Fintech AML compliance can feel overwhelming when you’re just getting started. The moment your product moves money, stores value, or supports customer transactions, regulators step in and expect you to understand the risks that come with financial activity.

Many founders figure this out quickly when they start onboarding users or working with banking partners, and it becomes clear that AML is something you’ve got to deal with right away.

This guide helps make that path more straightforward. It introduces the key regulators that shape AML expectations, the core requirements that apply to fintech companies, and how those obligations shift based on your business model.

What Fintech AML Compliance Means Today

Fintech AML compliance has become a much broader discipline. It touches identity verification, data quality, customer risk scoring, transaction monitoring, and how your company responds when something seems unusual.

Most of the rules that apply to fintechs were written long before digital finance existed. As a result, companies often need to connect older regulatory concepts to new technology and modern use cases.

This shift has pushed regulators to focus less on rigid checklists and more on whether a fintech understands the specific risks created by its own product design. Those risks can look very different depending on the business model.

For instance, a payments app doesn’t face the same exposure as a lending product or a crypto platform. Even small changes to onboarding flows, funding paths, or product features can reshape the overall risk picture.

That’s why AML compliance programs need to remain flexible and adaptable while still meeting foundational regulatory expectations.

Who Are the Key Regulators in Fintech AML Compliance?

Fintech AML compliance is shaped by overlapping regulators across regions, which means your obligations rarely come from a single source. Understanding who sets the rules helps you map your responsibilities and prepare for growth.

Here are the main regulators in major jurisdictions.

United States

Fintech AML compliance in the US begins with the Financial Crimes Enforcement Network (FinCEN), which sets the core rules for verifying customers, monitoring activity, and reporting anything suspicious.

Most fintechs also operate within the Bank Secrecy Act framework, either because they’re directly covered or because they rely on banks and other licensed financial institutions that are.

Several other regulators also shape the broader landscape.

The Federal Reserve, Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) oversee the banks that many fintechs rely on for core infrastructure, which means their expectations often flow directly into fintech operations.

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) add another layer of regulation for companies involved in securities or derivatives. And at the state level, licensing and reporting requirements for money transmitters and virtual asset businesses introduce obligations that can influence daily workflows more than many founders anticipate.

Together, these agencies form a layered regulatory system that reaches into nearly every part of a fintech’s operations.

Europe

Europe takes a structured and highly coordinated approach to AML oversight.

The European Commission sets the core framework through its AML directives, and each member state turns those directives into national rules. This creates a shared foundation across the EU while still allowing local supervisors to apply their own interpretation.

Fintechs operating in Europe navigate several layers of oversight.

National financial intelligence units handle reporting

Local regulators supervise licensed firms

The European Banking Authority provides guidance that shapes how AML programs work in practice.

Soon, the new EU AML Authority will add another level of consistency by directly supervising higher-risk firms across the region.

For growing fintechs, the message is straightforward. Europe rewards preparation. Strong documentation, clear governance, and reliable risk assessments can make cross-border expansion far easier.

United Kingdom

The United Kingdom follows a risk-based approach to AML compliance, built around the Money Laundering Regulations.

Fintechs that offer payments, lending, wealth services, or crypto activities must register with the Financial Conduct Authority (FCA) or His Majesty's Revenue and Customs (HMRC), depending on their business model.

Each supervisor expects firms to demonstrate that they understand their risks and can adjust controls as the business grows.

The FCA places strong emphasis on clarity and documentation. Firms are expected to show how they assess customer risk, monitor activity, and escalate concerns. Reviews often look at real examples from onboarding and transaction monitoring rather than relying on policy statements.

For fintech teams, the UK environment rewards transparency and consistency. A well-structured AML program makes partnerships easier and reduces friction during regulatory reviews, especially when launching new products or expanding beyond early customers.

International and FATF-Aligned Jurisdictions

Many countries base their AML frameworks on the standards published by the Financial Action Task Force.

These principles act as a global blueprint and influence how regulators expect fintechs to manage financial crime risk. And although each jurisdiction adapts the rules to fit its local market, the core principles stay largely the same.

Fintechs expanding into Asia, the Middle East, or Latin America often find that the themes feel familiar. Regulators across these regions care about the same core pillars:

Knowing who your customers are

Understanding beneficial ownership

Monitoring transactions

Maintaining solid governance

The speed of change may differ from one market to another, and expectations can shift as new products catch on, but the overall direction often remains consistent.

This is why FATF alignment is so helpful. Building your AML program around these global principles can help you mitigate risks as you move into new markets.

Core AML Requirements for Fintech Companies

Fintechs follow a set of foundational AML obligations across nearly every business model. These requirements form the backbone of your compliance program, guiding how you understand your customers, evaluate potential risks, and watch for unusual behavior.

Customer Identification and Verification

Customer identification and verification form the first layer of any AML program.

Fintechs need reliable information to understand who they’re onboarding and whether that person fits their risk profile. The tricky part is finding the balance between a smooth user experience and controls that are strong enough to catch false identities, synthetic profiles, and other types of fraud.

Most fintechs rely on a mix of document checks, database lookups, and tools like Regly to validate identity. Getting this step right pays off later because accurate customer data makes ongoing monitoring far more effective.

Beneficial Ownership Requirements

This part of AML compliance focuses on identifying the people who ultimately control or benefit from a company or account. Regulators want fintechs to look past the surface level and understand who is really behind the account.

Most fintechs gather ownership details during onboarding and verify them through documents, registries, or trusted data sources. The amount of information needed depends on the customer’s risk profile and the rules in each jurisdiction.

Getting this right helps mitigate the risk that legal entities are used to hide funds or conceal suspicious activity.

Customer Due Diligence

Customer due diligence builds on the information collected during onboarding. It helps you understand the customer’s risk level and whether their activity fits what your product is designed to support.

Fintechs usually gather details about the customer’s background, expected account use, source of funds, and overall risk factors. Higher risk profiles call for deeper checks, while lower risk customers may only need standard reviews.

The aim is to build a clear picture that guides monitoring and future decisions.

Transaction Monitoring

Transaction monitoring tracks how customers use your product and helps you spot activity that may signal financial crime risk. It’s one of the most visible parts of an AML program because it operates every day and reacts to real customer behavior.

Fintechs rely on rules, thresholds, and behavior models to identify unusual patterns. These can include rapid movement of funds, unusual transaction sizes, activity that doesn’t match the customer’s profile, or transfers involving higher-risk locations.

The goal is to flag behavior that needs a closer look, not to block every outlier.

See how Regly’s AML transaction monitoring compliance can help you →

Suspicious Activity Reporting

Suspicious activity reporting turns internal findings into regulatory action. When your team identifies activities that raise concern, you may need to file a report with the relevant financial intelligence unit so it can be reviewed at a national level.

Fintechs usually rely on analysts to review alerts, assess context, and determine whether the activity meets the threshold for reporting. Good documentation is essential, since regulators consider how you reached your decision and whether your process followed internal policies.

Sanctions Screening

Sanctions screening helps you spot whether a customer or transaction is connected to a restricted individual, entity, or jurisdiction. These lists come from governments and international organizations, and they change often, so fintechs need dependable tools that stay up to date.

Screening starts at onboarding and continues throughout the customer relationship. Fintechs compare names, businesses, wallet addresses, and counterparties against current sanctions lists, then take follow-up steps whenever a potential match appears.

Most alerts require a closer look to determine whether the hit is real or simply a similar name that triggered the flag.

See how Regly’s AML screening module can help you conduct sanction screening →

Program Governance

Program governance sets the structure for how your AML program runs. It defines roles, responsibilities, reporting lines, and the ways your team makes decisions. Strong governance keeps a fintech organized as it grows, adds new products, and faces more complex risks.

Most companies appoint an AML officer, establish clear escalation paths, and create policies that guide everyday work. Boards and senior leaders also play a key role because regulators expect them to understand the risks tied to the business and support the program with the resources it needs.

Recordkeeping and Audit Practices

Recordkeeping and audit practices form a reliable foundation for your AML program. Regulators expect fintechs to maintain clear records of customer data, decisions, monitoring results, and reports. These records help show how your team applied its policies and managed risk over time.

Fintechs typically store onboarding information, case files, alert histories, and internal reviews in a structured system. When everything is organized, it becomes much easier to respond to audits, partner reviews, or regulatory inquiries. Strong recordkeeping also helps inform your team from lessons learned and refine how it approaches future risks.

AML Obligations by Fintech Business Model

AML expectations shift based on how your product works and how customers use it. Each fintech model carries its own risk profile, which shapes the controls regulators expect to see.

Business Model | Key AML Risks | High-Priority Controls |

|---|---|---|

Payments & Money Transmitters | Fast fund movement, cross-border flows, and high-volume activity | Strong KYC, tuned monitoring rules, and sanctions controls |

Digital Banking | Account funding risks, layered transactions, and customer misuse | Layered verification, risk scoring, and comprehensive monitoring |

Lending & BNPL | Fraudulent identities, misuse of credit, and third-party repayments | Identity checks, fraud controls, and repayment pattern monitoring |

Wealth & Investing | High-value transactions, complex entities, cross-border transfers | Enhanced onboarding, suitability checks, and movement oversight |

Cryptoasset Services | High-speed transfers, anonymous wallets, mixers, and high-risk jurisdictions | Blockchain analytics, sanctions screening, and on-chain monitoring |

Banking as a Service | Partner-driven risks across multiple products | Partner due diligence, program oversight, and tailored monitoring |

Payments and Money Transmitters

Payments and money transmitters handle fast, frequent movement of funds, which means regulators expect strong controls at every stage of the customer lifecycle.

The risk levels often shift based on how users fund their accounts, how money moves through the product, and which jurisdictions are involved in each transaction. Therefore, fintechs in this category focus on accurate onboarding data, clear transaction monitoring rules, and reliable escalation paths.

Digital Banking

Digital banking platforms function like traditional banks but move faster, reach more customers, and deliver entirely digital experiences. That combination raises customer expectations and draws closer regulatory attention, particularly around identity verification, funding sources, and how transactions flow through accounts.

AML programs for digital banks typically include layered verification, detailed risk scoring, and monitoring rules that account for deposits, transfers, card usage, and account features. Regulators want to see that these platforms understand how their customers use their accounts and can adjust controls as behavior shifts.

Growth at digital banks can be rapid, which makes well-documented workflows and consistent processes critical. Without them, teams struggle to stay coordinated, alerts pile up, and the risk profile starts drifting from what the product and customer base actually look like.

Lending and BNPL

Lending and BNPL platforms face a different AML profile because money flows are tied to credit decisions rather than direct transfers. Even so, regulators expect these businesses to understand who they’re serving and how funds move once credit is extended.

AML programs in this space often focus on identity, fraud prevention, source of funds for repayments, and patterns that suggest credit misuse. Certain behaviors, such as repeated short-term borrowing funded through unusual channels, may trigger closer review.

Wealth and Investing

Wealth and investing platforms deal with money that moves less often but comes with higher stakes. Customers expect transparency, and regulators pay close attention to how these firms understand where funds come from, what the customer's goals are, and whether the overall profile holds together.

AML programs here tend to go deeper at onboarding, particularly for higher-value accounts or customers with layered financial backgrounds. Once accounts are open, monitoring typically centers on funding events, withdrawals, transfers out to external accounts, and anything that doesn't fit the customer's stated investment profile.

Cryptoasset Services

Cryptoasset services operate in a fast-moving environment where transaction speed, wallet activity, and cross-border flows create unique AML challenges. Regulators expect these firms to understand how blockchain activity works and to apply controls that match the risks tied to digital assets.

AML programs in this space often combine standard checks with blockchain analytics. Teams review wallet histories, monitor on-chain behavior, and watch for links to mixers, sanctioned addresses, or high-risk jurisdictions. Identity verification remains important, too, since many risks stem from unclear or incomplete customer information.

Banking as a Service

Banking as a Service platforms support multiple fintech partners, which means their AML responsibilities extend across several products and customer flows. Regulators expect these providers to maintain clear oversight and to understand how each partner’s model affects the overall risk picture.

AML programs in this space usually include detailed onboarding requirements for partners, regular reviews of program effectiveness, and monitoring rules tailored to each use case. Well-defined governance is also critical because decisions need to be consistent across partners while still allowing for risk-based adjustments.

Fintech AML Compliance Workflow

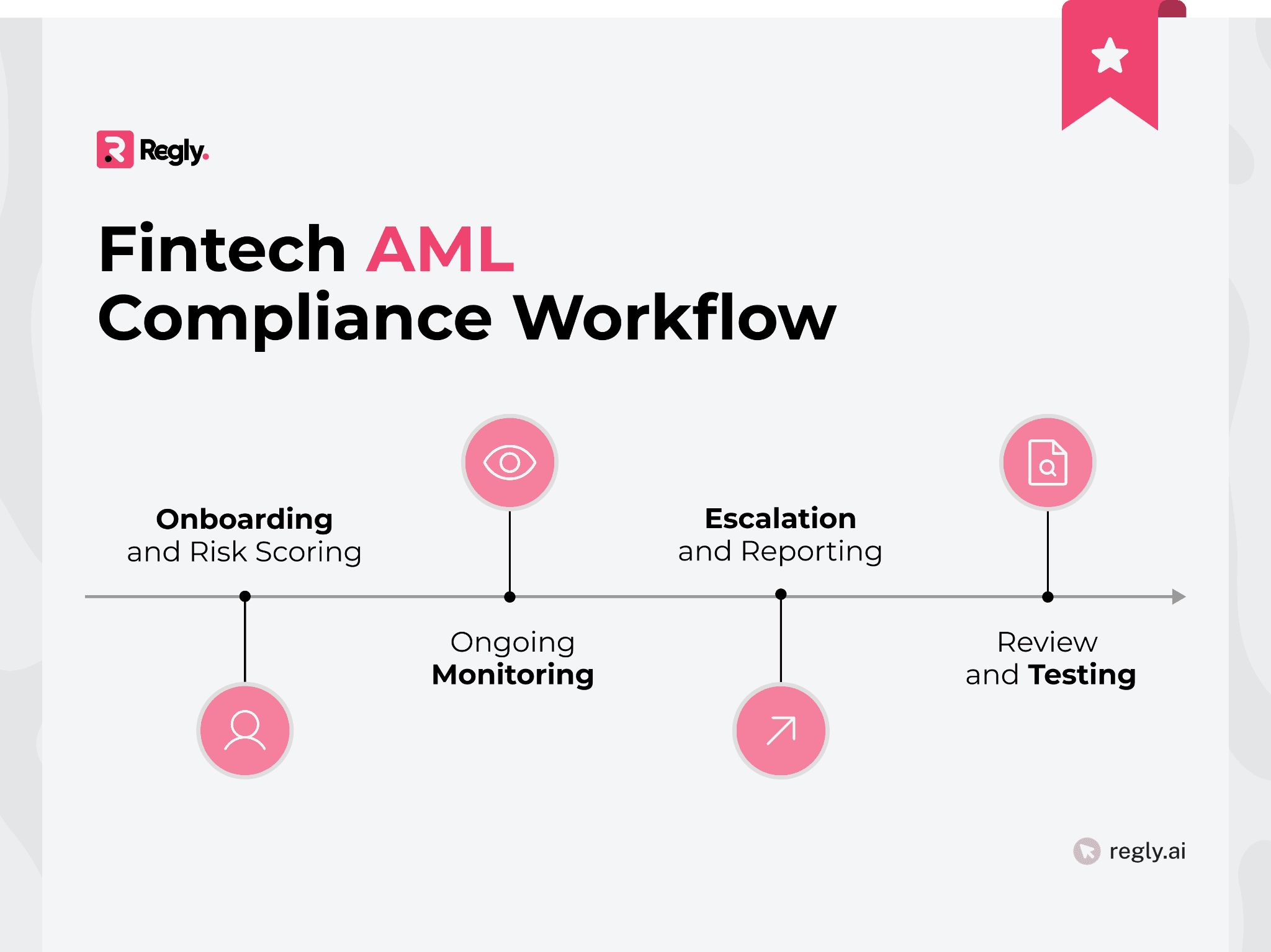

A strong AML program follows a straightforward sequence of steps that guide how customers are onboarded, monitored, and reviewed. This workflow helps teams stay organized and apply controls consistently as the business grows.

1. Onboarding and Risk Scoring

Onboarding and risk scoring set the foundation for the customer relationship. This step helps you understand who you’re onboarding and what level of oversight they require.

Fintechs gather identity data, verify documents, and assess factors like geography, product use, and expected activity. These inputs shape the customer’s initial risk rating, which influences how they’re monitored going forward.

See how Regly’s risk scoring module can help you →

2. Ongoing Monitoring

Ongoing monitoring keeps track of customer activity after onboarding. It helps you identify patterns or behaviors that differ from your expectations based on the customer’s profile. Regular monitoring also builds on the information gathered during onboarding and allows you to see how a customer’s activity changes over time.

To do this, fintechs use rules, behavior models, and tools like Regly that flag unusual transactions. These might include rapid fund movements, sudden increases in activity, or transfers involving higher-risk locations. When an alert appears, analysts review it, gather the relevant context, and decide whether further action is needed.

3. Escalation and Reporting

Escalation and reporting procedures determine what happens after monitoring flags something that needs a closer look. When these steps are well-defined, teams know exactly how to move from an initial alert to a documented decision without things stalling out.

In practice, an analyst picks up the alert, reviews the details, and pulls together any additional context. If the activity warrants it, they escalate to compliance leadership for further review. When the behavior crosses the line into reportable territory, the team prepares and files the required documentation.

4. Review and Testing

Review and testing help confirm that your AML program is working as intended. These steps give you visibility into what is effective, what needs adjustment, and where new risks may be emerging.

Internal reviews look at policies, controls, and workflows to verify that teams are following established procedures. Independent testing, on the other hand, takes a deeper look by checking alert quality, documentation, and how decisions are made. Both processes help identify gaps before they turn into issues.

Common AML Compliance Gaps in Fintech

Even well-designed programs run into challenges as products grow and customer behavior changes. Many fintechs share similar pain points that tend to surface during audits, partner reviews, or regulatory exams.

Digital Identity Weaknesses

Digital identity issues often show up when onboarding tools miss important risk signals. When that happens, synthetic identities, incomplete profiles, or customers with low-quality data can slip through the process. These gaps create risks early in the relationship and can complicate everything that follows.

To avoid this, many fintechs use several data sources and validation steps to strengthen identity checks. But if those sources aren’t aligned or calibrated correctly, the system may produce inaccurate risk scores. That creates challenges later in the customer lifecycle because monitoring tools depend on the quality of the data collected at the start.

Monitoring and Alert Tuning Issues

Monitoring systems generate alerts based on rules and behavior patterns, but problems arise when those rules are too broad or not updated regularly. This can create a high volume of low-quality alerts that pull attention away from real risks.

These challenges often appear when a fintech’s products evolve faster than its monitoring setup. New features, customer segments, or funding methods can shift transaction patterns, and the system may not recognize those changes right away.

Regular tuning brings the alerts back in line with actual customer behavior. This improves accuracy, reduces noise, and gives analysts more time to focus on cases that truly matter.

Overreliance on Bank Partners

Many fintechs lean heavily on their bank partners for AML oversight, especially in the early stages. While partnerships are important, regulators expect fintechs to understand and manage their own risks rather than relying solely on the bank’s program.

Gaps often appear when responsibilities are not well defined. For instance, if a fintech assumes the partner is handling a control, but the partner expects the fintech to lead, key steps can fall through the cracks.

Detailed documentation and regular communication help prevent these issues. Each party needs to understand its own role, so the program operates smoothly and stands up to regulatory scrutiny.

Inconsistent Risk Models

Risk models guide how customers are scored and monitored, but they can drift when different teams apply criteria in different ways. This inconsistency can lead to uneven reviews and gaps that regulators notice quickly.

Fintechs often face this challenge when they grow fast or add new products without updating the risk framework. That’s because what worked for early customers may not fit new segments or expanded geographies.

A well-defined and regularly updated model helps keep decisions aligned across teams. It also gives you something concrete to point to during partner assessments or regulatory exams.

Process Fragmentation

When processes are fragmented, information moves slowly, reviews take longer, and decisions become harder to document. Teams may duplicate work or miss important context because the right data is stored in different systems or handled by separate groups.

A more unified approach helps reduce that friction. Clear workflows and consistent tooling help teams collaborate, maintain visibility across the customer lifecycle, and respond effectively when risks surface.

Staffing and Expertise Challenges

Lean teams are common at early-stage fintechs, and that can leave gaps when AML expectations shift. As products scale and customer activity grows, the volume of reviews and the complexity of decisions increase quickly.

Gaps appear when teams lack specialized experience or when hiring can’t keep pace with growth. This can lead to delays, uneven decisions, and pressure on analysts who are juggling multiple responsibilities.

A balanced mix of employee training, clear workflows, and the right technology mitigates these challenges. It helps teams stay focused on higher-value reviews and maintain consistent oversight as the business expands.

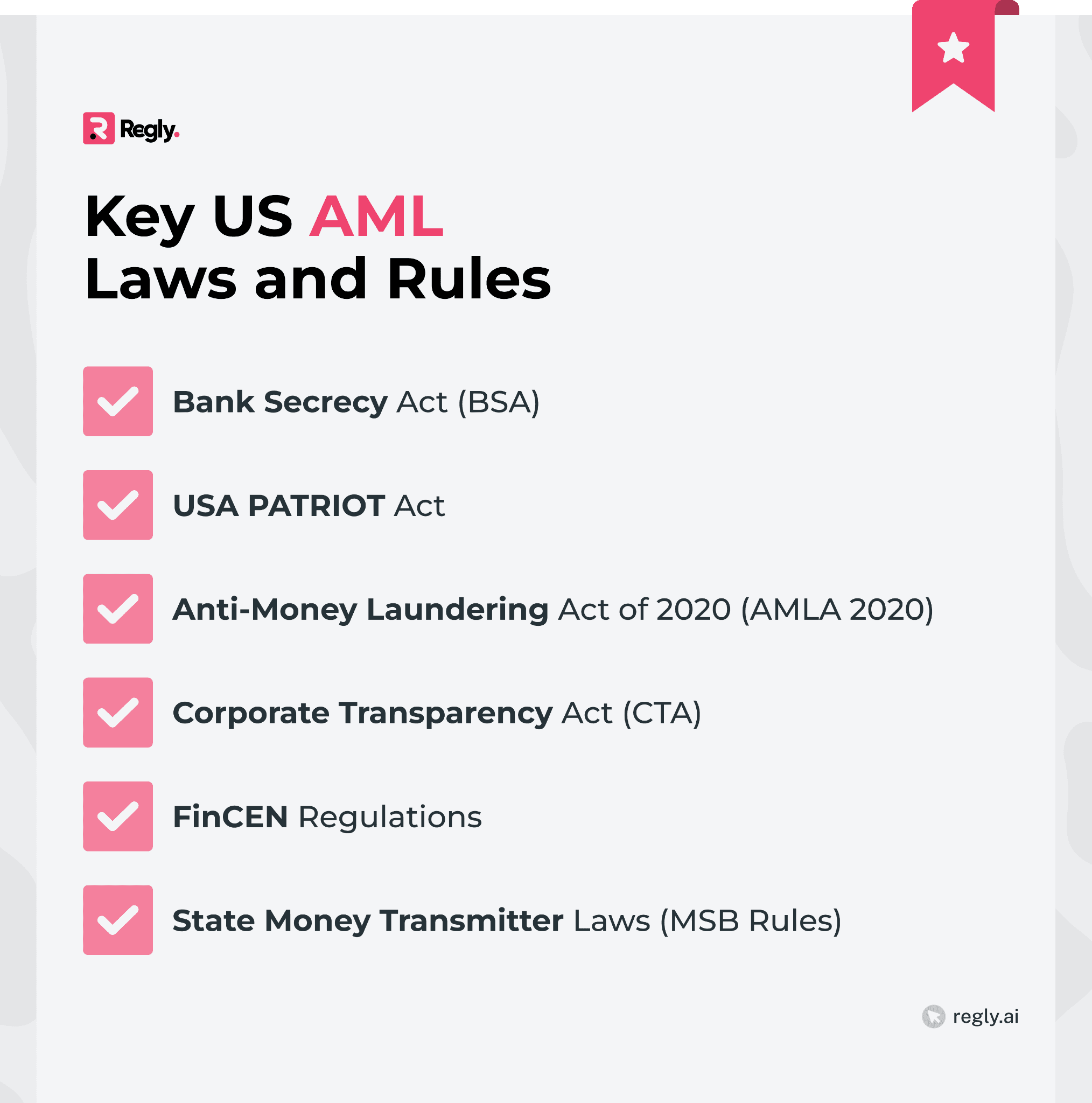

Key US AML Laws and Rules

US AML obligations come from a mix of long-standing laws and newer updates that reflect how financial crime risks have changed. Together, they define the requirements fintechs must follow, from customer identification to reporting and governance.

Bank Secrecy Act

The Bank Secrecy Act is fundamental to AML compliance in the United States. It sets the expectations for customer identification, monitoring, reporting, and recordkeeping that most fintechs follow either directly or through partnerships.

This act requires companies to understand who their customers are, watch for unusual activity, and submit reports when something looks concerning. It also establishes the need for written policies, designated officers, and documented controls.

For fintechs, the BSA is often the starting point for building an AML program. Its principles guide how teams design workflows, select technology, and manage risk throughout the customer lifecycle.

USA PATRIOT Act

The USA PATRIOT Act expanded the original BSA framework and introduced new requirements aimed at strengthening customer identification and information sharing. Many of the onboarding and verification standards used today trace back to this law.

Key provisions include enhanced identity checks, stronger due diligence for certain customers, and clearer expectations for monitoring accounts. The act also supports greater cooperation between financial institutions and government agencies through information-sharing programs.

For fintechs, the PATRIOT Act shapes how onboarding and due diligence are designed. Its requirements influence the data collected at account opening and the level of verification needed for higher-risk customers.

The Anti-Money Laundering Act of 2020 (AMLA 2020)

AMLA 2020 modernized the US AML framework and responded to the growth of digital finance. It expanded FinCEN’s authority, strengthened whistleblower protections, and introduced new requirements for how financial institutions assess and manage risk.

One of its major contributions was the push for more consistent risk-based programs. AMLA 2020 emphasized the need for clear documentation, regular reviews, and strong communication between institutions and regulators.

For fintechs, this law highlights the importance of structured governance and well-documented decision-making. It encourages programs that can adapt as products evolve, rather than relying on static rules or legacy practices.

Corporate Transparency Act

The Corporate Transparency Act introduced new rules requiring certain companies to report their beneficial ownership information to FinCEN. The goal is to reduce the use of shell companies and improve visibility into who controls legal entities.

At present, all entities created in the United States are exempt from these UBO disclosure requirements, as reflected in current FinCEN guidance. However, the exact scope and timelines have been changing through rulemaking and court decisions, which means fintechs should always check the latest FinCEN updates rather than relying on older assumptions about who must report and when.

For fintechs, the main point is straightforward. As ownership transparency improves, the data available for due diligence and risk assessment becomes much more reliable. Even if your own company is not required to report, understanding how beneficial ownership reporting works can help you make better decisions, spot red flags, and build a clearer picture of the customers you serve.

State-Level MSB Requirements

State-level money transmitter rules add an extra layer of oversight for fintechs that move funds or handle stored value. Each state sets its own licensing standards, reporting timelines, and compliance expectations, which means obligations can vary widely across regions.

Fintechs often need to maintain multiple licenses, respond to examinations from different states, and follow local rules related to recordkeeping, audits, and financial reporting. These requirements influence how products are designed, especially when expanding nationally.

Understanding the state landscape helps teams plan ahead. Early preparation makes it easier to manage renewals, track obligations, and maintain a consistent AML framework across all licensed jurisdictions.

FinCEN Priorities

FinCEN publishes national AML priorities that highlight the areas posing the greatest risk to the financial system. These priorities guide how institutions shape their programs and where they focus their monitoring and due diligence.

For fintechs, the list offers a clear view of what regulators expect teams to understand. Priorities often include cybercrime, fraud, terrorist financing, corruption, and risks tied to virtual assets. While not all priorities apply equally to every business model, they help companies align their controls with broader national concerns.

Staying familiar with them supports better decision-making. It also helps teams adjust their risk assessments and monitoring rules as new threats or regulatory updates appear.

Key Global AML Rules

Fintechs operating across borders work within a mix of regional and international frameworks. These rules share common principles but differ in their application and supervision. Understanding the major global standards helps teams build programs that scale into new markets.

FATF Standards

FATF Standards lay out what an effective AML program should look like, how regulators should assess risk, and what financial institutions need to do to catch and respond to suspicious activity. Even the most detailed national rules tend to trace back to these recommendations.

For fintechs, FATF influence is everywhere. Customer due diligence, beneficial ownership verification, ongoing monitoring, sanctions screening, and governance structures all stem from FATF principles. Countries interpret them differently, but the core concepts stay the same. That consistency makes it easier to build a program that works across borders without starting over in each new market.

FATF evaluations also shape how regulators behave. When a country receives findings during its mutual evaluation, local authorities often tighten supervision or update guidance. Fintechs that follow FATF-aligned practices are better positioned to adapt as these changes roll out.

EU AML Directives and EU AML Authority

The EU’s AML framework has historically been built around AML directives that all member states must follow. Each new directive added more detail and helped create a shared baseline across the region, even though countries applied the rules through their own local laws.

This approach is now shifting toward a more unified system. A new EU AML Regulation, sometimes called the “single rulebook,” will apply directly in all member states and bring more consistent requirements for private sector firms.

At the same time, a new EU Anti-Money Laundering Authority (AMLA) will coordinate supervision and directly oversee certain higher-risk institutions across the bloc.

For fintechs, this points to a more predictable environment over the next few years. An AML program that follows the EU framework and is supported by strong governance, documentation, and risk assessment can be better positioned to operate in multiple EU markets with fewer structural changes as the single rulebook comes into full effect.

UK Money Laundering Regulations

The UK Money Laundering Regulations set the foundation for AML expectations across payments, crypto services, lending, wealth platforms, and other regulated activities. These rules outline how firms should assess risk, verify customers, monitor transactions, and document decisions.

The FCA and HMRC supervise different types of businesses, but both expect firms to apply a risk-based approach. That means understanding how customers use the product, setting controls that match those risks, and keeping records that show how decisions were made.

Singapore MAS Rules

Singapore’s Monetary Authority (MAS) sets one of the most detailed AML frameworks in the Asia Pacific region.

Its rules highlight clear risk assessments, reliable customer identification, and strong controls for cross-border activity. The guidance is practical and often reflects the realities of digital finance, which makes it especially valuable for fintechs building or scaling in the region.

Fintechs supervised by MAS must show that they understand the risks tied to their business model and have controls that match those risks. This includes due diligence, ongoing monitoring, sanctions screening, and periodic reviews.

MAS also places significant emphasis on governance and expects senior leaders to stay closely involved in how the AML program operates.

Asia-Pacific (APAC) and Middle East & North Africa (MENA) Guidelines

Most APAC and MENA regulators build their AML frameworks around FATF principles but adapt them to local risks and market structures. That means fintechs expanding into these regions face a mix of familiar concepts and jurisdiction-specific wrinkles.

In APAC, markets like Australia, Japan, and Hong Kong have well-established regulatory systems with detailed expectations around customer due diligence, monitoring, and governance. Other countries in the region are still building out their frameworks as digital finance takes hold.

MENA regulators tend to focus on cross-border activity, beneficial ownership transparency, and risks connected to remittance flows.

The core challenge for fintechs is inconsistency. Even when regulators draw from the same global standards, the details can vary significantly from one market to the next. An AML program that's flexible, well-documented, and built on adaptable workflows makes it much easier to expand without having to rebuild from scratch each time.

Regulatory Expectations Checklist for Fintech AML Programs

Regulators want to see AML programs built around how your product actually works, not generic frameworks applied across the board. A strong program shows that the company understands how customers use the platform, how money moves, and where vulnerabilities may appear.

The checklist below captures what supervisors, banking partners, and auditors commonly look for.

Program Structure and Governance

A documented AML program approved by senior leadership

A designated AML officer with clear responsibility and authority

Defined reporting lines and regular updates to the board

Policies that match the actual product design and customer flows

Evidence that leadership understands the company’s risk profile

Risk Assessment

A written risk assessment that covers products, customers, geographies, and delivery channels

Clear scoring logic that ties risks to specific controls

Regular updates when the product or customer base changes

Alignment between the risk assessment and day-to-day processes

Customer Identification and Due Diligence

Documented onboarding procedures for individuals and businesses

Processes for verifying identity and validating data sources

Beneficial ownership collection and verification, where required

Enhanced due diligence steps for higher-risk customers

Explicit criteria for approving, rejecting, or offboarding customers

Monitoring and Investigations

Rules and models that reflect how customers actually use the product

Alert handling procedures with clear timelines and documentation standards

Case management tools that support consistent reviews

Defined escalation triggers for compliance leadership

Metrics to track alert quality, false positives, and review speed

Reporting and Regulatory Interaction

A structured workflow for suspicious activity reporting

Documentation that explains decision-making for each case

Processes for responding to inquiries from regulators or partners

Testing that confirms reporting timelines and data quality

Sanctions and Watchlist Controls

Screening at onboarding and throughout the customer lifecycle

Coverage for customers, counterparties, and transaction details

Procedures for resolving potential matches

Regular updates to the list sources and screening logic

Recordkeeping and Audit

Organized records that support onboarding, monitoring, and reporting decisions

Retention practices that meet jurisdictional requirements

Independent audits that test controls and recommend improvements

Evidence of follow-up on audit findings

Program Adaptation and Scalability

Processes to update controls as the business grows

Training for staff involved in onboarding or monitoring

Technology that supports scale without sacrificing oversight

Documentation that shows how the program evolves over time

This version reflects what regulators typically look for during exams and what bank partners often require before supporting new features or higher volumes.

—

AML compliance touches almost everything at a fintech. It affects how you design products, how customers experience your platform, and how partners and regulators size up your operation.

The steps in this guide give you a working foundation. They show how onboarding, monitoring, governance, and reporting fit together, and how expectations shift depending on your business model and where you operate. As you scale, getting these pieces right matters even more. They're what allow you to stay consistent while expanding into new markets or rolling out new features.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.