If compliance seems like running a marathon of endless hurdles, chances are you’re not running your business with the right tools.

Compliance software provides fintechs with the automation, workflows, and centralized data needed to navigate regulatory obligations. With the right approach, it shifts from a checkbox exercise to your operational backbone. But it’s not a silver bullet and cannot effectively operate in a vacuum.

Compliance software doesn’t eliminate your regulatory obligations, and it won’t think for you. Founders still need to understand the rules that apply to their model, maintain policies and controls, and make judgment calls when something falls into a gray area.

This article breaks down what fintech teams should look for when evaluating compliance software. You’ll get a clear view of the challenges these platforms aim to solve, what regulators expect from your stack, and a buyer’s checklist to help you evaluate options in a practical, cost-conscious way.

What Compliance Software Does (and Doesn’t) Do

Compliance software helps fintech teams manage and operationalize regulatory requirements. It centralizes workflows, automates routine checks, and gives compliance officers a clearer view of where the risks are. But it’s important to know what the software actually can and can’t do.

Here’s a simple breakdown:

What It Does | What It Doesn’t |

|---|---|

Automates repetitive tasks (e.g., KYC checks, transaction monitoring) | Interpret legal gray areas or make policy decisions |

Tracks deadlines for licensing, renewals, and regulatory filings | Eliminate the need for regulatory registrations or obligations |

Flags high-risk transactions or behaviors based on rules and thresholds | Guarantee that all risks are caught or appropriately escalated |

Generates audit trails and regulatory reports | Replace experienced compliance professionals or advisors |

Supports team collaboration across legal, ops, and product | Provide a one-size-fits-all compliance strategy |

Integrates with CRMs, payment processors, and customer onboarding flows | Automatically makes you compliant without setup or oversight |

Compliance software is a toolset. It enhances visibility, reduces manual workload, and helps your team stay organized under regulatory pressure. But it won’t solve everything out of the box. Someone still needs to understand the rules, configure the system properly, and monitor its outputs.

Why Fintechs Can’t Ignore Compliance Software

Regulatory expectations are rising fast. Whether you're running a crypto exchange, digital lender, or embedded finance platform, you’re held to the same scrutiny as traditional financial institutions. That means recordkeeping, risk monitoring, customer due diligence, and timely reporting, often from day one.

Here’s what happens as you grow:

Regulatory complexity piles up. A single product can trigger federal, state, and even global rules.

Licensing gets fragmented. Payments, lending, crypto, and brokerage services often require different registrations across dozens of jurisdictions.

Bank partners start asking questions. Due diligence from sponsor banks or vendors can quickly turn into compliance audits.

Investors want to see controls. Due diligence checklists now routinely include policies, risk assessments, and evidence of monitoring.

Examinations don’t wait. Some regulators conduct reviews early, even before a product fully launches.

Compliance software helps fintechs handle that volume. It doesn’t eliminate regulatory work, but it reduces time spent chasing spreadsheets and deadlines. It creates structure, tracks activity, and gives your team space to focus on risk.

For lean teams, it also reduces the need for expensive hires by handling repeatable tasks through workflows and automation. When chosen well, it acts as a foundation that scales with your business.

Common Compliance Challenges in Fintech

Fintech teams face regulatory expectations that rival those of legacy institutions, but without the headcount, budget, or precedent. That imbalance creates pressure, and most of it shows up in three areas: fragmented rules, manual processes, and shifting oversight.

Here’s what typically breaks down:

Licensing Gaps

It’s easy to miscalculate which activities trigger regulatory obligations. A company offering digital wallets might add peer-to-peer transfers or lending features without realizing these changes require additional licenses across multiple US states. That oversight can delay launches, attract fines, or trigger partner scrutiny.

Manual Tracking

Many teams start out using spreadsheets and shared calendars to manage renewals, deadlines, or onboarding checks. This may work with a handful of clients. But as volume grows, so does the risk of missing key steps, like filing a suspicious activity report or renewing a state license on time. Manual systems break under pressure.

Disorganized Documentation

Policies, procedures, and records are often scattered across folders, emails, and tools. There’s no central place to see what’s current or who approved what. When regulators, banks, or investors request documentation, teams scramble to compile materials that should have been logged and versioned months ago.

Inconsistent Monitoring

Transaction reviews, if done at all, often happen too late to catch issues proactively. Without automated alerts or standardized rules, suspicious behavior may go unnoticed. Manual risk scoring is slow and inconsistent, making it challenging to separate real concerns from noise.

Siloed Teams

Compliance doesn’t operate in a vacuum. Yet, many fintechs run their legal, compliance, ops, and product on disconnected tools. As a result, approvals get missed, policies aren’t followed, and responsibility gets blurred. The lack of shared systems leads to delays, confusion, and compliance blind spots.

These challenges don’t come from neglect. They come from the growth outpacing process. As scrutiny from regulators and banking partners continues to increase, what was once tolerable becomes unacceptable.

Regulatory Landscape: Who’s Watching What

There’s no single fintech regulator. Most companies fall under a patchwork of oversight, depending on the products they offer and where they operate. That makes tracking obligations more complicated and more critical.

The following regulatory bodies are actively involved in the oversight:

FinCEN: Covers anti-money laundering (AML) and customer due diligence. If you handle funds or crypto, you’re likely an MSB (Money Services Business) and must register, file reports, and run a formal AML program.

SEC and FINRA: Regulate securities. If your platform involves trading, investing, robo-advising, or anything that touches securities (directly or indirectly), you may need broker-dealer registration, disclosure controls, and proper recordkeeping.

CFPB: Oversees consumer-facing financial products. That includes lending, credit reporting, and digital wallets. Expect rules around fair lending, disclosures, user privacy, and marketing practices.

State regulators: Money transmission, lending, and other financial services often require 40-50 individual state licenses. Each has its own requirements for applications, bonding, renewals, and reporting. New York and California are especially active examiners.

CFTC: Covers derivatives and some types of crypto assets treated as commodities. If you offer trading or products involving futures, swaps, or certain tokens, you may fall under its jurisdiction.

Banking regulators (OCC, FDIC, Federal Reserve): If you partner with a bank, their regulators will review your compliance practices. Bank-as-a-Service relationships bring indirect oversight, even if you’re not directly supervised.

This overlapping landscape means that fintechs must map their obligations early and frequently revisit them. Compliance software can help track licensing requirements, manage filing calendars, and centralize audit documentation.

Misconceptions About Compliance Software

Most fintech teams know they need compliance controls. But when it comes to software, expectations often don’t match reality. That mismatch leads to wasted time, poor implementation, and in some cases, regulatory exposure.

Here are the most common misconceptions:

You’re too young: Regulators don’t care about your headcount. If you’re offering a regulated product, you’re expected to have controls from day one. Waiting until you grow just makes the gaps harder to fix.

Our bank partner covers compliance: Sponsor banks provide licenses, not protection. In Banking-as-a-Service models, the burden shifts, but it doesn’t go away. Most banks will audit your compliance stack, and they expect real systems, not placeholders.

The software makes us compliant: It doesn’t. The software helps you track, execute, and document your compliance work. But someone still has to interpret rules, respond to alerts, and adjust controls as regulations evolve.

We’ll deal with it when regulators come knocking: That’s already too late. Examinations, investor diligence, and partner onboarding all happen early. If you can’t show working systems, you’ll slow down or lose those conversations.

Compliance is a legal problem: It’s a company-wide responsibility. Product decisions, marketing claims, and customer support all carry compliance implications. Your tools and workflows should reflect that.

Buying compliance software without addressing these misconceptions often leads to shelfware. The most effective platforms are adopted by cross-functional teams, used consistently, and paired with clear internal ownership.

Compliance Software Buyer’s Checklist

Choosing compliance software isn’t about ticking features off a list. It’s about finding a system that fits your regulatory footprint, internal workflows, and growth plans.

Look for the listed core capabilities that the following sections break down. We’ve drawn these from the areas where compliance teams struggle most, and where software can provide real operational value:

Regulatory Coverage and Built-In Expertise

A good compliance platform reflects a working understanding of the regulations fintechs actually face. This includes federal, state, and partner-driven requirements across payments, lending, crypto, brokerage, and other areas.

Here’s what to look for:

Pre-built modules aligned with real obligations. AML programs, licensing trackers, disclosure logs, ideally mapped to US and state-specific rules.

Content informed by regulatory standards. Templates and workflows should reflect the expectations of agencies like FinCEN, the SEC, or the CFPB.

Support for multi-jurisdictional operations. If you operate across states or internationally, the system should track and distinguish requirements by region.

Clear audit trails. Built-in logic for documentation and versioning makes it easier to demonstrate compliance during exams or partner reviews.

Generic workflow tools can be retrofitted for compliance, but that often leads to gaps. Platforms built specifically for fintechs tend to align better with what regulators actually expect to see.

Real-Time Monitoring and Alerts

Compliance isn’t static. Rules change, customers behave unpredictably, and what looked fine yesterday might raise a red flag today. That’s why real-time monitoring is a critical feature, not a nice-to-have.

Look for platforms that offer:

Automated alerts for high-risk activity. Whether it’s a flagged transaction, an overdue filing, or a missing attestation, the system should surface issues as they happen.

Configurable thresholds. You should be able to define what counts as risky based on your business model, risk appetite, and regulatory obligations.

Live dashboards. Real-time status updates across key areas of licensing, customer reviews, and suspicious activity help teams prioritize.

Change detection and regulatory updates. Some platforms offer feeds or alerts when relevant laws or rule interpretations change. This can be especially useful for teams without in-house legal staff.

Static checklists and point-in-time reviews aren’t enough for growing fintechs. Real-time tools help compliance teams stay ahead of issues instead of reacting after the fact.

AML/KYC and Transaction Monitoring Automation

For most fintechs, AML and KYC are foundational. But building these processes manually is slow, expensive, and prone to error. Compliance software should help automate the repetitive parts while giving your team control over how risks are reviewed.

Here’s what to evaluate:

KYC workflows that match your onboarding flow. Look for support for ID verification, watchlist screening, and customer risk scoring, integrated into your existing user experience.

Transaction monitoring with rules and logic you control. The platform should let you set thresholds, flag behavior patterns, and adjust triggers based on evolving risk.

Case management built into the system. When a suspicious transaction is flagged, you should be able to assign it, investigate it, and document outcomes all in one place.

SAR/CTR report generation. If you’re filing with FinCEN, the software should help streamline that process with data pre-fill, templates, and submission tracking.

Manual transaction reviews don’t scale. And piecing together KYC checks from separate vendors creates gaps. The right software helps centralize AML compliance without turning your team into a ticket queue.

Risk Assessment and Issue Management

A strong compliance program can successfully anticipate red flags. That’s where risk assessments come in. Whether you're launching a new product, onboarding a third-party vendor, or expanding into a new market, you need a process for evaluating regulatory exposure before the fact.

Good compliance software should support this by providing built-in tools for structured risk assessments. That includes customizable templates for:

Product launches

Vendor diligence

Periodic program reviews

These assessments should feed directly into your controls, not sit in a silo. Equally important is how the platform handles issue management. When something goes wrong, like a failed control, a missed deadline, or a negative audit finding, you need a system for logging the issue, assigning follow-up, and tracking resolution.

Without that, issues fall through the cracks or get resolved without proper documentation.

Policy, Training, and Recordkeeping Tools

Every fintech needs documented policies for regulators and internal clarity. This includes AML procedures, customer complaint handling, disclosure controls, and more. But writing a policy isn’t enough. It needs to be communicated, reviewed, and maintained over time.

A solid compliance platform should make that easier by helping you:

Store and manage policy documents in one place, with version control and clear ownership

Distribute updates to relevant teams and track attestations automatically

Schedule recurring training and record who completed it, when, and for which topics

Log procedural changes so you can show how your controls evolve over time

The recordkeeping piece is key. Regulators often ask for evidence of what was in place, when it was implemented, and who was trained. If your documentation lives across shared drives and inboxes, that becomes a risk in itself. Good software creates a single source of truth.

Workflow, Collaboration, and Audit Trails

Compliance doesn’t live in one department. Legal, product, operations, and customer support all play a role. The software you choose should reflect that cross-functional reality and make it easier for teams to work together without creating gaps.

Look for tools that offer:

Task assignment and workflow routing so reviews and approvals go to the right people

Commenting and change tracking to streamline collaboration on policies, marketing reviews, or incident follow-up

Role-based access controls so the right people see the right information without oversharing sensitive data

Automated audit trails that log who did what, when, and why

This matters when regulators ask how a decision was made or a risk was handled. If you’re relying on Slack threads or email chains, you may not have a defensible record.

Reporting, Analytics, and Exam Readiness

When regulators, banks, or auditors show up, they don’t want opinions; they want records. Your compliance software should make it easy to surface evidence, track patterns, and package everything into a usable format.

Strong platforms typically offer:

Pre-built regulatory reports like SAR logs, license renewals, or annual reviews

Custom reporting tools so you can pull data by timeframe, risk category, or business unit

Dashboards and metrics that help you monitor trends like alert volume, resolution time, or training completion

Export-ready audit packages that compile documents, attestations, and issue histories without manual assembly

Customization, Scalability, and API Integrations

Your compliance program isn’t static. Neither is your product roadmap. As you expand into new markets or add services (like crypto, lending, or embedded finance), your software needs to adapt with you.

Look beyond feature lists. Ask how the platform handles change:

Can workflows be customized to fit your review process, not just a preset template?

Does it support multi-entity or multi-region oversight as you scale?

Will it integrate with your existing stack without engineering headaches?

Can it accommodate different user roles and permissions as your team grows?

Rigid tools break under pressure. Look for platforms that are built for iteration, not just implementation. That flexibility matters more than bells and whistles.

Data Security, Privacy, and Vendor Oversight

Compliance tools handle sensitive information like customer identities, transaction records, and internal policies. That makes data security a non-negotiable.

Start with the basics. The platform should offer:

Encryption in transit and at rest

Role-based access controls

Regular security audits and certifications (e.g., SOC 2, ISO 27001)

But it doesn’t stop there. Regulators increasingly expect companies to manage third-party risk. That includes the vendors you use for compliance. If your platform goes down or if it mishandles data, your company is still on the hook.

You’ll want answers to questions like:

Where is data stored?

Who has access to it, internally and externally?

What happens during downtime or an incident?

Does the vendor have a clear business continuity plan?

Remember, in regulated fintech, your software should support security.

User Experience and Support

Compliance tools don’t work if no one uses them. That includes your compliance team as well as your legal, product, ops, and support. If the interface is clunky or if tasks require five extra steps, people will find workarounds. And that’s where risk creeps in.

Strong platforms prioritize usability:

Clear navigation and dashboard views

Role-specific access, so users only see what they need

Task automation that reduces clicks, not adds them

Minimal training required to get started

Support matters too. If something breaks or if a process needs to be reconfigured, how quickly can you get help? Look for vendors who offer responsive support, detailed documentation, and a track record of working with compliance-heavy teams.

Comparing Top Compliance Software for Fintechs

The compliance software market is crowded. But not all compliance software is built for the realities fintech teams face. Some platforms cater to large institutions with extensive legal departments. Others lean into automation but lack the regulatory depth fintechs need.

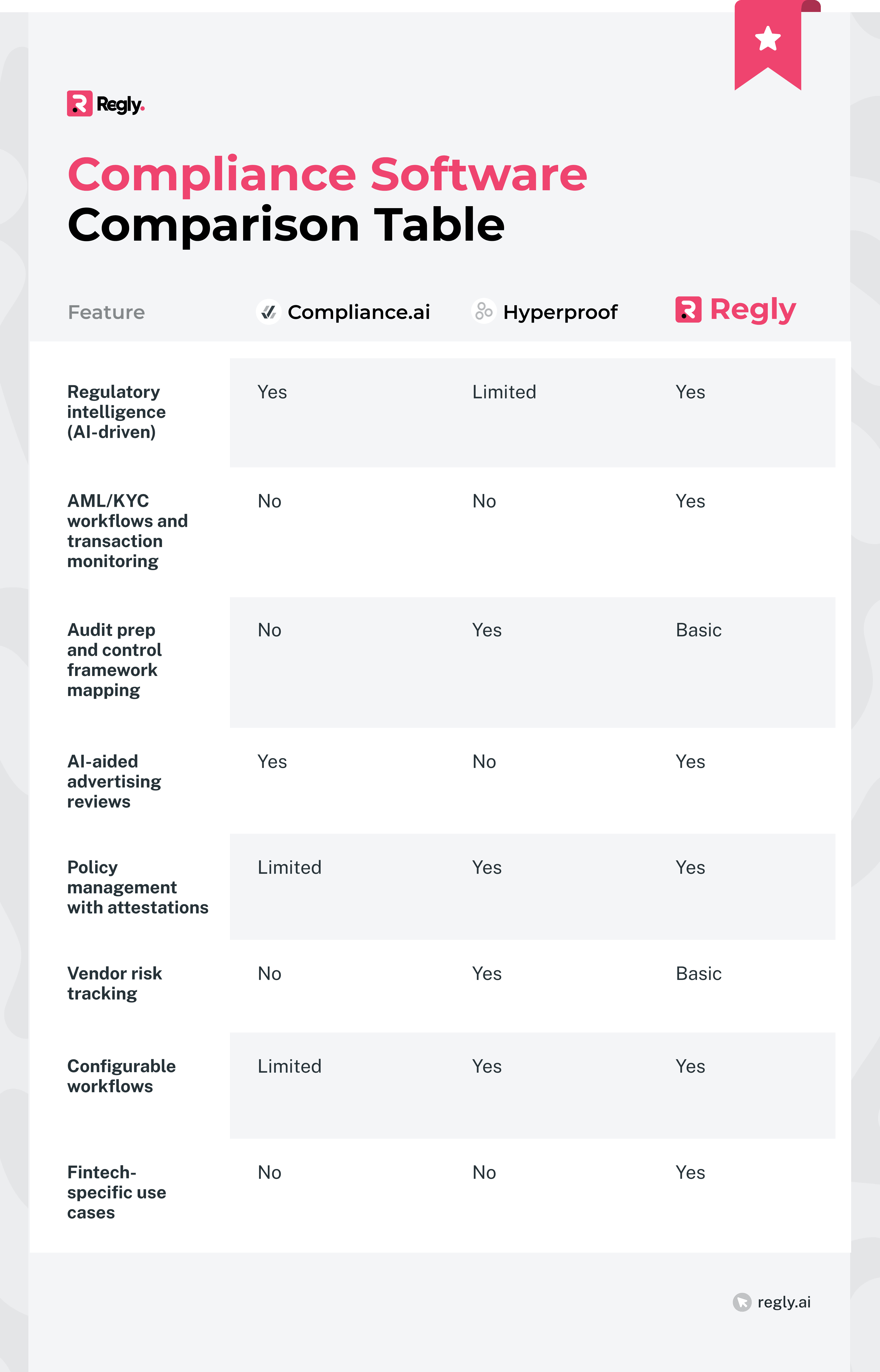

Below is a practical comparison of three compliance software platforms:

1. Compliance.ai

Compliance.ai is a regulatory intelligence platform. It uses AI to monitor regulatory updates across hundreds of agencies, helping legal and compliance teams stay current. Its core value lies in surfacing new rules quickly, not operationalizing them.

Key features:

AI-driven alerts for regulatory changes

Jurisdiction- and topic-based filtering

Workflow tools to assign and track policy updates

Custom rulebooks and regulatory dashboards

Integration with legal teams for policy governance

Best for: Financial institutions with in-house legal teams focused on tracking regulatory changes.

2. Hyperproof

Hyperproof is a general-purpose compliance operations platform. It helps companies manage audits, vendor risk, and control frameworks across standards like SOC 2, ISO 27001, and NIST. Its strength lies in structured documentation and assurance workflows, not financial regulation.

Key features:

Control mapping across frameworks (e.g., SOC, ISO, NIST)

Audit preparation and evidence management

Vendor risk assessment tracking

Team workflows and task automation

Pre-built templates for common standards

Best for: SaaS companies and enterprises standardizing internal controls or preparing for audits.

3. Regly

Regly is explicitly built for fintech companies. It combines compliance automation, regulatory intelligence, and workflow management. It helps small to medium-sized fintech teams automate AML tasks, manage policies, and collaborate across departments without overbuilding.

Key features:

AI-assisted advertising reviews

AML/KYC workflows and real-time risk monitoring

Policy attestations and change logs

Employee compliance solutions

Regulatory updates tied to practical action items

Built-in templates reflecting fintech regulatory expectations

Best for: Fintech startups and scaleups that need to operationalize compliance across multiple regulators and functions.

Questions to Ask Before You Buy

Not all compliance software is built the same, and not all demos tell the whole story. Before signing on, fintech teams should pressure-test how well the platform aligns with their actual needs.

Ask these questions during evaluation:

What regulatory domains does the software support? Look for fintech-relevant areas like AML, money transmission licensing, disclosure controls, and transaction monitoring.

Was it built for fintech or retrofitted from another industry? Many platforms start in enterprise IT or healthcare and add “compliance” later. That often leads to gaps in financial regulatory coverage.

Can it scale with your growth and complexity? You might start small, but if you're adding products, states, or banking partners, the system should be able to handle increasing obligations without breaking.

Does it support collaboration across functions? Compliance intersects with legal, ops, product, and support. The right platform helps teams work together, not in silos.

What happens when something changes, like a new rule, a new product, or a new jurisdiction? How easy is it to update controls, notify staff, and document your response?

What does onboarding look like? Is the implementation guided? Are workflows prebuilt or fully custom? What’s the learning curve?

Who actually uses it? Ask for examples of companies like yours. See if they’ve supported fintechs with similar regulatory exposure or product models.

Good compliance software can become your operational partner. Asking the right questions up front will save your team time, money, and rework later.

Final Takeaways

Fintech teams face growing regulatory expectations, often with limited resources and shifting oversight. Manual tools and scattered processes might work for a while, but they don’t scale under pressure.

The takeaway is simple: compliance needs structure. Software can’t replace good judgment, but it can support consistency, visibility, and collaboration at scale. In other words, it means faster onboarding, better collaboration, fewer gaps, and a stronger footing when regulators or partners come calling.

If your team is evaluating compliance software built for the realities of fintech, Regly can become a practical, expert-driven solution. Built by compliance professionals with deep industry experience, it helps you stay organized, audit-ready, and focused on execution.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.