Document management rarely makes the top of a compliance team’s priority list, but it’s often where the biggest risks hide. When records are scattered or outdated, even a small gap in organization can quickly turn into a real compliance risk.

This article explains how to manage documents in a way that supports compliance instead of slowing it down. You’ll learn what good document management looks like, the risks of getting it wrong, and practical steps to build a system that actually works in a regulated environment.

If you’re running a fintech startup or managing compliance for a growing team, this guide will help you take control of your documents with less friction and more confidence.

What Does Document Management Mean in Regulated Finance?

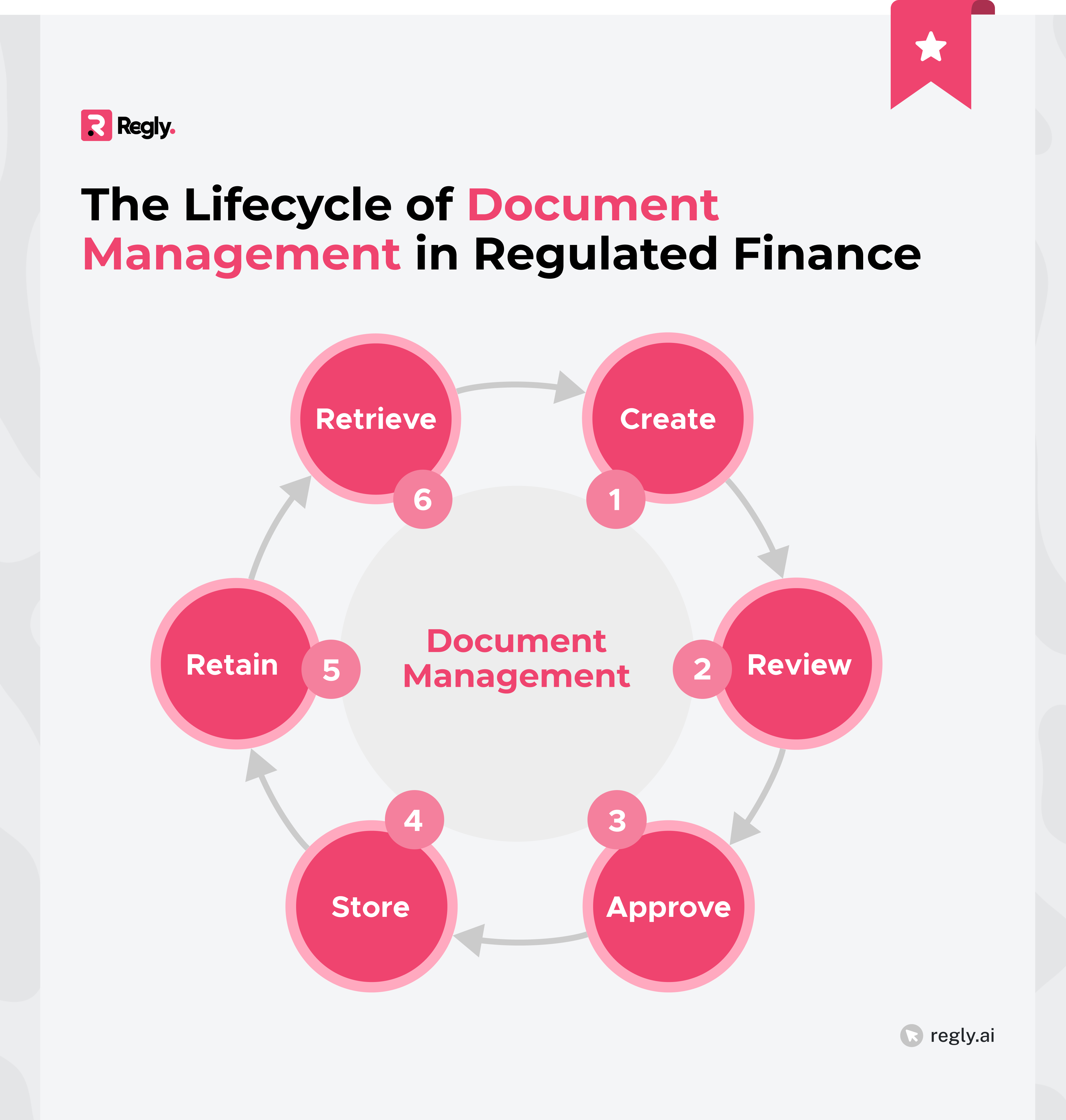

In regulated finance, document management is about knowing where every record lives, who worked on it, and how it supports your compliance program. Policies, procedures, client records, and approvals each tell part of your company’s regulatory story.

Things move quickly for fintech teams. People use different tools, update documents in real time, and share files across departments. Without a clear structure, file versions get mixed up, and key information disappears. When that happens, answering regulator requests is stressful and time-consuming.

Good document management gives teams clarity and control. It helps them find the right information fast, track changes, and keep compliance work moving smoothly.

Why Is Document Management a High-Risk Area for Compliance Teams?

For many fintechs, document management is not a top priority, but treating it as an afterthought introduces risk. And those gaps don’t always show up until a regulator starts asking questions. Here are some of the main reasons this area deserves closer attention:

Information lives in too many places: Policies, reports, and client records get scattered across cloud folders, drives, and emails. When it’s time to find the right version, no one is entirely sure which file is final.

Regulators expect structure: Agencies like the SEC, FINRA, and state regulators want clear, consistent records. Missing or outdated documents can quickly turn into findings or delays during an exam.

Accountability gets blurred: Multiple teams, including legal, operations, and product, often share the same files. Without clear version control, tracking who made changes or approved updates is difficult.

Manual tracking takes time: Teams waste hours collecting documents for audits or investor reviews, pulling data from multiple sources instead of one reliable system.

Compliance confidence drops: When documentation feels scattered, it undermines the credibility of compliance operations and makes leadership more cautious about scaling.

Strong document management builds trust across the organization and reduces the daily friction of proving that compliance work is being done right.

Platforms like Regly simplify this by keeping all your key compliance documents, including marketing materials, internal policies, and employee records, in one place. This way, every record that supports your compliance program stays organized, easy to review, and ready for an audit.

How Does Poor Document Management Impact Fintech Growth?

Poor document management can slow a company’s momentum, increase costs, and create barriers to scaling. When records are incomplete or scattered, the impact reaches far beyond the compliance team.

Here are the most common ways weak document control limits fintech growth.

Delays in Licensing and Regulatory Approvals

Licensing is one of the first major tests of a fintech’s organization. Regulators expect quick, complete responses to document requests. When files are missing, mislabeled, or stored in multiple locations, even simple questions can take days to resolve.

Each delay adds up. Applications stay under review longer, launch timelines slip, and business plans get pushed back. A clear and consistent document management system helps teams stay ready for these requests, making it easier to move from application to approval without unnecessary hold-ups.

Slower Customer and Partner Onboarding

Onboarding is where many fintechs first feel the pain of weak document management. Compliance teams need access to policies, procedures, and client verification records to approve new relationships. When those documents are hard to find or incomplete, the entire process slows down.

Delays in onboarding don’t just frustrate customers and partners. They can also delay revenue, create internal tension, and make a growing company look disorganized. A well-structured approach to document storage helps teams find what they need quickly, so onboarding stays smooth and consistent.

Increased Audit and Remediation Costs

When audit season arrives, scattered records can quickly turn into extra work and higher expenses. Compliance teams spend hours searching for documents, confirming versions, and recreating missing files. What could have been a quick review becomes a stressful, time-consuming project.

External auditors and regulators notice disorganization. Missing or inconsistent records often lead to additional requests, longer reviews, and sometimes the need for costly remediation work. Keeping documents organized and accessible reduces these surprises and helps audits stay focused on the findings that truly matter.

Using a system like Regly can help mitigate these challenges. It automatically tracks version history, maintains immutable audit trails, and organizes records so they’re always ready for review.

Missed Deadlines During Regulatory Exams

Regulatory exams often come with tight timelines. Examiners expect firms to provide specific records quickly, sometimes within days. When documents are scattered across folders or stored in personal drives, tracking them down becomes a race against the clock.

Missed deadlines create a poor impression and can lead to additional scrutiny. Even if the information eventually arrives, delays suggest weak internal controls. A clear, well-organized document system helps teams respond confidently and keeps exams on schedule.

Weakened Trust From Banks and Investors

Banks and investors look closely at how a fintech manages compliance before doing business. They want to see clear documentation, reliable recordkeeping, and proof that the company takes its obligations seriously. When files are disorganized or outdated, confidence fades quickly.

Poor document management can make even solid companies look risky. Missing records raise doubts about how well the business tracks financial and regulatory details. On the other hand, a well-structured system signals professionalism and helps build lasting trust with partners and investors.

Lost Institutional Knowledge During Staff Turnover

When key team members leave, they often take valuable context with them. If important documents live in personal folders or scattered chats, the next person has to start from scratch. This slows down onboarding, interrupts projects, and increases the chance of missing critical information.

Strong document management protects knowledge by keeping it within the organization, not with individuals. With a clear structure and shared access, new hires can pick up where others left off and keep compliance work moving without losing momentum.

Higher Legal and Operational Risk Exposure

Disorganized documents can quickly turn into bigger problems when something goes wrong. Missing contracts, incomplete approvals, or outdated policies make it difficult to defend decisions or prove compliance efforts. What starts as a simple oversight can become a legal or regulatory issue.

A solid document management system helps teams stay prepared. It provides a clear record of what was done, when, and by whom. That level of organization reduces uncertainty and gives leadership the confidence to respond quickly if a question or dispute arises.

Key Regulatory Requirements for Document Management

Regulators expect firms to maintain clear, accurate, and accessible records for specific periods of time. These requirements vary depending on the type of entity, the activity involved, and the jurisdictions where a company operates.

For fintechs, understanding these rules shapes how documents are stored, who can access them, and how long they must be kept.

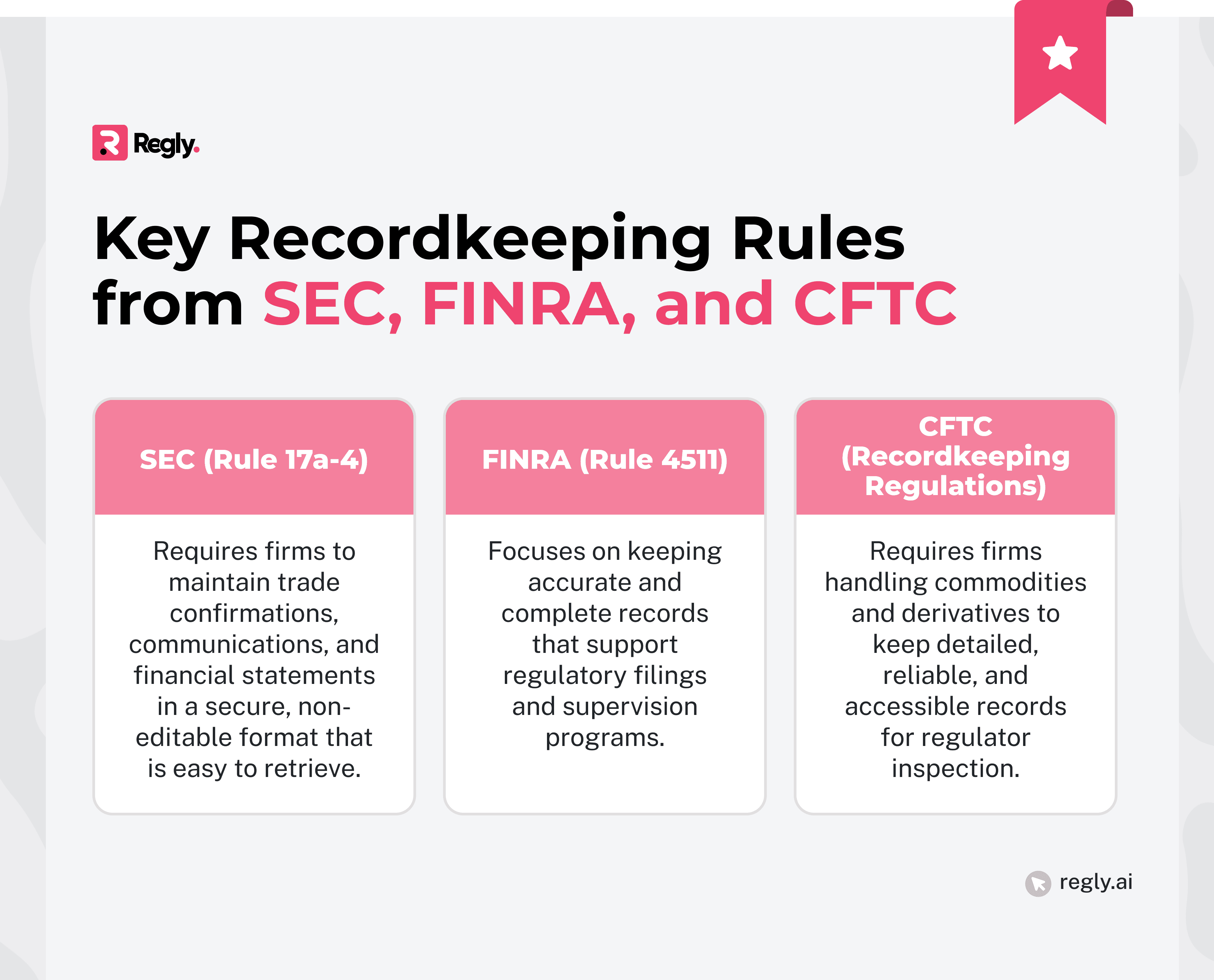

1. SEC, FINRA, and CFTC Rules

Financial regulators have clear expectations for how firms handle their records. The goal is to keep information accurate, accessible, and secure over time. Here’s how each major regulator approaches document management:

Securities and Exchange Commission (SEC ): SEC Rule 17a-4 requires firms to keep important records such as trade confirmations, communications, and financial statements for specific periods. These records must stay in a non-editable format and be easy to retrieve when needed.

Financial Industry Regulatory Authority (FINRA): FINRA Rule 4511 focuses on maintaining accurate and complete records that support regulatory filings and supervision programs. Firms are expected to keep documents current, organized, and ready for review.

Commodity Futures Trading Commission (CFTC): The CFTC requires detailed records of transactions and communications for firms dealing in commodities or derivatives. These records must remain reliable, readable, and available for inspection at any time.

2. AML Recordkeeping Under the BSA

The Bank Secrecy Act (BSA) sets clear expectations for how financial institutions and fintechs must collect, store, and maintain records related to anti-money laundering (AML) compliance. Strong document management plays a central role in meeting those requirements.

Customer identification and verification: Fintechs must keep detailed records of customer onboarding documents, such as identification, account applications, and verification checks. These records show that proper due diligence was completed before a relationship began.

Transaction monitoring and reporting: Firms are required to maintain records of suspicious activity reports (SARs), currency transaction reports (CTRs), and any supporting documents. These help demonstrate that potential risks were identified and reported on time.

Record retention timelines: The BSA typically requires AML records to be kept for at least five years, depending on the document type. Having a reliable system for tagging and archiving these files helps avoid confusion later.

Good AML recordkeeping also helps fintechs build a stronger understanding of customer behavior, identify unusual patterns faster, and stay prepared for audits or examinations.

3. State Data Retention Laws

While federal regulators set broad rules for recordkeeping, state laws add another layer of complexity. Each state can have its own data retention and privacy requirements, which means fintechs must manage documents carefully across multiple jurisdictions.

Different timelines: Some states require certain financial records to be kept longer than federal rules. Others may allow shorter retention periods. Knowing these differences helps avoid keeping data longer than necessary or deleting it too soon.

Privacy and consumer protection: States such as California, New York, and Texas have specific laws governing how customer information is stored, shared, and deleted. These rules often overlap with compliance obligations, so teams need clear policies to stay aligned.

Coordination across entities: Fintechs that operate in several states often work with regulators, banks, and service providers that follow different retention schedules. Consistent organization and documentation practices help keep everything in sync.

Understanding and following state-level rules takes planning, but it helps create a stronger compliance foundation. It also shows regulators and partners that the company takes both privacy and operational integrity seriously.

4. Global Data Retention Laws

Fintech companies that serve customers around the world face a complex web of data retention rules. Each country sets its own standards for how long records must be kept, where they can be stored, and how they can be shared. Keeping up with these variations is essential for staying compliant and maintaining trust.

In the European Union, the GDPR requires firms to collect and store only what they need and to delete personal data once it’s no longer necessary. The United Kingdom, Singapore, and other major financial hubs have similar regulations with slightly different timelines and expectations. These differences can make global operations challenging, especially for growing fintechs that work across several markets.

Cross-border data transfers bring another layer of responsibility. Some jurisdictions restrict the movement of personal or financial information outside their borders, while others require companies to meet specific security standards before doing so.

For fintechs, the goal is to find a balance. A sound document management system helps teams follow each region’s rules without creating unnecessary complexity. It also builds confidence among customers, partners, and regulators who expect clear and responsible data practices.

Common Compliance Gaps in Document Management

Even well-organized compliance programs can fall short when document practices are inconsistent or incomplete. Here are the most common areas where fintechs run into trouble and how those gaps affect day-to-day compliance.

Retention Policies That Don’t Match Regulatory Timelines: Many fintechs set general retention rules without matching them to specific regulatory requirements. The result is either keeping documents longer than needed or deleting them too soon. Both situations create risk. When records are deleted early, firms lose the ability to prove compliance if questions arise later. When they’re kept indefinitely, data privacy concerns increase and storage costs climb.

Lack of Reliable Audit Trails: Without a reliable audit trail, it’s challenging to show how documents were created, reviewed, or updated. Regulators often ask for proof that records haven’t been altered, and without a clear trail of activity, even well-kept files can raise doubts.

Use of Unapproved Tools and Shadow IT: When documents are stored in personal drives, shared informally, or managed through unapproved apps, vital records slip outside the company’s control. Shadow IT makes it harder to track who has access to sensitive information or which version of a file is correct. It also complicates audits since not all records are visible to compliance teams.

No Clear Ownership of Compliance Documentation: When no one is clearly responsible for managing compliance documents, things start to fall through the cracks. Policies go out of date, procedures don’t get reviewed, and version control becomes guesswork. It’s not always about neglect. Sometimes fast-growing teams simply assume someone else is taking care of it.

Inconsistent Version Control Across Teams: When multiple people edit the same document without a clear process, confusion spreads fast. Teams might work from old drafts, make conflicting updates, or lose track of which version was approved. During a regulatory review, that lack of consistency can create unnecessary risk.

Delayed or Incomplete Response to Regulator Requests: When regulators ask for documents, quick and accurate responses make a strong impression. The problem comes when files are spread across different systems or labeled inconsistently. Teams spend valuable time searching, and even minor delays can raise concerns about how well records are managed.

Over-Reliance on Vendors Without Oversight: Relying too much on third parties without proper vendor management can create compliance risks. Even if vendors handle key documents or data, your firm is still responsible.

Best Practices for Compliance-Focused Document Management

Strong document management doesn’t happen by accident. It’s the result of clear structure, consistent habits, and tools that support compliance from day to day. For fintechs, this means treating documentation not just as storage, but as part of how the business operates and proves accountability.

Classify Documents by Regulatory Category and Risk

Not all documents carry the same level of importance or regulatory weight. Grouping them by category and risk helps teams focus on what matters most. For example, policies, client records, and transaction reports have different retention rules and review requirements.

Start by identifying which regulators apply to your business, then map each document type to those obligations. High-risk items like AML reports or customer disclosures should have stricter access and review controls than routine internal files.

This approach keeps your compliance program organized and makes it easier to locate the proper documents when auditors or regulators ask for proof. It also helps teams prioritize their time and attention where it truly counts.

Apply Role-Based Access and Edit Controls

Access control is one of the simplest and most effective ways to protect sensitive information. Not everyone needs permission to view or edit every document. By setting roles and permissions, you limit access to only those who truly need it for their work.

This approach reduces the risk of accidental edits or unauthorized sharing. It also helps maintain a clear record of who has interacted with each file. For compliance teams, that visibility is valuable during audits or internal reviews.

Keeping permissions structured also makes collaboration smoother. Everyone knows which documents they can use, which ones require approval, and where to find the most accurate version.

Use Version Control to Track Changes and Approvals

Version control keeps your compliance documents accurate and trustworthy. Without it, multiple people might edit the same file, creating confusion about which version is current. That kind of mix-up can lead to errors in policies, reports, or filings.

A good version control process records who made each change, when it was made, and what was updated. It also keeps previous versions safely stored so you can refer back to them if needed.

With consistent version control, everyone works from the same page. Teams spend less time sorting through old drafts and more time focusing on meaningful compliance work.

Automate Retention Schedules Based on Jurisdiction

Different regulators and jurisdictions have their own rules for how long documents must be kept. Trying to track all those timelines manually is time-consuming and leaves room for mistakes. Automation helps solve that problem.

By setting retention schedules in your document management system, files can be flagged or archived automatically once they reach their required age. This keeps your records compliant without constant manual review.

Automating retention also helps reduce clutter. Teams keep what’s needed and safely store or remove what’s not, creating a cleaner, more efficient system that supports both compliance and productivity.

Maintain Immutable Audit Trails for All Actions

An immutable audit trail records every action taken on a document, from creation to deletion. It shows who accessed the file, what changes were made, and when those actions occurred. This level of transparency helps compliance teams demonstrate control and accountability.

Audit trails also streamline investigations and internal reviews. If a regulator or auditor asks how a document was managed, the history is already there. Nothing needs to be recreated or explained from memory.

Ultimately, when audit trails are built into daily workflows, they quietly strengthen the foundation of a compliance program. They give teams confidence that every record has a clear, trustworthy history behind it.

Integrate Document Review Into Compliance Workflows

Document management works best when it’s part of everyday compliance activities, not something handled only before an audit. Integrating document reviews into regular workflows keeps records accurate and up to date year-round.

Set review checkpoints for policies, procedures, and key reports. For example, some documents might need quarterly updates, while others only require an annual review. The goal is to make reviews predictable and easy to complete without disrupting other priorities.

Therefore, when document management fits naturally into compliance routines, teams spend less time catching up and more time focusing on proactive improvements. It turns recordkeeping from a task into a habit.

Prepare Templates and Playbooks for Exams and Subpoenas

When regulators request information, the last thing a team needs is to start from scratch. Having ready-to-use templates and playbooks makes the response process faster and more consistent.

Templates can include checklists for common exam requests, standard response formats, and document submission guidelines. Playbooks go a step further by outlining who does what, where files are located, and how communication with regulators should be handled.

These tools save time and reduce stress when deadlines are tight. They also help new team members learn the process quickly, keeping compliance responses smooth even as the company grows.

How Technology Supports Modern Document Management

Technology has changed the way compliance teams manage, store, and access their records. What used to be a manual, paper-heavy process is now digital and data-driven. For fintechs, this shift means greater control, faster access, and fewer repetitive tasks.

Manual vs. Automated Systems

Aspect | Manual Systems | Automated Systems |

|---|---|---|

Process | Team members manually upload, name, and organize files across folders. | Files are automatically categorized, tagged, and stored based on predefined rules. |

Accuracy | Higher chance of mistakes, inconsistent naming, or misplaced documents. | Consistent organization with built-in checks that reduce human error. |

Retention Management | Requires manual tracking of regulatory timelines and deletions. | Applies retention schedules automatically based on rules and jurisdictions. |

Audit Readiness | Time-consuming to gather and verify documents before an audit. | Records are instantly searchable with available version history and audit trails. |

Scalability | Works for small teams but becomes difficult to manage as the company grows. | Adapts easily to growth, supporting more users and larger document volumes. |

Team Focus | Staff spend time on repetitive filing and maintenance tasks. | Automation handles repetitive work so teams can focus on analysis and decision-making. |

Manual document management relies on people to upload, label, and organize files. It works for very small teams, but as a company grows, it becomes harder to keep track of versions, deadlines, and approvals. Human error and inconsistent practices start to create gaps that slow everything down.

Automated systems make this process smoother and more reliable. They apply retention rules automatically, track version history, and log every change for easy review. Automation also helps compliance teams respond faster to audits or regulator requests because everything is already organized and searchable.

Regly automates much of this work. Compliance teams can easily locate, review, and approve items like policies, marketing content, and employee documentation without relying on scattered folders.

What to Look for in a Compliance-Grade DMS

A true compliance-grade document management system does more than organize files. It brings structure, accountability, and visibility to how records are created, reviewed, and retained. When evaluating options, focus on features that make compliance easier to manage every day.

Clear version control: Every compliance document should have a single source of truth. A sound system tracks edits, timestamps updates, and preserves past versions so you can always show how a policy or record evolved over time.

Role-based permissions: Access should reflect responsibility. Legal, operations, and compliance staff need different levels of visibility. Role-based permissions keep sensitive records secure while still supporting collaboration across teams.

Automated retention schedules: Each regulator has its own timelines for keeping records. A system that automates these rules reduces manual tracking and helps teams avoid mistakes like deleting a record too early or holding it longer than allowed.

Comprehensive audit trails: Regulators expect firms to show not just the document, but how it was handled. A strong system automatically logs every action, from uploads to edits to approvals, so there’s always a full history ready for review.

Seamless integration with compliance workflows: The best systems don’t sit in isolation. They connect with case management, onboarding, or reporting tools so compliance flows naturally without extra steps or duplicate data.

Advanced search and intelligent organization: Tags, filters, and metadata make it easy to locate records by client, product, or regulatory category. Smart search tools cut through clutter and save time during audits or internal checks.

Secure, scalable storage: Growth brings complexity. A reliable system scales with your operations while keeping data encrypted, backed up, and accessible for authorized users.

For fintech companies, these capabilities make compliance faster, clearer, and easier to sustain as the business grows.

—

Good document management doesn’t just keep regulators happy. It also keeps your team sane. When everything is organized and easy to find, compliance feels less like a scramble and more like part of the daily workflow. Teams can focus on what matters instead of digging through folders or chasing down old versions.

For fintechs, structure is freedom. A clear system supports faster audits, smoother onboarding, and stronger trust with partners and investors. It helps you respond confidently to regulator requests, even when timelines are tight. Most importantly, it builds a culture of accountability where information is shared, accurate, and up to date.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.