainty. Fintechs can adopt a recurring workflow that connects compliance and vendor teams directly:

Step | Control Activity | Outcome |

|---|---|---|

1 | Assign ownership for vendor monitoring | Defined accountability |

2 | Set reporting cadence for performance and exceptions | Consistent updates |

3 | Use system-based task tracking | Visibility across teams |

4 | Record communication and reviews in a shared platform | Traceable audit trail |

Regly’s Vendor Management module supports this process by linking vendor controls, documentation, and compliance checks inside one workspace. This creates an organized record of how oversight is performed, reviewed, and maintained.

Building a Culture of Collaborative Compliance

Technology enables compliance integration, but culture makes it sustainable. A collaborative compliance culture builds shared accountability across departments so that compliance becomes part of how teams operate.

How Leadership Drives Cross-Functional Accountability

Compliance culture starts at the top. Executives and compliance officers set expectations by communicating that compliance is tied to performance, not bureaucracy.

Leadership should:

Frame compliance as a shared business goal, not a checkpoint.

Promote open communication between compliance, product, and marketing.

Allocate resources and time for compliance input early in project design.

When teams see that compliance supports growth and protects long-term strategy, collaboration becomes instinctive rather than enforced.

From Checklists to Shared Goals: Shifting Team Mindsets

Many fintechs still treat compliance as a series of tasks to complete rather than an operational value. Shifting to a shared-goal approach aligns teams around outcomes:

Accurate reporting

Clear documentation

Risk-aware innovation

This shift happens gradually through transparency and collaboration tools. Dashboards that display compliance progress, pending reviews, and open issues help teams understand how their actions affect regulatory outcomes. Over time, this visibility replaces checklists with accountability.

Encouraging Daily Dialogue Between Compliance and Business Units

Culture grows through conversation. Short, consistent touchpoints, whether weekly syncs or embedded Slack channels, help compliance stay connected to changing priorities. These discussions prevent surprises during reviews and help business teams interpret new rules in context.

A strong collaboration culture depends on communication that’s frequent, structured, and documented. Using shared systems for updates and approvals keeps these dialogues transparent, turning compliance into an everyday function of teamwork.

How to Implement Collaborative Compliance in Your Organization

Building collaborative compliance takes planning, not just technology. The process starts with understanding how your teams work today and where communication or oversight breaks down. From there, the goal is to create consistent workflows that connect every function to compliance in real time.

Assess Silos and Map Interdependencies

Before introducing new tools, fintechs should identify where silos exist and why. This can be done through:

Reviewing how compliance requests move across departments.

Mapping communication patterns between legal, product, and operations.

Noting where duplicate data entry or unclear ownership occurs.

The outcome: a clear picture of which workflows overlap and where technology can have the most impact.

Choose Technology That Supports Cross-Team Workflows

Once pain points are identified, firms should look for solutions that connect compliance directly to team operations. The right platform should provide:

Centralized visibility across all compliance tasks.

Integration with existing tools like Slack or project management systems.

Automated workflows and transparent audit trails.

Regly’s platform can support this by linking compliance monitoring, approvals, and reporting in one system, so teams can collaborate without losing control of regulatory data.

Train Teams on Integrated Compliance Processes

Technology is only effective when teams know how to use it consistently. Training should focus on how compliance fits into each department’s daily work, not just how to navigate a platform.

Regular refreshers keep these processes active and prevent drift back into manual habits.

Measure Effectiveness and Iterate

Implementation is never one-and-done. Compliance teams should track performance indicators such as:

Review turnaround time

Number of late or incomplete approvals

Cross-department response rates

Collecting and reviewing this data quarterly helps identify where collaboration is working and where it still stalls. Over time, the goal is to build a measurable, repeatable compliance framework that scales with company growth.

—

Collaborative compliance is more than a framework. It is how modern fintechs stay agile without losing control. When technology connects compliance with everyday workflows, oversight becomes part of innovation rather than a hurdle to overcome.

By combining shared systems, clear accountability, and leadership commitment, fintechs can close the gap between speed and regulation. The result is an organization where compliance supports growth and resilience in equal measure.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.