Fintech compliance in 2026 feels different. The pace of change is faster, and the rules are evolving to match it. Founders, lawyers, and compliance professionals are expected to keep up while also building products, serving customers, and scaling their businesses.

This guide breaks down what fintech compliance means right now and how it’s shaping the industry. You’ll see which regulators matter most, what core areas demand attention, and how leading fintechs are adapting their programs.

The goal is to help you cut through the noise. Whether you’re launching a product or expanding into new markets, this article gives you a clear view of the compliance landscape and what it takes to stay ahead in 2026.

What Fintech Compliance Means in 2026

Fintech compliance in 2026 is about building trust, protecting users, and creating a foundation that supports long-term growth. As products evolve and partnerships with banks, payment processors, and crypto platforms become more common, compliance now touches every part of a fintech’s operation.

At its core, fintech compliance means understanding how your product fits into existing financial regulations and taking the right steps to manage those obligations. That includes knowing whether your activities trigger licensing, which laws apply to your customer onboarding process, and what standards you must meet to protect data and prevent financial crime.

The biggest change in 2026 is the shift toward accountability and transparency. Regulators expect fintechs to show not just that they have policies in place, but that those policies actually work. For many startups, that means moving from a reactive approach to one that’s embedded in daily operations, where compliance is part of how the business runs, not an afterthought.

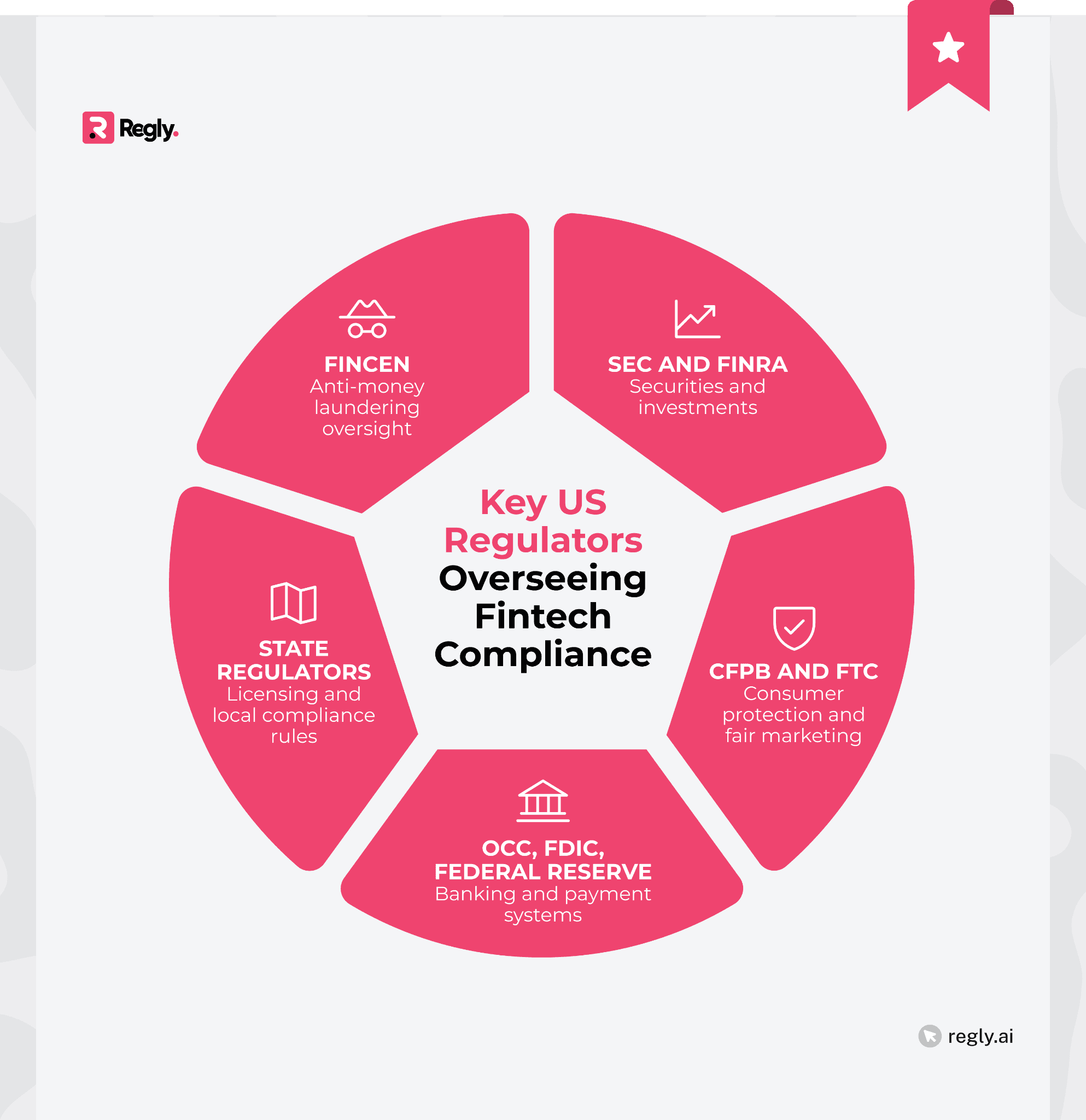

Key US Regulators Overseeing Fintech Compliance

Fintechs in the US work under several regulators, each with its own focus. Knowing who they are and what they oversee makes it easier to manage compliance from the start.

SEC and FINRA

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) oversee how fintechs handle investments, trading, and other securities-related activities. If your platform helps people invest, trade, or manage portfolios, these two regulators will likely be part of your journey.

The SEC focuses on protecting investors and keeping markets fair. It looks at how fintechs share information, handle client funds, and design investment products. Even early-stage startups can trigger SEC oversight if they deal with digital assets or offer investment features that look like securities.

FINRA works closely with the SEC to regulate broker-dealers and their representatives. It sets the standards for how firms supervise activities, communicate with clients, and manage potential conflicts of interest.

Together, the SEC and FINRA shape how investment-focused fintechs build trust and operate responsibly. Understanding their expectations early helps you design products and workflows that support both innovation and compliance.

CFPB and FTC

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) focus on protecting consumers and promoting fair business practices. For fintechs that offer loans, credit, payments, or other consumer-facing services, these two agencies play a significant role in shaping how products are designed and marketed.

The CFPB oversees how financial companies interact with consumers. It looks at disclosures, fees, complaint handling, and product transparency. If your app offers lending, credit scoring, or personal finance tools, the CFPB expects your communications and policies to be clear and fair.

The FTC, on the other hand, focuses on truth in advertising and data privacy. It reviews how fintechs promote their services and handle customer information. Misleading claims, confusing terms, or weak data practices can all attract attention from the FTC.

Together, the CFPB and FTC help keep fintechs accountable to the people who use their products. Building clear policies, honest marketing, and responsible data practices not only supports compliance but also strengthens customer trust.

FinCEN and AML Oversight

The Financial Crimes Enforcement Network (FinCEN) leads the effort to prevent money laundering and financial crime in the US. For fintechs that move, store, or exchange money, this is one of the most critical areas of compliance.

FinCEN requires certain fintechs to register as Money Services Businesses (MSBs). Once registered, companies must build an anti-money laundering (AML) program that fits their risk profile. That includes verifying customer identities, monitoring transactions, and reporting suspicious activity through Suspicious Activity Reports (SARs).

Strong AML oversight isn’t just about meeting obligations. It’s also about protecting your business from fraud and maintaining credibility with partners, banks, and regulators. Whether you’re handling fiat payments, crypto transactions, or peer-to-peer transfers, transparent processes and regular reviews go a long way in keeping operations safe and compliant.

OCC, FDIC, and Federal Reserve

The Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve oversee the stability of the banking system and the partnerships that connect banks with fintechs. If your company works with a sponsor bank or offers products tied to deposit accounts, these regulators are part of your world.

The OCC: It supervises national banks and guides how they collaborate with fintech partners. It also reviews how banks manage risk, safeguard customer funds, and maintain control over outsourced activities.

The FDIC: It focuses on protecting depositors and promoting confidence in the financial system. Fintechs that offer bank-like products often rely on FDIC insurance through a partner bank, so it’s important to represent that relationship accurately in all communications.

The Federal Reserve: It oversees payment systems and bank holding companies. Its influence grows as fintechs become more involved in payments, digital wallets, and faster money movement.

Understanding these three regulators helps fintechs build stronger, more transparent relationships with their banking partners while keeping operations stable and compliant.

State-Level Regulators

State regulators play a considerable part in fintech compliance, especially for startups just getting off the ground. Each state has its own set of rules for money transmission, lending, and consumer protection, and those rules can differ more than you might expect.

Most states require fintechs that handle payments, lending, or stored value to hold licenses before offering services to local residents. These licenses come with specific obligations, such as maintaining financial reserves, following reporting schedules, and meeting consumer disclosure standards.

For companies operating nationwide, managing dozens of state licenses can be a real challenge. Some fintechs work with licensing partners or apply for a nationwide framework like the Multistate Money Services Business Licensing Agreement to simplify the process.

Staying ahead of state-level rules helps fintechs expand more smoothly and avoid costly delays. A proactive approach to state compliance can also open the door to faster approvals and stronger relationships with regulators.

Key Areas of Fintech Compliance

Fintech compliance touches every corner of a company’s operations. From onboarding customers to marketing your products, each step carries its own regulatory expectations. The core areas below outline where most fintechs need to focus their attention to stay compliant and build long-term credibility.

Area | Focus Area |

|---|---|

Licensing and Registration | Determines which federal and state approvals your business needs before launching or offering services. |

AML and KYC Requirements | Prevents money laundering and verifies customer identities through due diligence and ongoing monitoring. |

Data Protection and Cybersecurity | Protects sensitive customer information and keeps systems secure from cyber threats. |

Consumer Protection and Fair Lending | Promotes fairness, transparency, and equal access in financial products and lending. |

Payments and Money Movement Rules | Governs how funds are transferred, stored, and reported within financial systems. |

Third-Party and Vendor Risk Management | Manages risks tied to vendors, service providers, and other external partners. |

Advertising and Marketing Compliance | Keeps promotions and communications honest, clear, and aligned with regulations. |

Securities, Investments, and Crypto Regulations | Covers compliance requirements for investment platforms and digital asset activities. |

Licensing and Registration

Licensing is one of the first real tests for a fintech. It’s where your idea meets regulation, and the kind of license you need depends entirely on what your company does. A business that moves money faces different rules than one that lends, invests, or provides financial advice.

Both money transmitters and lenders usually need state-level licenses; money-transmitter licenses for fund transfers, and consumer-lending or loan-broker licenses for lending activities. Fintechs that offer investment products may have to register with the SEC or FINRA. Each route has its own process and timeline, and knowing which one applies to you makes everything else easier.

AML and KYC Requirements

AML and know-your-customer (KYC) practices and procedures sit at the heart of fintech compliance. They help companies confirm who their customers are, understand how they use financial services, and spot potential risks before they become problems.

Most fintechs that move money or handle transactions must register with FinCEN and build an AML program. That usually includes appointing a compliance officer, verifying customer identities, monitoring transactions, and reporting anything suspicious.

KYC goes hand in hand with these requirements. It focuses on collecting reliable customer data, confirming identities, and keeping an eye on unusual patterns over time. A well-structured KYC process protects both your business and your customers from fraud and financial crime.

Strong AML and KYC programs also make fintechs more attractive to partners and investors. They show that compliance is not just about following rules, but about running a responsible and trustworthy business.

Data Protection and Cybersecurity

Fintechs handle some of the most sensitive information, including personal data, financial records, and transaction histories. Protecting that information is a core part of compliance.

Regulators expect fintechs to have strong data protection measures that safeguard customer information at every step. That means encryption, access controls, regular system monitoring, and clear data retention policies. Many fintechs also follow standards like ISO 27001 or NIST to show that their systems meet industry best practices.

Cybersecurity goes hand in hand with data protection. If not managed properly, threats like phishing, ransomware, and API breaches can cause serious damage. Regular risk assessments, security training, and incident response planning help keep systems resilient.

Customers trust fintechs with their money and their information. Protecting that trust through solid data and cybersecurity practices is one of the most important investments a company can make.

Consumer Protection and Fair Lending

Consumer protection is about making sure financial products are transparent, fair, and accessible. For fintechs, this means being clear about how services work, what they cost, and what risks customers might face.

Fair lending rules add another layer. They require that companies treat all applicants equally, without discrimination based on factors like race, gender, or age. These standards apply not just to traditional loans but also to digital credit, buy-now-pay-later programs, and automated underwriting systems.

Clear disclosures, honest marketing, and fair decision-making go a long way toward meeting these expectations. Many fintechs use technology to improve access to credit and financial tools, but that innovation comes with responsibility. Platforms like Regly help teams manage these obligations by tracking policies, monitoring risks, and keeping compliance consistent across products.

Payments and Money Movement Rules

Fintechs that handle payments sit at the intersection of innovation and regulation. Moving money, whether between users, merchants, or across borders, triggers specific compliance obligations that keep the financial system secure and transparent.

At the federal level, laws like the Bank Secrecy Act (BSA) and the Electronic Fund Transfer Act (EFTA) outline how payment providers must operate. These rules cover everything from transaction monitoring to consumer disclosures and error resolution procedures.

Building payments compliance into your core operations helps prevent costly missteps later. When customers and partners know their transactions are handled responsibly, it strengthens both trust and business growth.

Third-Party/Vendor Risk Management

Most fintechs rely on outside partners to power parts of their business. That might include cloud providers, payment processors, KYC vendors, or marketing platforms. Each relationship adds value, but it also introduces potential compliance risks.

Regulators expect fintechs to understand who their vendors are, what data they handle, and how they manage security. This means performing due diligence before onboarding, setting clear contractual standards, and reviewing vendors regularly.

Good vendor management is about protecting your customers and your business from hidden risks. Clear oversight, strong documentation, and open communication with third parties make it easier to stay compliant and build reliable partnerships.

Advertising and Marketing Compliance

Fintech marketing is where innovation often meets regulation. Creative campaigns and bold claims can grab attention, but they also attract scrutiny if they mislead or leave out key details.

Regulators like the FTC and CFPB focus on truth in advertising, transparency, and fairness. Fintechs are expected to present products accurately, disclose fees clearly, and avoid language that could confuse consumers. This applies across websites, social media, emails, and influencer promotions.

Marketing compliance also includes proper handling of testimonials, endorsements, and performance claims. Every statement should be backed by facts that customers can verify.

Clear, honest communication helps fintechs stand out for the right reasons. When marketing builds trust instead of hype, it strengthens both brand reputation and long-term customer relationships.

Securities, Investments, and Crypto Regulations

Fintechs offering investment or crypto products face some of the most complex compliance requirements in the industry. They’ve got to navigate the increased regulatory scrutiny of offering/trading digital assets, while also complying with the areas that often overlap with traditional securities laws.

The SEC oversees activities that involve securities, such as tokenized assets, robo-advisory services, and investment platforms. FINRA adds another layer for broker-dealers, focusing on supervision, disclosures, and client communications.

For crypto-focused businesses, compliance goes beyond registration. It involves building strong AML programs, protecting customer assets, and staying up to date with evolving guidance from both federal and state authorities.

Common Compliance Challenges for Fintechs

As fintechs grow, compliance becomes more complex. Regulations evolve, new markets add layers, and keeping everything aligned can be a real challenge. Below are some of the most common hurdles fintechs face and practical ways to manage them.

Licensing Triggers and Early Obligations

Fintechs typically move fast and build first, only to find out later that their product activities fall under licensing rules. Moving money, issuing credit, or connecting users for financial transactions can all trigger early regulatory obligations.

The tricky part is that these triggers vary depending on your product and where you operate. Something as simple as holding customer funds or processing payments between users can require a license in some states but not others.

The best approach is to understand your business model in regulatory terms from day one. When you know which rules apply early, you can plan your launch and growth strategy with fewer surprises down the road.

Scaling Compliance With Product Growth

Growth brings opportunity, but it also adds layers of complexity. As fintechs expand into new products or markets, their compliance programs need to keep up. What once worked for a small team can quickly feel stretched when regulations, partnerships, and customer activity increase.

Many companies start with manual reviews or spreadsheets, but those tools only go so far. At scale, compliance requires stronger systems, more transparent processes, and better coordination between teams.

The goal is to grow without losing control. When compliance evolves alongside the product, it becomes part of how the business operates, not something that slows it down. Tools like Regly FinCrime make that balance easier by automating monitoring, tracking risks, and keeping teams aligned as the company scales.

Multi-Jurisdiction Complexity

Growth creates momentum, but it also introduces new challenges. As fintechs expand into more products, markets, and partnerships, their compliance programs need to grow in step. What worked for a small team early on can quickly feel stretched as regulations and customer activity multiply.

The most successful fintechs treat this complexity as part of their growth strategy. By centralizing compliance tracking and leaning on local expertise, they can stay organized, adapt quickly, and keep expansion moving in the right direction.

Bank–Fintech Partnerships and Oversight

Many fintechs work with banks to offer products like deposits, lending, or payment services. These partnerships open doors to regulated activities, but they also come with shared compliance responsibilities.

Banks are required to oversee their fintech partners closely. They expect detailed documentation, strong internal controls, and transparent communication. For fintechs, this means building programs that meet not only regulatory expectations but also the bank’s own risk standards.

The best partnerships are built on trust and preparation. When fintechs understand what their banking partners need and maintain open communication, they create stronger relationships that support both compliance and growth.

Documentation and Audit Readiness

Good documentation is the backbone of any compliance program. Policies, procedures, and records show regulators and partners that your controls are active and effective. Without them, even a well-run program can look incomplete.

Audit readiness goes hand in hand with documentation. It’s not just about storing files but keeping them organized, up to date, and easy to retrieve when questions arise. Regulators, banks, and investors all want to see clear evidence of compliance in action.

Fintechs that make documentation part of their daily workflow are always one step ahead. When records are accurate and accessible, audits become smoother, and teams can focus on improving processes instead of scrambling to prove them.

Fragmented Systems and Manual Processes

As fintechs expand, their compliance operations often grow faster than their systems. What begins with a few spreadsheets and shared folders can quickly turn into a maze of disconnected tools and documents.

When data and tasks are spread across different platforms, visibility fades. Teams struggle to track what’s been done, duplicate work creeps in, and important updates get missed. Over time, small inefficiencies can turn into real compliance risks.

Bringing everything into one organized system helps restore control. With clear workflows, shared access, and reliable data, teams can work more smoothly and keep compliance aligned with the pace of growth.

Talent and Resource Constraints

Finding and keeping skilled compliance professionals is one of the toughest challenges for fintechs. The demand for experienced talent is high, and the right mix of regulatory knowledge and fintech experience can be hard to find.

Many startups begin with small teams that wear multiple hats. That works early on, but as the company grows, the workload expands faster than the team can handle. Training, reporting, and oversight all compete for limited time and attention.

Balancing people, tools, and processes is key. Some fintechs bring in external experts or use technology to handle routine tasks so their teams can focus on higher-value work. With the right balance, compliance becomes manageable even when resources are tight.

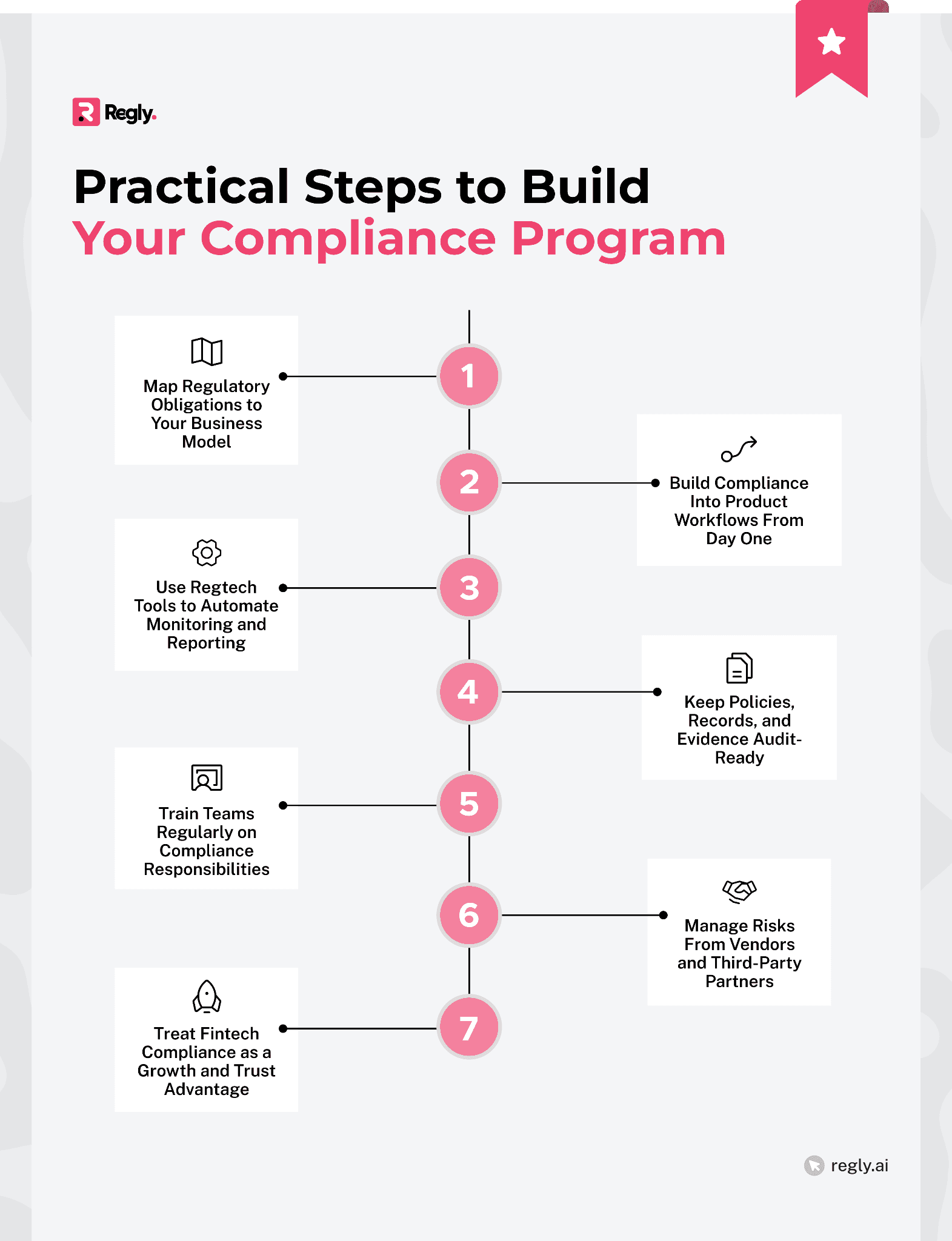

Practical Steps to Build Your Compliance Program

Building a strong compliance program doesn’t have to feel overwhelming. The key is to start with a clear structure and add layers as your business grows. Below are practical steps that help fintechs stay compliant while keeping operations efficient and scalable.

Map Regulatory Obligations to Your Business Model

The best compliance programs start with a clear understanding of how the business operates. Before diving into policies or tools, take time to connect your products and services to the specific regulations that govern them.

Begin by listing your core activities, such as payments, lending, or investments, and then identify the agencies or frameworks that apply to each. This exercise reveals where you have direct obligations and where risks might arise as you expand.

When your compliance plan reflects your actual business model, it becomes far more effective. You can allocate resources wisely, avoid unnecessary complexity, and focus on building controls that fit how your fintech truly works.

Build Compliance Into Product Workflows From Day One

Compliance works best when it’s part of the product, not an afterthought. Every feature that involves customers, transactions, or data has a compliance angle, and building those checks in early saves time and effort later.

Collaborate with your product and engineering teams from the start. Make sure compliance considerations like customer verification, recordkeeping, and disclosures are built into the design process. When compliance is integrated into your systems, it becomes part of your company’s routine, rather than an extra step.

This approach helps teams move faster and reduces the need for rework. It also creates a smoother experience for customers, who benefit from transparent, secure, and ready-for-growth products.

Use Regtech Tools to Automate Monitoring and Reporting

As compliance demands increase, manual tracking quickly becomes unsustainable. Regtech tools help automate the repetitive parts of compliance so teams can focus on higher-level decisions.

These tools can connect data across departments, making it easier to spot patterns and identify potential issues early. Automation also reduces human error and creates consistent, reliable records for audits or reviews.

Choosing the right technology depends on your needs and scale. Look for tools that integrate smoothly with your existing systems and grow with your business. The right setup makes compliance more efficient and gives your team more time to focus on strategy.

Keep Policies, Records, and Evidence Audit-Ready

Strong compliance programs depend on good documentation. Policies, procedures, and records show how your company operates and how risks are managed. When these materials are current and organized, audits and reviews become much easier to handle.

Make documentation part of your routine rather than something done in a rush before an exam or partnership review. Store key files in one place, update them as your processes change, and track who is responsible for maintaining them.

Train Teams Regularly on Compliance Responsibilities

Even the best compliance framework only works if everyone understands it. Regular training keeps your team informed about the rules that apply to their work and helps them spot potential issues before they grow into bigger problems.

Training shouldn’t feel like a one-time presentation. Short, focused sessions or quick refreshers tied to daily tasks are often more effective. Teams stay engaged when they see how compliance connects directly to what they do.

A well-informed team builds a culture of accountability. When everyone understands their role in maintaining compliance, it becomes a shared effort rather than a separate function.

Manage Risks From Vendors and Third-Party Partners

Fintechs often rely on vendors for key functions like payments, cloud storage, or identity verification. These partnerships are valuable but can also introduce new risks if not managed carefully.

Before working with a vendor, review their security standards, data handling practices, and regulatory track record. Once they’re onboarded, keep the oversight active with regular reviews and clear communication about expectations.

Good vendor management protects both your company and your customers. When third parties follow the same high standards you do, it strengthens your overall compliance program and reduces the chance of unpleasant surprises later.

Treat Fintech Compliance as a Growth and Trust Advantage

Compliance isn’t just a requirement. It’s a signal of credibility. Fintechs that invest in strong compliance programs stand out to regulators, investors, and customers who value transparency and accountability.

When compliance is built into daily operations, it helps teams move faster with fewer risks. It also makes it easier to form partnerships, attract funding, and expand into new markets with confidence.

Rather than seeing compliance as a cost, view it as part of your growth strategy. It builds trust, supports innovation, and sets your company apart in an increasingly competitive industry.

—

Fintech compliance in 2026 is a foundation for sustainable growth. As regulations evolve and products become more complex, the companies that succeed are those that treat compliance as part of their core strategy, not a separate task.

Understanding the rules, building smart systems, and keeping teams aligned all contribute to stronger, more resilient operations. Whether you’re just starting out or scaling globally, the goal is the same: create a compliance program that supports innovation while protecting your customers and your business.

When compliance is done right, it becomes a competitive edge. It builds trust, attracts partners, and helps your fintech grow with confidence in an industry where accountability matters as much as innovation.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.