Operationalizing compliance means turning regulatory intent into day-to-day execution. For fintechs, that’s where the real challenge begins.

As innovation pushes into gray areas of finance, traditional compliance models often fall short. What matters isn’t just having policies in place; it’s whether those policies are applied consistently across fast-moving teams.

This article unpacks what operationalizing compliance actually involves, why it’s becoming a priority across the fintech landscape, and how to approach it. We’ll look at what regulators expect, where companies often stumble, and how to structure your workflows so compliance becomes part of how your teams operate.

What Operationalizing Compliance Means in Fintech

In a regulated industry, compliance doesn’t just live in documents or audits. Operationalizing compliance means embedding regulatory obligations into how a company runs every day. It’s the difference between writing a policy and making sure it actually works across departments.

For fintechs, that target keeps shifting. Products change quickly, and so do team structures, partnerships, and what regulators expect. Compliance has to move at the same speed, which means building it into workflows from the beginning rather than bolting it on when problems surface.

This often includes:

Translating legal obligations into actions for engineering, product, and operations

Automating routine controls where possible

Tracking whether procedures are followed in real time, not just on paper

Operationalizing compliance is execution-focused: building the right habits, assigning ownership, and making compliance part of the business rhythm.

Why Operationalizing Compliance Matters

Policies set direction, but they don’t shape behavior on their own. Without an operational structure, even well-written rules fall out of sync with daily work. That gap is where most compliance issues begin.

Operationalizing Compliance Is About Execution, Not Documentation

Compliance programs usually begin as documents. But policies sitting in a folder don't reduce risk on their own. Operationalizing compliance is what transforms those policies into action, and action into actual protection.

This matters because fintechs face regulatory scrutiny early. A startup with ten employees can still get fined for marketing missteps, broken disclosures, or sloppy onboarding practices. Regulators don't give you a pass for being new. They want to see whether your controls actually function.

When compliance is operationalized, teams understand what's expected of them. Controls get built into workflows rather than tacked on after the fact. That consistency is what regulators look for.

What Regulators Actually Care About

Most fintechs don't stumble because they're missing a license or filed the wrong registration form. They get flagged because their compliance programs fall apart in practice.

Regulators don't just flip through your policies. They dig for evidence that controls are active, consistent, and monitored. They ask questions like:

Are internal procedures actually followed by frontline teams?

Do your systems flag suspicious activity, and does someone respond to those alerts?

When something breaks, is it documented, reported, and resolved?

They’re also paying attention to patterns. Customer complaints that keep popping up. Audit issues that never quite get fixed. Exceptions that show up again and again. A beautifully written compliance manual doesn’t carry much weight if the company can’t show how it actually operates day to day.

At the end of the day, regulators aren’t looking for perfect paperwork. They want to see that risk is being actively managed, not just recognized in a policy and left there.

They’re also paying attention to patterns. Customer complaints that keep popping up. Audit issues that never quite get fixed. Exceptions that show up again and again. A beautifully written compliance manual doesn’t carry much weight if the company can’t show how it actually operates day to day.

At the end of the day, regulators aren’t looking for perfect paperwork. They want to see that risk is being actively managed, not just recognized in a policy and left there.

Ultimately, regulators want to know whether risk is being managed and not just acknowledged.

Why Fintechs Can’t Afford to Wait

Many early-stage fintechs assume they can operationalize compliance later, like after launch, after traction, or after funding. That’s a risky bet. Regulators don’t delay enforcement based on the company's stage.

What’s more, partnerships often depend on compliance maturity. Banking partners and payment processors assess operational risk. If internal controls don’t hold up, they can walk away or never engage in the first place.

Waiting also means retrofitting. And rebuilding compliance infrastructure around a live product, with users and real revenue on the line, is slower, costlier, and more disruptive than doing it upfront.

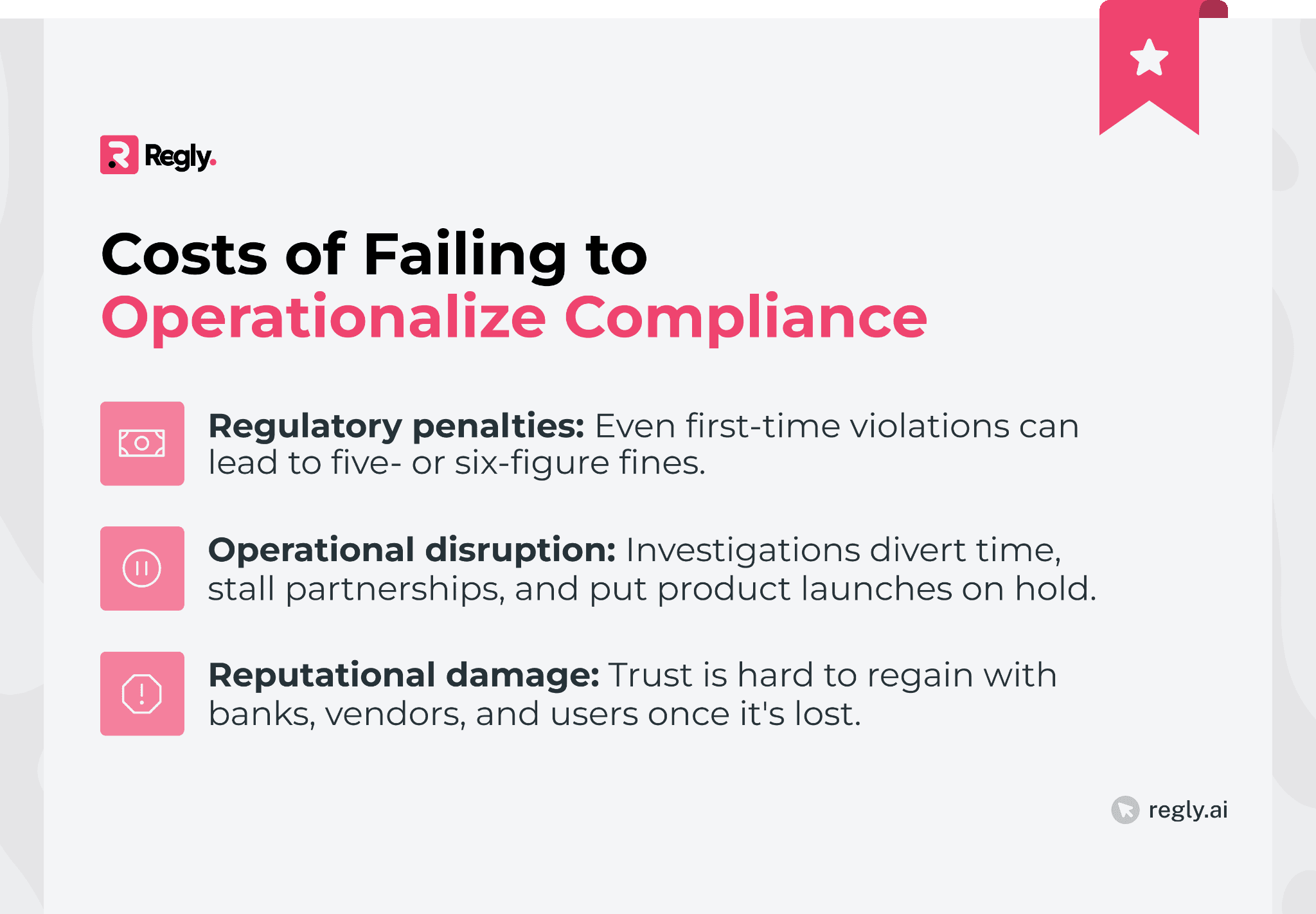

The Cost of Getting It Wrong

Compliance failures rarely start with ill intent. They begin with gaps, unclear ownership, missed steps, and outdated processes. Once those gaps surface publicly or during an exam, the fallout can be significant.

For fintechs, the margin for error is often narrow. A single compliance incident can derail funding, trigger audits across partner networks, or even freeze customer onboarding.

Operationalizing compliance helps reduce these risks before they compound. It’s about catching issues upstream where they’re easier and cheaper to fix.

Key US Regulators and Their Expectations

Fintech companies operate under overlapping regulatory frameworks. The specific agencies depend on the business model, but the expectations are similar: controls must work in practice, and risk must be managed consistently.

Understanding what each regulator focuses on helps teams operationalize compliance early and avoid gaps.

SEC and FINRA

The SEC and FINRA focus heavily on whether a broker-dealer or investment platform operates with consistent, documented controls.

They look for proof that supervision, disclosures, and customer protections function as part of the daily workflow. This applies whether the firm supports traditional securities, fractional shares, or more complex fintech models.

In most cases, that includes things like:

Clear supervisory structures with named owners

Accurate, timely disclosures in customer-facing materials

Procedures that match how the platform actually works

Documented reviews of advertising, communications, and product changes

For fintechs, the hardest part is keeping compliance in step with fast-moving product teams. For example, engineering that outpaces compliance processes creates gaps. That’s where SEC and FINRA findings typically begin.

CFPB and Consumer Protection

The CFPB focuses on how companies treat customers. They look closely at marketing claims, onboarding flows, fee disclosures, and complaint handling. For fintechs offering lending, payments, or deposit-like products, this is often where the most exposure sits.

Key operational expectations include:

Clear, accurate language in all customer-facing materials

Consistent disclosures across website, app, and support scripts

A documented process for receiving, tracking, and resolving complaints

Monitoring for unfair, deceptive, or abusive acts or practices (UDAAP)

For fast-moving teams, the pressure comes from volume. Small changes in copy, pricing, or product flow can create consumer protection risk. The CFPB often identifies issues when internal reviews don’t keep pace with product updates, or when complaints reveal gaps no one was monitoring.

FinCEN, AML, and Sanctions Compliance

FinCEN’s focus is straightforward. Firms must protect financial products against money laundering, fraud, and sanctions violations. For fintechs, that means operational controls that work at scale, not just an AML policy on paper.

Core expectations include:

Reliable KYC and KYB workflows

Ongoing transaction monitoring with documented reviews

Clear escalation paths for suspicious activity

Accurate, timely filing of SARs and CTRs

Screening for OFAC and sanctions exposure

AML failures often surface when product teams modify onboarding or payment flows without looping in compliance. A small change in data capture or account setup can weaken key controls. FinCEN looks for operational consistency, audit trails, and evidence that alerts are reviewed and acted on.

Learn how Regly’s AML screening module can help you →

Data Privacy and Cybersecurity Oversight

Data handling has moved to the center of compliance conversations. Regulators now treat privacy and cybersecurity controls as core operational responsibilities, particularly for fintechs processing sensitive financial data. And the expectations come from multiple directions: the FTC, state privacy laws, bank partners, and sector-specific rules all have something to say about how you protect information.

Key operational expectations include:

Collecting only the data needed for the product

Documented access controls and permissioning

Monitoring for unauthorized access or misuse

A clear process for breach detection, response, and notification

Consistent data retention and deletion practices

For fintechs, the pressure increases as systems scale and more vendors touch customer data. Gaps often appear when engineering ships updates faster than privacy reviews can keep up, or when legacy data flows remain undocumented. Regulators look for proof that privacy requirements are translated into real controls, not just included in a policy binder.

State-Level and Bank Partner Pressures

Fintechs often focus on federal regulators, but state agencies and bank partners play an equally important role. State regulators look for operational consistency in licensing, disclosures, fee practices, and consumer protection. Their examinations can be detailed and frequent, especially for money transmitters and lending products.

Operational expectations at the state level often include:

Licensing tied to accurate, up-to-date business activity

Documented onboarding and servicing procedures

Clear fee structures and disclosure practices

Reliable complaint tracking and resolution

Bank partners add another layer. They assess how a fintech manages compliance because any gaps can expose the bank to risk. Partner due diligence often mirrors a full regulatory exam, covering AML controls, marketing practices, operational resilience, and data security.

For many fintechs, these pressures converge. State reviews, bank audits, and federal expectations all require the same thing: operationalized compliance that holds up in practice.

The Real-World Risks of Not Operationalizing Compliance

When compliance isn’t part of daily operations, issues tend to surface quietly before becoming visible in audits, partner reviews, or customer complaints. Minor inconsistencies accumulate into patterns, and those patterns are what regulators respond to.

These breakdowns rarely stay contained. Once a regulator or bank partner identifies recurring gaps, the scope of the review expands. The problem shifts from a single control failure to a broader operational concern, which is more complex and more time-consuming to address.

For fintechs, the practical impact is significant. Leadership attention turns to remediation, product timelines slip, and partnership conversations slow down. Most of these outcomes trace back to the same root cause: compliance wasn’t operationalized early enough to keep pace with the business.

Common Challenges in Operationalizing Compliance

Most fintech teams don’t struggle with policy creation. They struggle with applying those policies across fast-moving functions.

Siloed Teams and Communication Gaps: Teams move quickly on their own tracks, and compliance updates don’t always reach product, engineering, or support. This creates mismatches between what a policy requires and how work is performed, often without anyone noticing until an audit.

Manual Processes That Don’t Scale: Spreadsheets and ad-hoc reviews work at five employees, not at fifty. As volume grows, manual steps fall behind product changes, leaving gaps in monitoring, documentation, and approvals.

Misreading Regulatory Scope: Fintech models evolve faster than most rules. Teams may assume a requirement doesn’t apply to them, only to learn later that regulators interpret the activity differently. This misunderstanding becomes a major source of findings.

Inconsistent Ownership and Accountability: A control will degrade if no one clearly owns it. Tasks get missed, escalations stall, and procedures drift from their original intent. Lack of ownership is one of the most common operational breakdowns.

“Compliance Is a Bottleneck” Mindset: When compliance is seen as a blocker rather than part of product execution, teams work around it. That mindset pushes decisions outside the compliance process, leading to surprises during reviews and exams.

These challenges tend to compound as a company grows. What starts as a small operational gap becomes a recurring pattern that regulators catch quickly. Addressing them early makes it easier to build a program that holds up under scrutiny.

How to Sync Compliance Across Teams

Syncing compliance across teams starts with clear ownership, practical workflows, and communication that fits how the business operates.

The steps below outline how fintech companies can align teams, reduce friction, and keep compliance active as products evolve.

Assign Ownership With Operational Clarity

Compliance breaks down when no one knows who owns a control or when responsibilities shift informally as teams grow.

Clear ownership keeps tasks from drifting and creates predictable accountability across functions. Each control should have a named owner, a documented process, and a defined escalation path.

This structure also helps new hires understand their role in the compliance program. When responsibilities are mapped to specific teams and individuals, work moves faster, and issues surface earlier. It creates consistency without adding complexity, which is critical for fintechs that scale rapidly.

See how Regly’s employee compliance module can help you manage attestations →

Align Policies With Day-to-Day Workflows

Policies only work when teams know how to apply them in real product and operational flows. Linking policy requirements to practical steps keeps compliance from becoming abstract or outdated. This means translating rules into checklists, approval steps, and triggers that show up where the work happens.

For product and engineering teams, this might include embedding compliance reviews into sprint planning or making certain changes dependent on approval gates.

For operations, it may involve adding verification steps or updating scripts to match regulatory expectations. The goal is to make compliance visible at the moment decisions are made, not after the fact.

When workflows and policies match, reviewers spend less time correcting avoidable issues, and teams avoid the rework that slows releases and increases risk.

Train Teams by Function, Not Just Annually

Annual training checks a box, but it doesn’t give teams what they need to apply compliance to real situations. Function-specific training makes compliance relevant by focusing on the decisions each group makes every day.

Engineers need clarity on data handling. Marketing needs guidance on claims and disclosures. Operations needs direction on onboarding and escalation steps.

Short, targeted sessions work best. They help teams connect regulatory requirements to their actual workflows, not hypothetical scenarios. This also creates a shared baseline across functions, reducing the friction that comes from inconsistent interpretations.

Set Up Cross-Functional Compliance Reviews

Regular reviews that bring product, engineering, operations, and compliance together keep controls aligned with how the business actually runs. These sessions create visibility across teams and surface risks early, before they turn into larger issues.

The format doesn’t need to be complicated. A recurring meeting with a clear agenda works well: upcoming product changes, new regulatory developments, recent issues, and open questions.

The value comes from getting the right people in the same conversation, so decisions reflect both operational reality and regulatory expectations.

Communicate Compliance Goals Like KPIs

Compliance goals need the same clarity and visibility as product or revenue metrics. When expectations are framed as measurable targets, teams understand what “good” looks like and how their work contributes to it. This turns compliance from a reactive function into an operational objective.

Examples include review turnaround times, completion rates for key procedures, or the volume of issues caught upstream instead of during audits. Simple metrics create alignment across functions, making it easier to spot trends and adjust processes before they become problems.

When compliance goals show up in team dashboards or leadership updates, they stay top of mind. That level of visibility helps keep execution consistent, especially as the company grows.

Tools and Tactics for Operationalizing Compliance

Operationalizing compliance becomes easier when teams use policy management software that matches how they already work. The goal is to support existing workflows with structure, automation, and visibility, not to force new systems that add friction.

Below are practical tactics that help fintech companies keep compliance active across functions without slowing down product development:

Using Automation for Repetitive Controls: Automation reduces the manual tasks that tend to break as volume grows. This can include identity verification steps, sanctions screening, transaction monitoring, or evidence collection tied to specific procedures. Automated controls are consistent and reduce the risk of missed steps, especially during product changes or onboarding spikes.

Connecting Policy to Procedure: Policy management tools that link policies to specific operational steps help teams understand how requirements translate into daily work. This may include mapping controls to workflows, embedding reminders, or attaching procedures directly to checkpoints in the product lifecycle. When teams see the policy in context, execution becomes more reliable.

Centralizing Evidence and Reporting: A shared system for storing reviews, approvals, audit trails, and monitoring results keeps information accessible and avoids scattered records. Centralization also helps leaders understand trends and identify gaps earlier. The cleaner the evidence trail, the easier it is for teams to respond to audits and partner requests.

Using a solution like Regly’s policy management module helps centralize policies, map them to operational steps, and make updates flow consistently across product, engineering, and operations.

Learn more about our Regly’s policy management →

—

Operationalizing compliance is about making controls part of how teams work, not something reviewed after the fact. Fintech companies that build these habits early reduce friction, avoid preventable gaps, and move faster with fewer surprises.

Clear ownership, aligned workflows, structured reviews, and the right tools all contribute to a compliance program that can keep pace with product growth. The goal isn’t perfection. It’s consistency, visibility, and the ability to adapt as the business evolves.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.