How to Create a Practical Employee Compliance Training Program

Published on

Nov 21, 2025

12

min read

Employee compliance training is a cornerstone of operational integrity, especially in fintech.

As fintechs handle sensitive customer data, financial transactions, and complex partnerships under constantly evolving oversight, they need structured, role-specific training. Even small errors can lead to significant compliance failures.

In this article, we have outlined how to create a practical framework that makes compliance education scalable, adaptive, and relevant to your fintech’s daily reality.

Why Employee Compliance Training Matters in Fintech

Fintech companies operate in a space in which regulations are complex and change quickly. Employees often handle customer data, financial transactions, or marketing materials that fall under multiple oversight bodies. Without clear training, small mistakes can trigger large compliance gaps.

Unlike traditional financial institutions, fintech startups grow and pivot fast. As the nature of startups often makes it difficult to keep compliance top of mind, a well-structured training program helps teams understand not just what the rules are, but why they matter in day-to-day operations.

For agencies like FinCEN, the SEC, and FINRA, training is a required component of a compliance program, equal in importance to written policies, recordkeeping, and internal audits.

Inconsistent or outdated training is viewed as a sign of a weak compliance culture. The absence of structured compliance training can create tangible risk. Regulatory penalties often cite “failure to train staff” as a contributing factor in violations.

What Regulators Expect From Employee Compliance Training

Regulators across financial and technology sectors view employee compliance training as a measurable control that demonstrates how well a business manages risk.

The main expectations include:

AML and BSA Training Mandates Across Industries

Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) regulations require every financial institution, and most fintechs handling money movement, to maintain a documented, recurring employee training program.

FinCEN and other agencies consider training one of the “four pillars” of an effective AML program, along with internal controls, independent testing, and a designated compliance officer.

Read our article to learn how to create an effective AML compliance program →

Training under AML/BSA rules must be risk-based and role-specific. That means employees receive instruction aligned with the nature of the business and their access to customer information or transaction systems.

For example, a customer support agent handling account onboarding needs to understand KYC procedures, while an engineering team may require training on how data flows impact AML screening tools.

Requirement | Description | Who It Applies To | Regulatory Source |

|---|---|---|---|

Regulatory Mandate | Every financial institution and most fintechs that handle money movement must maintain a documented, recurring AML/BSA training program. | All Money Services Businesses (MSBs), including fintechs offering payments, crypto, or money transfer services | FinCEN’s 31 CFR §1022.210; AML Act of 2020 |

Training Frequency | Training should occur on an ongoing basis, typically annually, with refreshers whenever products, regulations, or risk profiles change. | All staff with AML-related duties, including compliance, operations, and customer-facing teams | FinCEN Guidance and AML Program Requirements |

Documentation | Firms must keep clear records of attendance, training materials, completion dates, and related communications for examiner review. | Compliance officers or designated program administrators | FinCEN and FFIEC Examination Manual |

Customization | Programs must reflect the company’s individual risk assessment and incorporate examples tied to actual business operations. | Each relevant business line or department | FinCEN’s AML Program Rule; Risk-Based Training Standards |

Many fintechs operate through Banking-as-a-Service or payments partnerships. Even if a sponsor bank handles core AML functions, regulators still hold the fintech accountable for employee awareness and oversight. Examiners often review whether staff understand red-flag indicators, suspicious activity reporting timelines, and escalation procedures.

Effective AML/BSA training translates regulatory text into clear operational steps: how to identify unusual customer activity, when to involve compliance, and how to document actions. Training should also adapt as new technologies (like AI-based transaction monitoring or digital asset transfers) reshape how financial crimes are detected and reported.

FINRA, SEC, and NYDFS Expectations

Regulators expect employee compliance training to be structured, documented, and relevant to each person’s role, experience, and responsibilities. Agencies like FINRA and SEC treat training as a key part of a firm’s supervisory system.

For fintech companies involved in securities, trading, or crowdfunding, this means compliance education must go beyond general awareness. It needs to cover the daily duties of registered representatives, operations staff, and supervisors.

Core Training Expectations

Under FINRA Rule 3110 and SEC Rule 17a-4, firms must keep verifiable records showing that employees were trained on:

Communication and advertising standards

Recordkeeping and documentation procedures

Suitability and anti-fraud obligations

Escalation paths for red flags and client issues

Missing or incomplete training records may be cited as books-and-records violations during an examination.

NYDFS Oversight for Virtual Asset Businesses

The New York Department of Financial Services (NYDFS) adds further requirements for fintechs operating under its oversight, particularly those dealing in virtual currency or money transmission.

Under 23 NYCRR 200.15 firms must train employees on:

Cybersecurity and data retention practices

Suspicious activity reporting (SAR) procedures

Internal access and control standards

Privacy, Cybersecurity, and Consumer Protection Requirements

As fintechs handle large volumes of personal and financial data, training employees on privacy and cybersecurity compliance is a regulatory expectation.

Agencies like the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), and state regulators expect staff to know how to manage sensitive information securely and follow disclosure rules.

Under the Gramm-Leach-Bliley Act (GLBA) and the Safeguards Rule, firms must train employees on data access, storage, and incident response. This includes recognizing phishing attempts, avoiding unauthorized sharing, and protecting customer information.

Training also covers consumer protection laws such as the Electronic Fund Transfer Act (Reg E) and Truth in Lending Act (Reg Z).

Employees in marketing, product, and support roles need to understand disclosure timing, fair lending principles, and what constitutes misleading communication.

The “Ongoing” Standard

Regulators expect employee compliance training to evolve with the business. A program that never changes signals stagnation. Examiners now look for evidence that firms update and document training regularly as products, risks, and rules shift.

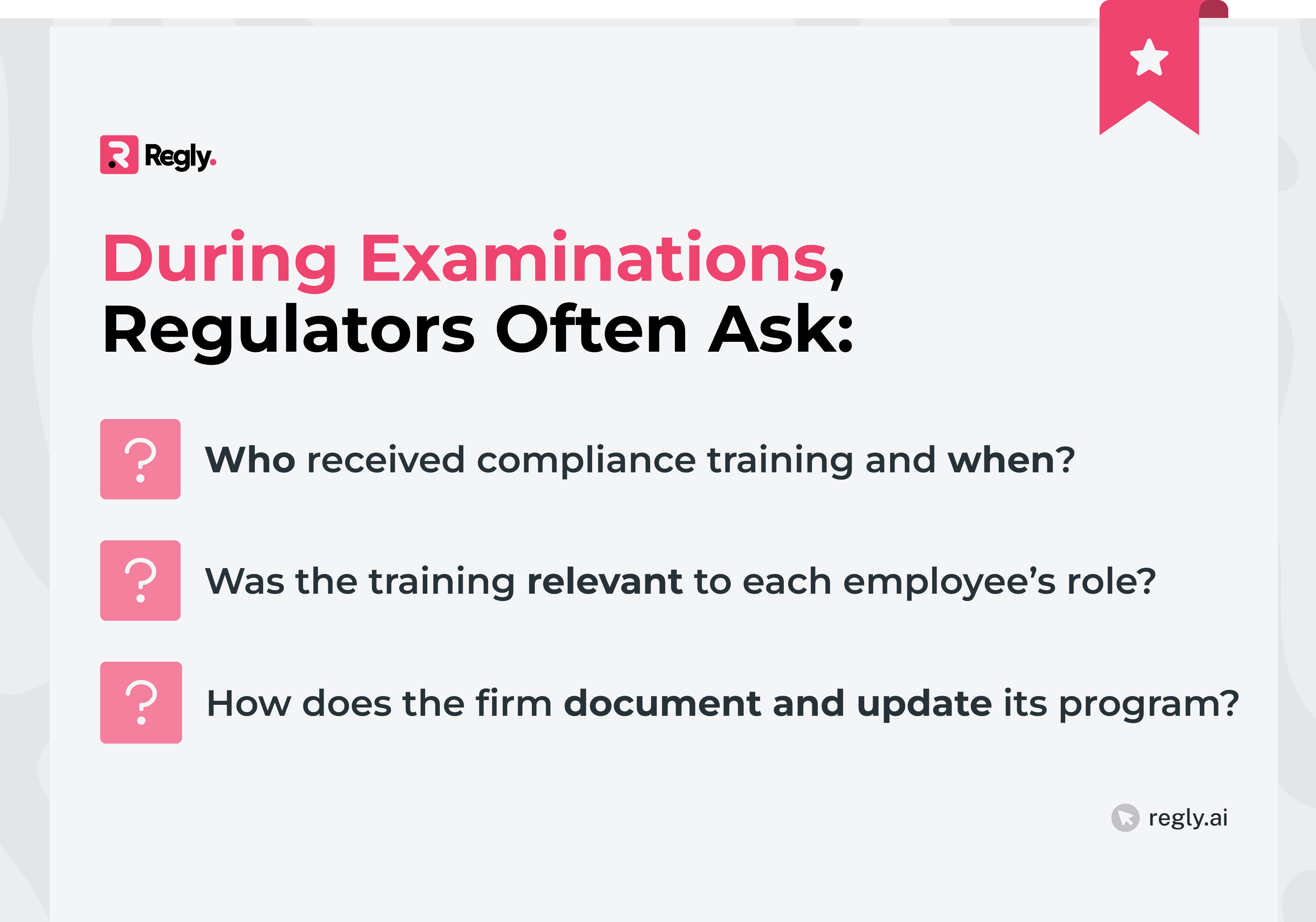

During an examination, regulators often review how consistently training programs are updated, delivered, and tracked. They usually evaluate:

Alignment with current risk assessments

Records of completion and testing

Documentation of make-up sessions or follow-ups

Updates tied to product launches or regulatory changes

Role- or department-specific modules

A static training plan tells regulators that compliance is reactive. In contrast, ongoing updates show an organization that treats compliance as part of daily operations.

For example, if a fintech introduces a crypto product or expands into a new market, examiners expect to see the added relevant training sessions at the time of rollout instead of when the annual cycle begins.

Core Elements of a Strong Employee Compliance Training Program

Effective employee compliance training follows a clear structure. Regulators expect programs that are comprehensive, role-specific, and consistently documented, not generic presentations repeated each year.

Strong programs typically include the following elements:

Comprehensive Coverage of Laws, Policies, and Procedures

Training should explain the regulations that govern the business, AML, securities, consumer protection, and privacy, while connecting them to internal policies.

Employees must see how company procedures map to actual legal obligations. For example, showing how internal communication rules satisfy SEC recordkeeping requirements reinforces accountability and context.

Periodic and Event-Driven Training

Compliance education should occur on a regular schedule, but also whenever major changes occur.

Product launches, system upgrades, or regulatory updates all warrant supplemental sessions.

Short, targeted refreshers keep staff aligned without overloading them with information.

Role-Specific Content: Staff vs. Management vs. Board

A one-size-fits-all approach rarely works. Front-line employees need operational guidance, while management and board members require strategic awareness of oversight duties.

Boards, in particular, should receive training on governance standards, escalation procedures, and regulatory expectations for leadership.

Accountability Through Documentation and Testing

Examiners often request proof that employees not only completed training but have also understood it.

Testing, sign-offs, and attendance logs provide this evidence. Maintaining a centralized record of completion supports future audits and shows that compliance officers actively monitor program performance.

Together, these components form a training structure that adapts to the business and demonstrates real control, which is a key signal regulators use when evaluating compliance maturity.

How to Build a Practical Employee Compliance Training Framework

A structured framework turns compliance training from an administrative task into a scalable system.

Each step below focuses on aligning training content, timing, and tracking with the realities of fintech environments:

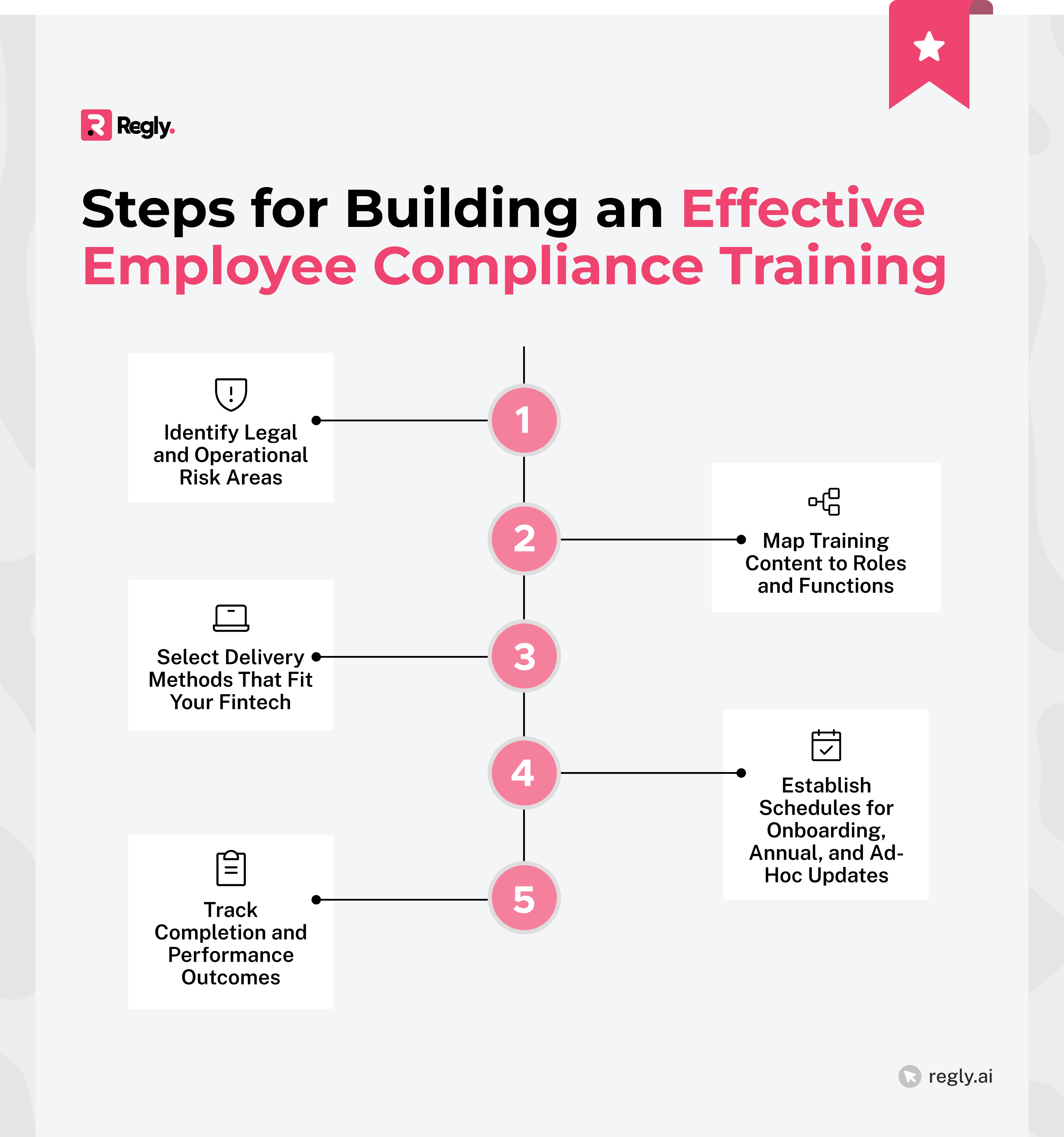

Step 1: Identify Legal and Operational Risk Areas

Start with a clear review of your business risks, and mapping out which laws and regulations apply: AML/BSA, SEC or FINRA rules, privacy laws, cybersecurity, and consumer protection. Then trace how each department connects to those obligations.

For instance, engineering influences data protection and system access, while operations manages KYC and transaction monitoring.

This creates a foundation for your employee compliance training plan, and also provides documentation showing regulators that your training reflects real risks.

Step 2: Map Training Content to Roles and Functions

After identifying your key risk areas, connect each one to the people who manage it. A generic training course may check the box, but it rarely drives real understanding.

Tailor sessions to actual responsibilities. For example, customer support teams should learn how to spot unusual activity or escalation triggers, while marketing staff need to know what qualifies as compliant advertising and disclosure.

Targeted instruction keeps compliance relevant and actionable at every level.

Step 3: Select Delivery Methods That Fit Fintech Realities

Most fintech teams work in hybrid or remote environments, which means training must adapt to different schedules and locations.

Use a mix of delivery formats (online courses, short virtual sessions, and quick micro-learning lessons) to keep participation high without interrupting daily work.

Not every topic needs the same depth. Annual privacy reminders might only need a quick digital module, while a hands-on session makes more sense when major rules change.

Offering a range of learning formats keeps employees engaged and supports long-term retention.

Step 4: Establish Schedules for Onboarding, Annual, and Ad-Hoc Updates

Every new hire should complete onboarding sessions that cover core regulatory topics and company policies. Annual refreshers keep awareness high and show that compliance education is continuous.

Beyond that, host targeted sessions whenever the firm expands into new products, markets, or vendor relationships.

This structure gives regulators a clear record of activity and helps employees follow a consistent learning path.

Step 5: Track Completion and Performance Outcomes

Tracking should measure effectiveness, not just activity. Maintain clear records of participation, test outcomes, and areas where employees struggle.

Review this information during compliance committee meetings to make sure the program evolves with your business.

These reviews demonstrate to regulators that training supports real understanding.

Making Compliance Training Engaging and Effective

An effective training program doesn’t just deliver information; it motivates employees to apply it. Engagement determines retention, and retention determines compliance performance.

Fintech companies can make compliance training more practical and memorable.

Using real-world fintech scenarios and examples: Employees learn best from examples that are similar to their daily challenges, like handling suspicious transaction alerts or reviewing promotional materials. Incorporating short fintech-specific case studies allows participants to see what compliance decisions look like in practice.

Micro-learning, quizzes, and spaced repetition: Dividing training into more manageable lessons can help employees focus and retain information better. Interactive lessons with quick quizzes reinforce key points without disrupting daily work. Periodic refreshers keep important rules familiar, especially when built into internal tools or chat platforms.

Personalizing content by skill level and risk exposure: Entry-level staff can focus on fundamentals, while management should receive instruction on oversight and decision-making.

Turning compliance from a “requirement” into part of culture: Encourage managers to discuss compliance in team meetings and connect the training outcomes to performance metrics. When employees view compliance as part of their professional standards, and not only as an external rule, engagement naturally increases.

Common Pitfalls to Avoid in Employee Compliance Training

Regulators often spot the same issues across fintech firms, such as outdated content, poor tracking, or overreliance on generic modules.

Avoiding these pitfalls makes your program more relevant and credible:

One-time or recycled content: Treating training as a one-time event or recycling old material signals stagnation. Employees stop engaging when lessons repeat without context. Updating modules whenever rules, products, or systems change shows regulators that your program reflects real operational conditions.

Generic off-the-shelf modules: Prepackaged courses can help with basics, but they rarely fit a fintech’s specific business model. Training should connect directly to your company’s services, partners, and compliance risks.

Lack of tracking or follow-up on noncompliance: Training completion rates alone don’t tell the full story. Firms should record attendance, test results, and remedial steps when employees miss sessions or fail assessments. Tracking this data demonstrates active oversight. Ignoring follow-up undermines accountability and raises questions during exams about whether firms are addressing compliance gaps.

Assuming vendors or partners cover your obligations: Some fintechs rely heavily on Banking-as-a-Service or KYC/AML providers and assume that vendor training is enough. Regulators take a different view: the fintech remains responsible for its employees’ understanding of compliance duties. Review partner training programs, but always maintain your own internal education plan to cover firm-specific roles and risks.

Leveraging Technology to Scale Employee Compliance Training

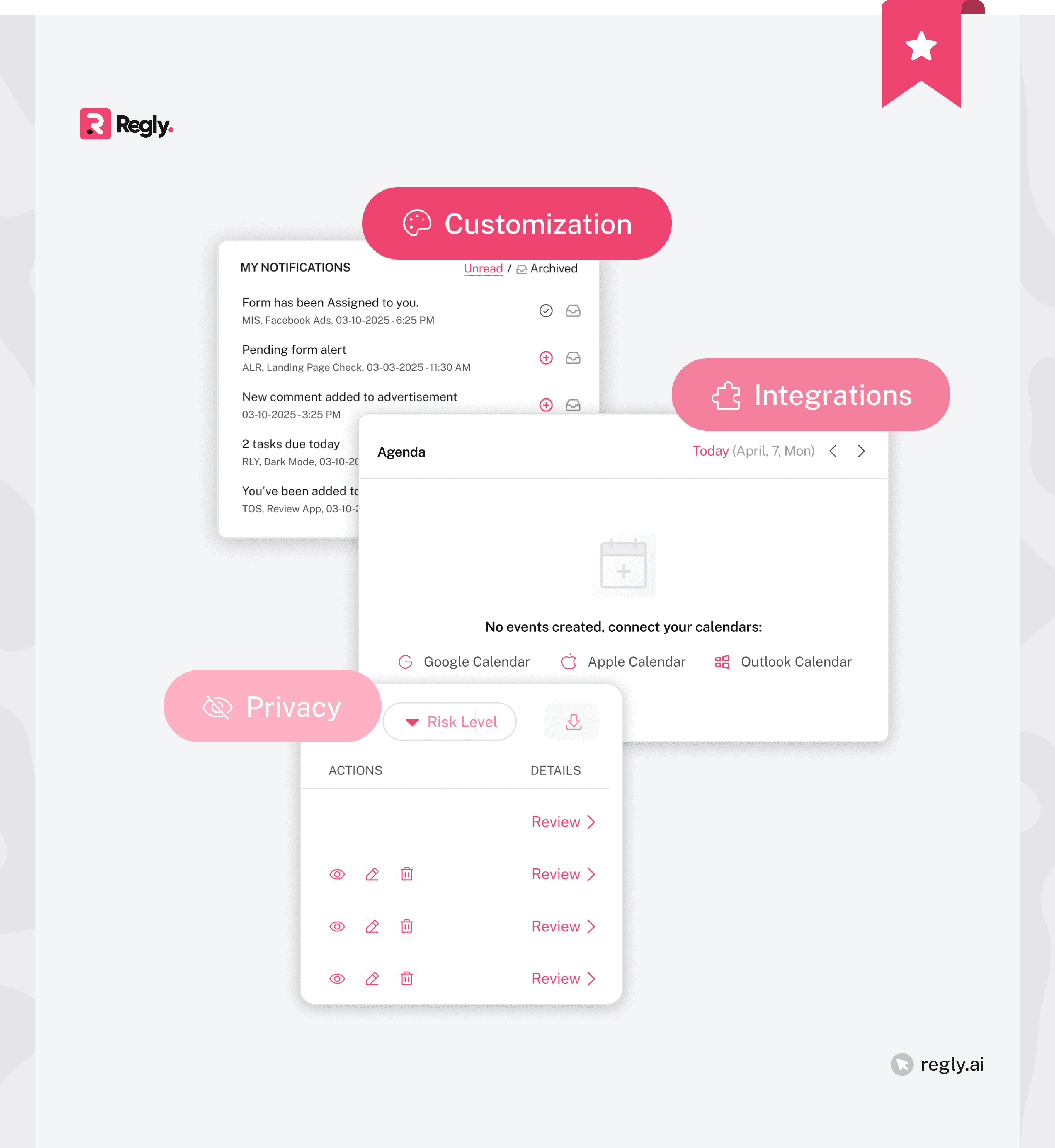

Technology allows compliance teams to keep pace with both business growth and regulatory change. Digital tools make it possible to deliver, track, and update training efficiently, reducing manual oversight while maintaining accountability.

Benefits of Using Compliance Software

Compliance software helps organize training and documentation in one place. It automates scheduling, distributes learning materials across teams, and keeps records accessible for examiner review.

Centralized systems make it easier to manage attendance logs, test results, and certifications, all key elements during audits.

Modern tools also let compliance officers segment training by department or role, assign new courses automatically, and track progress in real time. This structure supports consistent delivery and creates a verifiable record of compliance activity when regulators request proof of program effectiveness.

Automating Updates for Regulatory Changes

Manual updates take time and introduce risk. Automated systems help by detecting regulatory changes, updating internal materials, and scheduling training refreshers as needed.

This automation helps fintech companies stay aligned with evolving regulations while limiting repetitive administrative tasks.

Solutions like Regly’s employee compliance module simplify this process by handling policy updates, attestations, and training in one integrated environment.

Integrating Compliance Tasks into Daily Workflows

Embedding training and reminders into tools employees already use, like communication platforms or CRM systems, keeps compliance visible and practical.

Instead of separate sessions that interrupt work, employees can receive short prompts, updates, or quizzes within existing workflows.

This approach reinforces compliance knowledge continuously. Integrating technology with everyday processes turns compliance from a scheduled event into an ongoing habit, strengthening awareness across teams and reducing the risk of oversight.

Building a Culture of Accountability Through Training

A strong compliance program depends on more than policies and software. It relies on culture. Training is one of the most effective tools for shaping that culture, helping employees understand that compliance is not just the responsibility of one department, but a shared commitment across the organization.

The Role of Leadership in Setting Tone and Expectations

When executives and managers actively participate in training and reference compliance in business discussions, employees follow suit. Visible support from leadership signals that compliance is a business priority, not an afterthought.

This can be as simple as senior leaders opening training sessions, recognizing teams that meet compliance milestones, or discussing regulatory updates during company meetings.

When leadership models accountability, compliance becomes part of the organization’s identity rather than a checklist requirement.

Making Compliance Part of Business Performance Metrics

Embedding compliance into performance metrics reinforces accountability at every level. Teams can include completion rates, audit findings, or control improvements as part of their operational goals. Linking these metrics to performance reviews encourages consistent participation and attention to compliance details.

Fintech companies that do this often see stronger engagement across departments. Employees understand that compliance performance is not separate from business success. It contributes directly to it. This approach also gives compliance officers measurable data to discuss during board or regulator reviews.

Aligning Training With Broader Compliance Strategy

Training should connect with the firm’s overall compliance roadmap. When policies, monitoring, and training work together, the organization presents a unified and credible program to regulators. Consistent messaging across these components helps employees see how their role fits within the company’s broader risk framework.

For example, if the company’s strategy focuses on improving transaction monitoring, corresponding training should highlight how employees detect, document, and escalate suspicious activity. This alignment reinforces that training is not theoretical but operational and tied to real business outcomes.

—

Building an effective employee compliance training program is about creating an operational framework that supports trust, accountability, and sustainable growth.

For fintech companies, the right structure turns training into a continuous process that adapts with each product launch, jurisdiction, and rule change.

By combining tailored content, technology-driven delivery, and visible leadership support, compliance training becomes part of the company’s rhythm rather than an isolated event.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.