Compliance Audit Trail: What It Is and Why It Matters

Published on

Oct 9, 2025

·

Last updated on

Oct 9, 2025

15

min read

Compliance audit trails are the backbone of accountability. Regulators, banking partners, and even your own team look to it as proof that your firm follows policies and has controls in place. A lack of accountability erodes trust.

In this article, we explain what a compliance audit trail is and why it is essential in financial services. We will cover the regulations that require it, the common challenges firms face in maintaining one, and the real risks of falling short.

You will also see how audit trails connect to daily compliance tasks such as transaction monitoring, marketing reviews, and policy updates, and what separates a strong log, organized with regulators in mind, from one that will not hold up under scrutiny.

What Is a Compliance Audit Trail?

A compliance audit trail is a chronological record of actions, transactions, and decisions within a system. Each entry captures key details such as who acted, what they did, when it happened, and sometimes why the action was taken.

In practice, this could mean documenting the approval of a new marketing disclosure, the review of a flagged transaction, or the update of a compliance policy. The value of this recordkeeping lies in creating a traceable path that shows regulators and internal teams how your firm made decisions.

For fintech companies, an audit trail proves that controls are active and compliance processes are functioning as designed. It provides transparency, supports internal oversight, and gives regulators confirmation that obligations are being met.

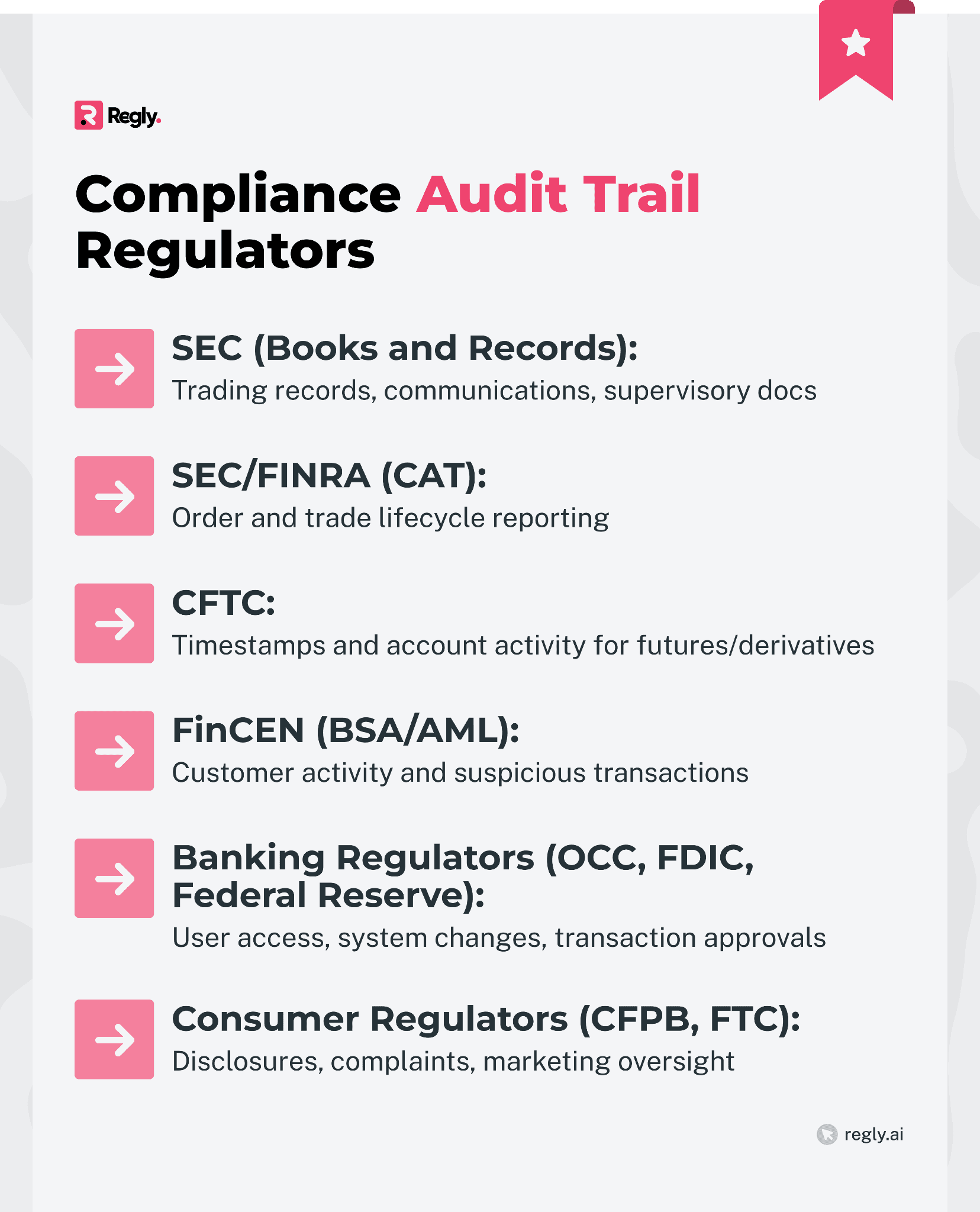

Who Regulates Compliance Audit Trails?

In the US, several regulators require or rely on compliance audit trails. Each brings a different set of expectations, and fintech companies often need to comply with more than one.

Securities and Exchange Commission (SEC): The SEC’s books-and-records rules, including Rule 17a-4, apply to broker-dealers, while investment advisors are subject to separate recordkeeping obligations under the Advisers Act, primarily Rule 204-2. These rules require firms to preserve communications, trading records, and supervisory documents in formats that regulators can review. Audit trails make it possible to prove that records are authentic, unaltered, and accessible when requested.

Financial Industry Regulatory Authority (FINRA): The SEC is the primary regulator overseeing the Consolidated Audit Trail (CAT). The SEC mandated the creation of CAT through Rule 613 and continues to supervise its operation, which is managed by a joint entity of FINRA and the securities exchanges called CAT LLC. CAT collects every order, trade, and quote in the equity and options markets. Broker-dealers must keep detailed internal audit logs so that their reported data can be matched against actual events. Gaps or inaccuracies in these logs can result in fines or restrictions.

Commodity Futures Trading Commission (CFTC): The CFTC requires firms operating in futures and derivatives markets to maintain a complete and reliable data audit trail. This includes timestamped records of order entry, modifications, and account activity. In past enforcement actions, firms have been penalized for failing to produce these records promptly.

Financial Crimes Enforcement Network (FinCEN): FinCEN enforces the Bank Secrecy Act. It requires financial institutions, including fintechs, to retain records of customer activity, suspicious transactions, and account changes for at least five years. These audit trails support anti-money laundering monitoring and provide law enforcement with the information needed to investigate financial crimes.

Banking Regulators (OCC, FDIC, Federal Reserve): These agencies supervise banks and review the internal controls of fintech partners. They look for audit trails that capture user access, system changes, and transaction approvals. During examinations, they expect to see clear evidence of how high-risk activities are tracked and reviewed.

Consumer Regulators (CFPB, FTC): Although they may not always use the phrase “audit trail,” these regulators require documentation of how firms handle consumer disclosures, complaints, and marketing practices. A clear audit log helps show that the firm treated customers fairly and met compliance obligations.

For fintech companies operating in the European Union, additional obligations come into play. The GDPR requires organizations to track and document access to personal data, while MiFID II mandates detailed logs of trading communications and activities. Companies often choose to align with the strictest applicable standard so that no regulator finds gaps in their records.

The Role of Compliance Audit Trails in Financial Services

In financial services, a compliance audit trail is a core part of how firms demonstrate accountability, manage risk, and maintain trust. Its roles extend across several critical areas:

Regulatory Evidence: Regulators often ask firms to produce records that show specific steps were taken. An audit trail provides the evidence. For example, if a broker-dealer approves a trade exception, the log shows who reviewed it, when the decision was made, and what action followed. This documentation helps satisfy books-and-records requirements and supports examinations.

Accountability and Governance: Every action in a financial system needs an owner. Audit trails link activities to specific users, making it clear who approved a transaction, changed a policy, or accessed sensitive data. This level of detail strengthens corporate governance by assigning responsibility and discouraging misconduct.

Fraud Detection and Risk Management: Audit trails act as an early warning system. By tracking unusual activity, such as repeated failed logins or changes to transaction data, they give compliance teams a way to spot problems before they escalate. In fraud investigations, the log often serves as the first source of truth about what happened.

Operational Transparency: External partners, from banks to investors, want confidence that a fintech’s compliance program is more than words on paper. Audit trails create transparency by showing the actual flow of reviews, approvals, and monitoring activities. This visibility makes partnerships more sustainable and reduces concerns about hidden risks.

Internal Oversight and Auditing: Audit trails make internal reviews more efficient. Compliance teams and auditors can follow a step-by-step record of activity instead of relying on fragmented documentation. This reduces time spent gathering evidence and increases confidence that reviews cover the full picture.

Dispute Resolution: When customers or counterparties question a decision, audit trails help resolve disputes. A detailed log can show that a disclosure was reviewed before release or that a transaction was processed exactly as requested. Having that record often prevents drawn-out investigations or litigation.

For fintech companies, these roles come together in a practical way. Audit trails provide the foundation for demonstrating that compliance is active, consistent, and built into daily operations. Without them, both regulators and partners will question the reliability of the entire compliance program.

Key Compliance Requirements That Involve Audit Trails

Several laws and frameworks in the US and abroad depend on compliance audit trails. Each one sets expectations for how records must be captured, stored, and produced.

1. SEC Rule 17A-4 (Worm vs. Audit Trail–Based Storage)

SEC Rule 17a-4 governs how broker-dealers must preserve records. Earlier requirements, such as WORM (write once, read many) storage, were designed to prevent records from being altered and to protect data integrity, but often kept firms tied to aging infrastructure.

The 2022 revision marked a turning point. By permitting audit trail-based storage, the SEC acknowledged that modern recordkeeping can deliver the same level of protection without relying on outdated hardware. Now, firms can use cloud and database platforms that log every change with timestamps, user identification, and complete details of the modification.

This shift not only gives firms more options but also more responsibility. A broker-dealer that adopts audit trail–based storage must be prepared to show regulators a clear and reliable record of every version of a document. That’s why compliance teams need systems that can produce logs quickly and without gaps.

With Regly’s marketing compliance tool, approved materials are archived with version histories, and you can export them as PDFs. The result is a clear audit trail that makes recordkeeping simpler and can help firms when regulators ask for proof of what was reviewed, approved, and stored.

2. FINRA Consolidated Audit Trail (CAT)

The Consolidated Audit Trail is one of the most ambitious regulatory reporting projects in the US securities markets. It was created to give regulators a complete view of order and trade activity across equities and options.

Under CAT rules, every broker-dealer must report the lifecycle of orders, from receipt to execution or cancellation. This includes detailed timestamps, CAT customer IDs and account information, and order routing information. The goal is to let regulators trace market activity step by step and identify patterns of manipulation or misconduct.

For firms, this means internal audit trails must be accurate and consistent with what they report to CAT. If timestamps are incomplete or customer details are mismatched, FINRA can impose fines or require corrective action.

3. BSA/AML Transaction Monitoring and Documentation

The Bank Secrecy Act (BSA) is the foundation of US anti-money laundering (AML) compliance. It requires financial institutions to keep detailed records of transactions and to monitor for suspicious activity. These records must be retained for at least five years.

A strong compliance audit trail is central to this requirement. Firms must log every transaction above reporting thresholds, AML transaction monitoring alerts, and steps taken during a review must be logged. Regulators expect to see not only the transaction itself but also the entire investigative history, including who reviewed the alert, when it was escalated, and what conclusion was reached.

Clear workflows help address this challenge. For example, a suspicious transaction alert should automatically generate a log that includes review notes, supporting documents, and final resolution. The same principle applies to other areas of compliance.

4. Sarbanes-Oxley Act (SOX) Internal Control and Financial Record Integrity

The Sarbanes-Oxley Act, better known as SOX, applies to public companies and requires strong internal controls over financial reporting. It was passed in response to corporate scandals where poor recordkeeping and weak oversight allowed fraud to go undetected.

Audit trails play a direct role in meeting SOX obligations. Every financial entry, approval, and adjustment must be traceable. Logs should show who accessed financial systems, when changes were made, and what approvals were given. This makes it possible for management to certify that financial statements are accurate and supported by reliable controls.

For fintech companies that plan to go public or work closely with public companies, SOX expectations often reach them earlier than anticipated. Investors and auditors want to see audit trails that demonstrate the integrity of financial data. A missing or incomplete trail can raise red flags about whether controls are operating as designed.

Practical steps include linking audit trails to financial workflows such as journal entries, reconciliations, and system changes. Compliance teams can then provide auditors with direct evidence rather than assembling records after the fact. This reduces risk during audits and builds confidence with stakeholders.

5. PCI DSS Audit Logging for Payment Card Environments

The Payment Card Industry Data Security Standard (PCI DSS) applies to any company that stores, processes, or transmits cardholder data. It requires firms to log all access to systems that handle card data. This includes successful and failed login attempts, administrative changes, and payment transactions. The purpose is to give security and compliance teams a record to review if fraud or unauthorized access occurs.

Logs must be kept for at least one year, with the last three months immediately available for analysis. Card networks and acquiring banks also expect firms to produce these records quickly during an investigation. A weak or incomplete audit trail can be seen as a control failure and may result in penalties or restrictions on card processing.

For fintechs, the challenge often lies in coordinating audit trails across multiple platforms, such as payment gateways, fraud systems, and cloud infrastructure. A practical approach is to centralize these logs so that compliance teams can monitor activity without piecing together records from different sources.

6. HIPAA Access and Activity Logs for Health-Related Financial Data

Some fintech companies handle financial transactions that involve healthcare, such as payment processing for medical expenses or financing for health services. In these cases, the Health Insurance Portability and Accountability Act (HIPAA) may apply.

HIPAA requires organizations to log access to protected health information. This includes who accessed the data, what actions they took, and when the activity occurred. For fintechs, that can mean documenting who viewed or processed a payment tied to healthcare, along with any changes made to account details.

Audit trails under HIPAA serve two purposes. They provide a record that helps detect unauthorized access, and they create evidence that only approved users are handling sensitive data. Regulators and business partners expect firms to demonstrate that these controls are in place.

For compliance teams, the practical challenge is integrating healthcare-related audit logs with broader financial compliance systems. Centralizing these logs helps reduce complexity.

7. CCPA/GDPR Auditability for Personal Data Access and Changes

Privacy regulations such as the California Consumer Privacy Act (CCPA) and the EU’s General Data Protection Regulation (GDPR) place strict requirements on how firms handle personal data. While the focus is on individual rights, audit trails are essential to demonstrate compliance.

Both CCPA and GDPR expect firms to track who accessed personal data, when it was accessed, and what changes or disclosures were made. This allows companies to show regulators, or even consumers themselves, how their information has been used. Without a clear audit trail, it becomes difficult to respond to data access or deletion requests within required timelines.

For fintechs, the challenge lies in balancing privacy with retention. Audit logs often contain personal information, yet regulators require that data not be kept longer than necessary. This means compliance teams must design audit trails that capture relevant activity while also following defined retention schedules.

How Compliance Audit Trails Apply to Everyday Tasks

A compliance audit trail connects abstract regulatory requirements to day-to-day work. It turns reviews, approvals, and monitoring into documented evidence that can be produced when questions arise. Here is how it applies across core activities.

Transaction and Account Activity Logging: Every movement of money needs to be traceable. Audit trails capture details such as the source and destination of funds, amounts, timestamps, and the user or system that initiated the action. This record helps identify patterns of fraud or money laundering and allows investigators to rebuild a customer’s financial activity step by step.

Marketing Content Review and Approval Tracking: Financial advertising is closely regulated, and firms are expected to document how they reviewed materials before publication. An audit trail captures drafts, reviewer comments, revisions, and the final approval. Without this record, it is difficult to prove that disclosures were vetted. Platforms like Regly Compliance offer features to support this regulatory requirement.

Policy Updates and Version Control History: Compliance policies change as regulations evolve. An audit trail shows when a policy was updated, who approved the change, and when it was distributed to staff. Having this version history prevents employees from relying on outdated rules and gives regulators confidence that the company tracks its governance carefully.

Employee Attestations, Disclosures, and Approvals: Staff are often required to confirm that they understand compliance obligations or to disclose conflicts of interest. Audit trails provide evidence of these acknowledgments. If questions arise later, the company can point to a clear record showing that employees reviewed and signed off on the relevant requirements.

Vendor Onboarding and Third-Party Risk Documentation: Fintech companies often rely on vendors for payments, identity verification, or data services. Regulators expect oversight of these relationships. An audit trail documents the due diligence performed, the risk assessments completed, and the decision-making process behind onboarding. This shows that third-party risk was considered, not overlooked.

Internal System Access and Administrative Changes: Access controls protect sensitive systems, but without audit logs, it is impossible to know who used those permissions. Audit trails record login attempts, administrative changes, and account modifications. This evidence helps identify misuse, trace insider threats, and support cybersecurity compliance requirements.

KYC and KYB Verification Steps: Onboarding customers and businesses requires documenting how identity information was collected and reviewed. Audit trails show each step, including document submission, analyst review, escalation to management, and final approval. This transparency is critical when responding to regulatory exams or bank partner audits.

AML Alerts, Reviews, and Resolution Tracking: Suspicious activity monitoring produces alerts that must be reviewed promptly. Audit trails record the alert, the reviewer’s notes, supporting documentation, and the final resolution. Regulators frequently ask to see this documentation to confirm that AML transaction monitoring is active and that firms do not ignore alerts.

How to Build a Compliance Audit Trail Program

Creating a compliance audit trail program requires a structured approach that links records to regulatory requirements and daily business operations. The following steps provide a practical framework.

Key Steps to Building a Compliance Audit Trail Program |

|---|

|

|

|

|

|

|

Finally, treat the audit trail program as a living process. Test retrieval speed, review integrity checks, and update procedures when regulations or business operations change. Documenting these efforts gives examiners confidence that audit trail management is an active part of the compliance program.

Common Challenges in Managing a Compliance Audit Trail

Creating a compliance audit trail is relatively straightforward. Keeping it reliable, consistent, and useful over time is where most fintech companies encounter obstacles.

Data Volume and Sprawl: Audit logs expand rapidly. A trading platform, payment processor, or lending app can produce millions of records daily. Without a structured retention and archiving strategy, teams drown in data. The result is either missed red flags or costly storage decisions that do not align with regulatory requirements.

Siloed Systems and Integration Gaps: Fintechs typically operate with multiple systems: payment gateways, KYC providers, CRM tools, and internal databases. Each produces its own log files in different formats. When regulators request evidence, pulling together a coherent timeline becomes difficult. The lack of integration not only slows response time but also raises questions about whether the company truly has end-to-end visibility.

Weak Log Security and Access Controls: An audit trail must be trustworthy. If staff can alter logs or delete entries, the records lose their evidentiary value, and regulators may reject them outright. Logs need to be protected with role-based access, encryption, and monitoring of who views or attempts to change them.

Inconsistent or Unclear Retention Policies: Regulations vary. SEC rules may require some records for six years, while AML laws often require five. Privacy laws, on the other hand, expect firms not to hold personal data longer than necessary. Without clear policies, fintechs risk either deleting records too early or holding them too long, creating exposure on both fronts.

Lack of Ownership and Regular Review: Collecting audit logs is not enough. Someone must be accountable for reviewing them, investigating anomalies, and testing whether firms meet requirements. In smaller fintechs, this responsibility often falls between compliance, IT, and operations, leaving gaps. Regulators increasingly expect named ownership of audit trail oversight.

Vendor and Third-Party Visibility Gaps: Many fintechs rely on vendors for critical services such as payment processing, custody, or onboarding. If those vendors do not provide access to complete logs, the fintech has limited ability to prove compliance. Regulators now emphasize vendor oversight, meaning gaps in vendor audit trails can expose the fintech itself to penalties.

Recent Enforcement Trends and Regulatory Updates

Regulators are paying closer attention to recordkeeping and audit trails. Several recent actions highlight how missing or incomplete records can lead to significant penalties.

Off-Channel Communications Fines (WhatsApp, SMS)

One of the clearest enforcement signals came from the SEC and CFTC in 2022. Regulators fined major financial institutions over a billion dollars in total for failing to keep records of business communications conducted through personal messaging apps like WhatsApp and SMS.

The core issue was not the use of these apps, but the absence of an audit trail. Regulators expect firms to capture and preserve all work-related communications, regardless of the channel. When employees discussed business outside of monitored systems, those messages became missing records.

For fintech companies, this is a practical reminder that communication platforms need the same compliance treatment as trading and payment systems. Emails, chat tools, project management platforms, and even text messages may fall under recordkeeping rules if they involve client or transaction discussions. Audit trails must cover these channels so that regulators do not view them as gaps.

CAT Security and Privacy Concerns (2026)

As the Consolidated Audit Trail expands, questions about security and privacy are growing. The system contains highly detailed trading data, along with sensitive information that could expose customer identities if mishandled.

Industry groups and lawmakers have raised concerns about how such a massive dataset is stored and protected. A breach or misuse of CAT data would not only undermine confidence in the system but could also put firms and investors at risk. In response, regulators are under pressure to show that CAT data is encrypted, access is tightly controlled, and audit trails exist for every query made against the database.

—

A compliance audit trail transforms regulatory obligations into verifiable records and provides the evidence regulators, partners, and investors expect to see. Whether it is transaction monitoring or marketing reviews, audit trails bring the transparency and accountability that make compliance programs credible.

The real challenge lies not only in capturing logs but also in keeping them organized, secure, and aligned with specific requirements. That takes clear policies, consistent workflows, and technology that reduces manual effort. Without this structure, gaps appear quickly and draw regulatory scrutiny.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.