Preparing for a regulatory exam is a reality every growing fintech faces. It’s not just about passing a review but proving that your business runs responsibly and transparently. With the right preparation, an exam can be an opportunity to strengthen your compliance program, not just a test of it.

In this guide, you’ll learn how the exam process works, who the main regulators are, and what areas tend to get the most attention. We’ll also walk through a practical, step-by-step approach that helps you prepare without losing focus on your business.

What Does Regulatory Exam Prep Look Like for Fintechs?

For fintechs, regulatory exam prep is really about structure, teamwork, and awareness. It’s about showing that compliance is part of how your business operates every day.

Getting started begins with knowing your regulatory landscape. Identify which agencies oversee your activities, such as the SEC, FINRA, CFPB, or state regulators. Each one has its own focus and expectations. Once you know who’s involved, look at the areas they care about most, like Anti-Money Laundering (AML) programs, customer onboarding, disclosures, data protection, and complaint handling.

From there, collaboration becomes key. Legal, compliance, operations, and technology teams need to work together so everyone understands their responsibilities and where key information lives. Gaps often appear when policies are outdated, files are spread across systems, or teams describe the same process differently. Fixing those details early helps the entire organization feel ready when the exam starts.

Finally, a strong prep routine ties it all together. Keep one organized library for documents, review your policies often, check your data for accuracy, and run mock exams to spot weaknesses before regulators do.

When preparation becomes part of your regular rhythm, exams can feel far less stressful and much better managed.

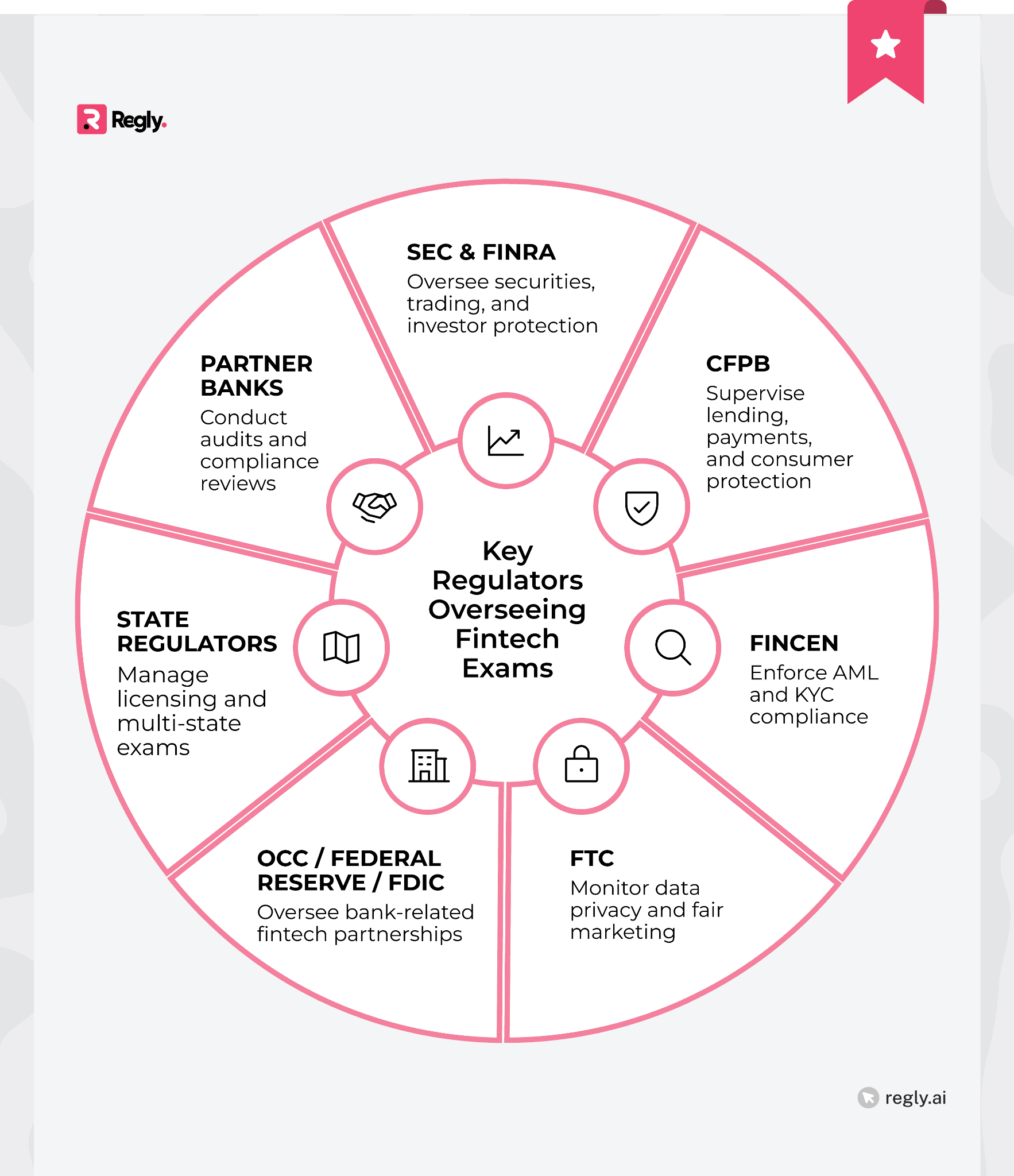

Who Conducts Regulatory Exams for Fintechs?

Fintechs often deal with more than one regulator, each overseeing different parts of their business. Some focus on trading, others on lending or payments. Knowing who’s likely to look at your company helps you stay focused and ready for what matters most.

1. SEC and FINRA: Oversight for Securities and Trading Fintechs

Fintechs that deal with securities, investments, or trading platforms often fall under the supervision of the SEC and FINRA. These two agencies work together to protect investors, maintain fair markets, and monitor how firms handle client relationships and transactions.

If your fintech offers brokerage services, digital trading, or automated investment tools, the SEC will likely review your registration status, disclosures, and internal controls. FINRA focuses more on operational conduct, advertising practices, supervision, and communication with clients. Both regulators want to see that your systems promote transparency and prevent conflicts of interest.

Preparing for an SEC or FINRA exam starts with having your documentation in order, including things like supervisory procedures, trade records, marketing materials, and compliance manuals. Examiners will take a close look at how your team is trained, how risks are managed, and how decisions are documented.

Running regular self-reviews and mock exams helps you catch issues early and keep your compliance program organized when regulators arrive.

2. CFPB: Consumer Protection for Lending and Payments

The CFPB plays a major role in overseeing fintechs that offer lending, credit, or payment services. Its main goal is to protect consumers by checking that financial products are fair, transparent, and easy to understand.

If your fintech offers loans, buy-now-pay-later options, digital wallets, or payment processing, the CFPB will take a close look at how you communicate with customers. They focus on things like disclosures, complaint handling, marketing language, and data privacy.

They also check whether your policies follow key consumer protection laws such as the Truth in Lending Act (TILA) and the Electronic Fund Transfer Act (EFTA).

During exams, the CFPB reviews your compliance management system, transaction data, and customer feedback. It may also look at how your team oversees vendors and partners who handle customer information or funds.

3. FinCEN: AML and KYC Enforcement Through Partner Agencies

The Financial Crimes Enforcement Network (FinCEN) plays a key role in helping fintechs prevent and report financial crimes like money laundering, fraud, and terrorist financing. It sets the rules for AML and KYC programs, but often works through other regulators to carry out reviews.

If your fintech moves money, handles crypto transactions, or verifies customer identities, FinCEN’s rules likely apply to you. This includes following the Bank Secrecy Act (BSA) and filing reports such as Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs). Regulators will look for clear processes that show how you monitor transactions, investigate red flags, and document your findings.

4. FTC: Data Privacy and Fair Marketing Practices

The Federal Trade Commission (FTC) plays a big part in how fintechs manage consumer privacy, data security, and advertising. Its primary concern is whether companies handle customer information responsibly and communicate clearly about their products and services.

If your fintech works in payments, lending, or personal finance, the FTC will review how you talk to users and how you protect their data. They’ll look at your website disclosures, privacy notices, and consent processes, as well as how you share information with third parties. They also check that your marketing reflects your actual products, including fees, rates, and terms.

5. OCC, Federal Reserve, and FDIC: Bank-Related Fintech Supervision

Fintechs that work with or provide services to banks often fall under the indirect supervision of regulators like the OCC, the Federal Reserve, and the FDIC. These agencies focus on keeping banks safe, compliant, and well-managed, and their expectations extend to the fintechs that help deliver banking products.

If your fintech offers Banking-as-a-Service (BaaS) solutions, embedded finance tools, or payment and deposit services through a partner bank, regulators will look at how you handle compliance risks. They’ll review your approach to data protection, customer verification, transaction monitoring, and complaint handling.

6. State Regulators: Licensing and Multi-State Exam Coordination

State regulators play a big part in keeping fintechs compliant, especially those offering money transmission, lending, or consumer financial services. For companies operating across several states, their oversight matters even more since every state has its own licensing and reporting rules.

Most states have a financial regulator within their banking or financial services department. These agencies review license applications, run regular exams, and monitor customer complaints. If your fintech operates in multiple states, you might go through a coordinated exam where several regulators review your business at once.

7. Partner Bank Audits: Indirect Oversight Through Compliance Reviews

Many fintechs work with partner banks to offer products like deposits, payments, or lending services. While these banks hold the regulatory licenses, fintech partners share responsibility for compliance. This relationship often brings a unique kind of oversight: partner bank audits.

During these reviews, banks assess how well their fintech partners follow compliance and operational standards. They may examine customer onboarding, transaction monitoring, data protection, and complaint handling. The goal is to confirm that the fintech’s activities align with the bank’s own regulatory expectations.

A partner bank audit can feel similar to a regulatory exam. You’ll need to provide documentation, explain processes, and respond to findings. Strong preparation means maintaining open communication with your partner bank and keeping policies, reports, and training records up to date.

Types of Exams Fintechs Can Expect (by Business Model)

Regulatory exams look different for every fintech. The type of license you hold, the products you offer, and the risks tied to your business all shape what regulators focus on and how often they review your operations. Understanding where your company fits helps you prepare for the right kind of exam with the right level of detail.

Broker-Dealers and Investment Platforms

Broker-dealers and trading fintechs are usually examined by the SEC and FINRA, which focus on how firms protect investors and maintain market integrity. These exams give regulators insight into how your business operates, manages risk, and uses technology to support fair trading.

During reviews, examiners look at supervisory systems, customer communications, trade execution, and disclosure practices. They may also review how you handle conflicts of interest, marketing materials, and relationships with third-party vendors or affiliates.

The best way to prepare is to keep your trade data and supervisory records organized and easy to find. Be ready to explain how your systems work and how compliance decisions are made. When your team stays proactive and open, exams become a natural extension of your regular compliance routine rather than a disruption.

Registered Investment Advisors (RIAs) and Wealth-Tech Firms

RIAs and wealth-tech platforms are usually examined by the SEC or state securities regulators, depending on their assets under management and registration status. These exams focus on how firms act in the best interest of clients, manage conflicts, and safeguard customer data.

Examiners often review advisory agreements, disclosures, fee structures, marketing materials, and records of client communications. They pay close attention to how investment advice is generated and delivered, especially for firms using automated portfolio tools or algorithm-based recommendations.

Preparing for an RIA exam involves reviewing your Form ADV, making sure disclosures are clear and consistent, and confirming that client documentation and financial records are complete.

Payments and Money Transmission Fintechs

Fintechs operating in payments or money transmission often fall under FinCEN and state financial regulators. Their exams focus on how companies move funds, verify customer identities, and prevent misuse of their platforms for fraud or money laundering.

During these reviews, regulators may request transaction data, customer onboarding records, AML and KYC policies, and documentation of how suspicious activity is identified and reported. They also look at vendor oversight and how your team handles customer funds in transit.

Because many payment firms hold licenses in multiple states, exams can involve several agencies coordinating together. Staying organized with centralized documentation and consistent policies across jurisdictions helps keep reviews efficient.

Lending and Credit Platforms

Lending and credit fintechs often interact with several regulators, including the CFPB, state banking departments, and sometimes the FDIC or Federal Reserve through partner banks. Exams for these businesses center on consumer protection, transparency, and fair lending practices.

Regulators typically review loan agreements, pricing models, marketing materials, and customer complaints. They also assess how the company manages data, evaluates credit risk, and monitors third-party service providers.

Another key focus is whether the lending process treats all borrowers fairly and complies with laws like the Equal Credit Opportunity Act (ECOA) and the Truth in Lending Act (TILA).

To prepare, fintech lenders should keep detailed documentation of policies, underwriting standards, and disclosures. Regular internal reviews of loan files and complaint logs can also help identify issues early.

Banking-as-a-Service and Embedded Finance Providers

Banking-as-a-Service and embedded finance providers work closely with banks, so their regulatory reviews often happen indirectly. Agencies like the OCC, FDIC, and Federal Reserve supervise the banks, and in turn, those banks assess their fintech partners to confirm that compliance and risk expectations are being met.

These reviews typically focus on customer onboarding, identity verification, data security, and transaction monitoring. Examiners or partner banks may also check how you handle funds, track complaints, and define responsibilities in your service agreements.

Preparation starts with strong coordination between compliance and operations teams. Keep documentation clear, organized, and up to date to show that your fintech takes its role in the banking relationship seriously.

Crypto and Digital Asset Companies

Crypto and digital asset firms face a complex and evolving regulatory landscape. Oversight often comes from multiple agencies, including the SEC, CFTC, FinCEN, and state regulators. Each focuses on different risks, including investor protection, market integrity, and the prevention of financial crime.

During exams or reviews, regulators look at how your company manages custody of digital assets, conducts KYC and AML checks, and communicates risks to customers. They may also review how tokens or digital products are classified and whether trading or lending activities comply with securities and commodities laws.

Preparing for a crypto-related exam means staying organized and ready to explain how your operations meet existing financial regulations, even when the rules feel unclear.

Insurtech and Specialty Finance Models

Insurtech and specialty finance companies sit at the crossroads of technology and traditional regulation. Depending on their products, they may be overseen by state insurance departments, the CFPB, or state lending and financial services agencies.

Each one focuses on fairness, transparency, and how companies manage and protect consumer data.

Exams in these sectors usually look at how insurance or credit products are marketed, priced, and serviced. Regulators often review policy documents, claims handling, and disclosures to confirm that information is accurate and easy for consumers to understand.

They also assess whether data privacy and vendor management practices meet industry expectations.

To stay ready, these fintechs should keep compliance programs current and clearly documented. Reviewing customer communications and tracking how data moves between partners helps catch potential issues early.

What Key Areas Do Regulators Scrutinize During Fintech Exams?

Regulators tend to focus on specific areas that reveal how well a fintech manages compliance risk. These areas cover everything from licensing and consumer protection to data security and internal governance.

Focus Area | What Regulators Review |

|---|---|

Licensing and Registration | Active licenses, renewal records, and scope of authorization. |

Consumer Protection | Disclosures, complaint logs, customer service records, fee transparency, product terms, and clarity of customer communications. |

AML and KYC Compliance | Transaction monitoring reports, training records, and SAR filings. |

Cybersecurity and Data Governance | Incident response plans, access controls, and vendor risk management. |

Advertising and Conduct Rules | Website and app content, marketing materials, disclaimers, social media posts, and internal approval workflows. |

Board Oversight and Governance | Board minutes, compliance reports, internal audits. |

Licensing and Registration

Licensing and registration are the starting point of regulatory oversight for fintechs. Examiners first verify that your company has the right authorizations for everything it does, whether it’s money transmission, lending, or investment services.

They’ll review the scope of your licenses, renewal timelines, and any gaps between your actual operations and what those licenses allow. If your business operates in multiple states, regulators will also look at how well you keep up with changing local and federal requirements.

A good approach is to keep all license records, applications, and renewal dates in one organized place. Assign someone to track updates and maintain supporting documents such as financial statements or background checks.

Consumer Protection (UDAAP, Disclosures, Complaints)

Consumer protection is a major area of concern for regulators' review during a fintech exam. They look at how your company treats customers, explains product terms, and handles complaints. Their focus is on fairness, clarity, and making sure customers can easily understand the products they’re using.

Examiners often review marketing materials, disclosures, and customer service records to check compliance with consumer protection laws like Unfair, Deceptive, or Abusive Acts or Practices (UDAAP). They want to see that fees, terms, and risks are communicated clearly and that customers have accurate information before making financial decisions.

A strong approach starts with clear, consistent messaging across your website, app, and customer channels. Keep your complaint records organized and look for patterns that reveal recurring issues. When regulators see that your team actively tracks and resolves concerns, it reinforces that customer protection is part of how your company builds trust and improves over time.

AML, KYC, and FinCEN Compliance

Regulators and partner banks want to see that your company understands its financial crime risks and has strong controls to manage them.

Examiners typically review how you identify and verify customers, monitor transactions, and report suspicious activity to FinCEN. They’ll also check how well your policies work in practice, including whether staff are trained consistently, systems detect unusual behavior, and investigations are clearly documented.

Being ready means going beyond a written policy. Keep your procedures detailed and current, test your systems often, and organize records of alerts, reviews, and reports. When AML and KYC processes are part of daily operations, regulators see a company that takes risk management seriously and runs with integrity.

Cybersecurity and Data Governance

Regulators want to know how your company protects customer data, prevents breaches, and manages risks tied to third-party vendors. Therefore, clear, well-documented policies around how data is stored, accessed, and secured are essential.

During exams, regulators often review your incident response plan, access controls, and vendor management processes. They may also ask about recent security tests or audits and how your team followed up on the results. For fintechs that handle sensitive information or financial transactions, this review carries even more weight.

Strong preparation starts with a cybersecurity framework that is both practical and tested. Review user access regularly, track activity logs carefully, and make sure your team is trained to respond quickly to alerts. Treating cybersecurity as part of your company’s daily routine shows regulators that data protection is a core part of your operations.

Advertising, Disclaimers, and Conduct Rules

Examiners look for clarity, balance, and honesty in your marketing materials. They want to see that your advertising matches the product’s actual features and that all required disclaimers are easy to find and understand.

Reviews often include your website, app content, emails, and social media posts. Regulators check for statements that could be considered misleading, especially around pricing, returns, or risk. They may also look at internal approval processes to see how marketing messages are reviewed before they go live.

Preparing for this part of an exam starts with consistency. Make sure your compliance and marketing teams collaborate on every campaign. Keep a record of all materials and approval notes in one place.

Board Oversight and Internal Governance

Strong governance is what ties a fintech’s compliance framework together. Regulators want to see that the board and senior leadership are actively involved in setting compliance priorities, reviewing risk reports, and supporting internal controls.

During exams, regulators often look at board minutes, committee charters, and reports shared with executives. They focus on how often compliance issues are discussed, how decisions are documented, and whether management follows through on corrective actions. The goal is to understand whether compliance is integrated into strategy, not treated as a side function.

Fintechs can prepare by maintaining clear reporting lines and consistent communication between compliance, risk, and leadership teams. Regular board updates, internal audits, and training sessions help keep everyone aligned.

Common Pitfalls in Regulatory Exam Prep

Even well-prepared fintechs can run into challenges during exam preparation. Knowing the common pitfalls can help you avoid unnecessary stress and keep your process organized.

Here are some frequent issues regulators see:

Starting too late: Many teams wait until they receive an exam notice before organizing documents or assigning roles. This often leads to rushed work and overlooked details.

Outdated or scattered documentation: Policies may be stored in different systems, with some versions no longer current. Examiners notice when records are inconsistent or incomplete.

Poor cross-team communication: If compliance, legal, and operations teams are not aligned, exam responses can be inconsistent or confusing. Having one coordinator helps keep messaging clear.

Lack of clear explanations: Submitting documents without context can make it hard for examiners to understand how your controls work. They value concise narratives that explain your processes and decisions.

Neglecting follow-up actions: Some fintechs prepare well but fail to track post-exam recommendations. Regulators often revisit these items, so it’s important to document progress and close the loop.

Recognizing these pitfalls early makes exam prep more manageable and helps your team present a confident, well-organized picture of your compliance program.

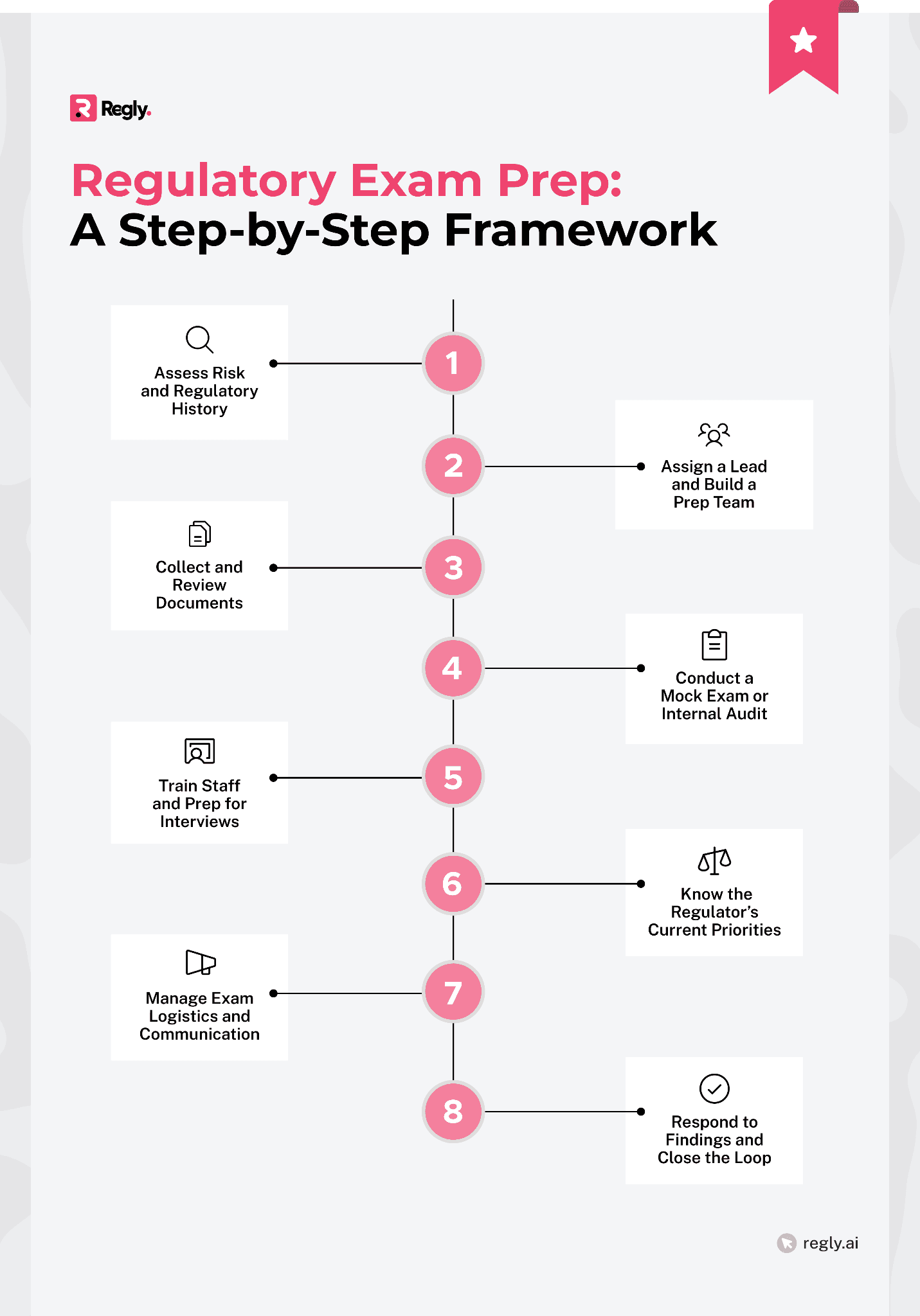

Regulatory Exam Prep: A Step-by-Step Framework

A structured approach helps fintechs stay organized and confident throughout the exam process. Here’s how to prepare effectively, from assessing risks to responding to findings once the review is complete.

Step 1: Assess Your Risk and Regulatory History

Start exam prep by understanding where your biggest risks and past challenges lie. Review your company’s regulatory footprint, including which agencies oversee your activities and the types of exams you’ve undergone before. This gives you a clear view of what to expect.

Look for patterns in previous findings or feedback. Were there recurring issues with documentation, customer disclosures, or AML controls? Identifying these early helps you focus on the areas most likely to draw attention again.

It also helps to assess new risks that may have emerged since your last review, such as product launches, new vendors, or technology changes. Taking time to map your risk landscape at the beginning keeps your preparation targeted and effective.

Step 2: Assign a Lead and Build a Prep Team

Once you understand your risk areas, the next step is to put the right people in charge. Designate a compliance lead or exam coordinator who will manage the process from start to finish. This person should be detail-oriented, calm under pressure, and familiar with both regulatory expectations and your company’s internal systems.

Build a cross-functional team that includes compliance, legal, operations, IT, and customer service representatives. Each department plays a role in gathering documentation and answering examiner questions. Clear ownership prevents confusion and keeps deadlines on track.

It also helps to set up a shared workspace or project tracker where everyone can see progress in real time. Open communication and regular check-ins keep the team aligned and reduce the risk of last-minute surprises once the exam begins.

Step 3: Collect and Review Documents

Document collection is the most time-consuming part of exam prep, so starting early helps everything run smoothly. Begin by reviewing the regulator’s document request list, then create a clear plan for how and where each item will be gathered.

Most exams require policies, procedures, financial records, and operational data. Make sure the versions you provide are current and consistent across departments. Regulators quickly notice when policies are outdated or when one team’s process doesn’t match what’s written.

Before submitting anything, perform a quick internal review. Check for missing attachments, broken links, or unclear labeling. A well-organized submission not only saves time during the exam but is also likely to convey to examiners that your company approaches compliance with structure and care.

Step 4: Conduct a Mock Exam or Internal Audit

A mock exam is one of the most effective ways to identify weak spots before regulators do. Treat it like a real review. Use the same document requests, interview format, and timelines you would expect in an official exam.

Bring in your compliance team or an external advisor to act as independent reviewers. They can test how well your records, policies, and controls hold up under scrutiny. Pay special attention to areas that often create risk, such as AML programs, customer disclosures, or cybersecurity documentation.

After the mock exam, summarize your findings and assign clear follow-up actions. Addressing issues now makes the official review much smoother and gives your team confidence when regulators start asking questions.

Step 5: Train Staff and Prep for Interviews

Regulators often interview employees to understand how compliance works in practice. These conversations help them gauge whether policies are being followed consistently across teams. Preparing staff ahead of time helps build confidence and keeps communication clear during the exam.

Start by explaining the purpose of the exam and what types of questions regulators might ask. Employees should be familiar with their roles, the company’s compliance policies, and how day-to-day procedures align with regulatory requirements.

Hold short training sessions or mock interviews to practice responses. Encourage honesty and clarity. For instance, if someone doesn’t know the answer, it’s better to explain who handles that area rather than guessing. A calm, informed team reflects well on the company and shows that compliance is part of the organizational culture.

Step 6: Know the Regulator’s Current Priorities

Every regulator has specific focus areas that shift over time based on market trends, new laws, and recent enforcement actions. Understanding these priorities helps you prepare for the questions and documentation requests most likely to appear during your exam.

Start by reviewing recent speeches, guidance documents, and exam reports from agencies such as the SEC, FINRA, CFPB, or FinCEN. These updates often highlight the themes regulators are emphasizing, like cybersecurity readiness, third-party risk, or customer disclosures.

Once you identify those themes, check how your firm aligns with them. Are your policies, reports, and training materials up to date? If a priority area affects your operations, be ready to explain how your company addresses it in practice. This approach helps you stay proactive and shows that your compliance program evolves with the industry.

Step 7: Manage Exam Logistics and Communication

Once the exam begins, organization and communication matter just as much as preparation. Assign a single point of contact to manage all regulator requests and coordinate responses across departments. This helps maintain consistency and avoids duplicate or conflicting submissions.

Keep a detailed log of every document shared and question answered. Regulators often follow up on earlier requests, so having a clear record saves time and prevents confusion. It also helps to set realistic internal deadlines so your team can review materials before they’re sent.

During meetings or interviews, aim for clarity and professionalism. Be direct when answering questions and provide supporting evidence when needed. A steady, transparent communication style builds trust and helps the exam process move forward smoothly.

Step 8: Respond to Findings and Close the Loop

Once the exam wraps up, regulators will share their findings. This stage is just as important as the preparation. Review the report carefully and categorize any issues by severity and timeline. Some findings may need immediate attention, while others can be addressed through process improvements or policy updates.

Create an action plan that outlines who is responsible for each item, what steps will be taken, and when follow-up documentation will be ready. Regulators appreciate clear communication and timely updates on remediation progress.

Finally, use the exam as a learning opportunity. Share insights with your leadership and compliance teams, update procedures where needed, and apply lessons from the experience to strengthen future readiness. Treating the exam as an ongoing feedback loop is a key element in developing a stronger, more adaptive compliance culture.

Recent Exam Trends Fintechs Should Watch

Regulators are paying close attention to how fintechs balance innovation with compliance discipline. Recent exams show a stronger focus on operational transparency, consumer protection, and technology oversight.

A few themes stand out:

Third-party and vendor management: Regulators want to see detailed oversight of partners, especially in BaaS and embedded finance models.

Data protection and cybersecurity: Fintechs are expected to maintain clear, tested controls for data security, incident response, and vendor access.

Marketing and consumer communication: Advertising claims, disclosures, and complaint-handling practices are under closer review, particularly for lending and payments platforms.

Crypto and digital assets: Agencies are refining their approach to digital asset supervision, focusing on custody practices and investor transparency.

AI and automation in compliance: Examiners are beginning to ask how fintechs use technology like Regly for risk monitoring, AML, and reporting, and whether human oversight is still active.

Staying ahead of these trends helps fintech leaders prepare for what regulators care about most. Regularly reviewing exam priorities and adapting internal programs keeps your compliance strategy strong and relevant.

Regulatory Exam Prep Checklist

A clear checklist helps keep your team organized when preparing for a regulatory exam. Use this list as a quick reference to track progress and confirm that nothing slips through the cracks.

Pre-Exam Preparation

Review your regulatory footprint and identify which agencies oversee your operations.

Assess past exams or audits to spot recurring issues.

Assign a lead coordinator and define team roles.

Create a timeline for document collection and review.

Documentation and Policies

Update compliance manuals, AML and KYC policies, and risk assessments.

Verify that licenses and registrations are current and properly documented.

Centralize key records, including financial statements, marketing materials, and training logs.

Keep vendor due diligence files and third-party contracts in one place.

Mock Exam and Staff Readiness

Conduct an internal audit or mock exam to test systems and procedures.

Hold training sessions to prepare employees for interviews.

Review how exam communications will be managed and tracked.

During the Exam

Log all regulator requests, submissions, and follow-up items.

Keep responses consistent and reviewed by the designated coordinator.

Maintain professional, clear communication during meetings and calls.

Post-Exam Actions

Review findings and create a remediation plan.

Assign ownership for follow-up actions and track completion.

Share lessons learned with leadership and update policies accordingly.

Using this checklist can help your team stay organized and ready for future reviews without starting from scratch each time.

—

Regulatory exams can feel daunting, but they’re also a valuable opportunity to strengthen your compliance program and demonstrate operational maturity. With the right preparation, your team can move through the process with clarity and control rather than pressure and uncertainty.

Approach exam prep as an ongoing cycle rather than a one-time project. Regular reviews, organized documentation, and open communication across teams help make future exams more manageable.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.