Employee Compliance Explained: Key Rules and Challenges for Fintechs

Published on

Oct 16, 2025

·

Last updated on

Oct 16, 2025

11

min read

Employee compliance is a central issue for financial services and fintech firms. It refers to how employees follow regulations and internal policies in their day-to-day work.

In industries where trust and oversight are non-negotiable, an employee’s actions can either protect the firm or expose it to significant risk.

This article explains what employee compliance means in fintech, why it matters, and how fintech companies can develop practical programs that work in fast-paced environments.

What Is Employee Compliance?

Employee compliance refers to the systems and behaviors that guide staff in following the legal, regulatory, and internal rules that apply to their role. This includes day-to-day activities such as handling client data, communicating with investors, executing trades, or marketing products.

Compliance directly affects business risk. A single employee who bypasses firm policy on record-keeping or uses personal devices for business purposes can expose a company to fines, lawsuits, and reputational damage. Regulators, therefore, expect firms not only to write policies but also to monitor and guide how employees actually operate.

Fintech companies sit at the intersection of new products and old regulatory frameworks. This means employees often work in areas where the rules are complex, overlapping, or not fully adapted to innovation. For example, an employee developing a payments feature might also need to comply with anti-money laundering rules and state money transmission laws.

Strong employee compliance helps fintech businesses mitigate costly enforcement actions and keeps operations aligned with customer trust. It also gives founders and compliance officers confidence that avoidable missteps won’t derail growth.

Why Employee Compliance Matters in Financial Services

Regulators don't just watch what your company does. They watch what your people do. When employees share confidential data, they shouldn't market products improperly or text clients outside approved systems. Regulators come after the firm, not the individual. The company pays the price through penalties, attorney fees, and new operational limits. For fintechs, a single enforcement action can halt growth, delay licensing, or jeopardize investor confidence.

In addition, employee compliance is closely tied to credibility. Clients expect companies to protect their data, handle their transactions fairly, and provide interactions with staff that meet professional standards. Business partners won't work with just anyone. Banks and custodians dig into your compliance culture before they'll touch your business. They want to see that your team follows the rules, not just that you have rules written down. When your employees understand compliance and actually practice it, partners see you as less risky and more likely to protect their reputation alongside your own.

Employee compliance also affects staff morale and retention. A workplace where employees consistently follow policies and procedures fosters stability and fairness. Employees are more likely to stay engaged when they see colleagues and managers held to the same standards. On the other hand, frequent lapses or a culture of ignoring rules leads to frustration and higher turnover. This link between compliance and morale is often overlooked but has a real operational impact.

Regulatory Framework for Employee Compliance

Employee compliance doesn’t exist in a vacuum. It is shaped by a patchwork of rules issued by regulators in the US and abroad. For fintech companies, this means employees must often follow standards designed decades ago for banks or broker-dealers, even when working with new technologies.

Key US Regulators: SEC, FINRA, CFTC, CFPB

Key regulators in the US are:

SEC (Securities and Exchange Commission): Oversees investment advisors, broker-dealers, and public companies. Requires employee codes of ethics, supervision of trading, and retention of communications.

FINRA (Financial Industry Regulatory Authority): Self-regulatory body for broker-dealers. Sets rules on outside business activities, outside brokerage accounts, and continuing education.

CFTC (Commodity Futures Trading Commission): Regulates derivatives and crypto assets that fall under commodity rules. Employees dealing in these areas must follow strict reporting and anti-fraud standards.

CFPB (Consumer Financial Protection Bureau): Focuses on consumer-facing fintech activities, such as lending and payments. Employees interacting with customers must follow disclosure and fair treatment requirements.

International Regimes: FCA (UK), SMCR, EU MiCA, and Others

Global regulators have taken a similar approach, with frameworks that emphasize personal accountability.

Key global frameworks include:

SMCR (Senior Managers and Certification Regime): Holds managers and employees in the UK personally accountable for conduct and oversight.

EU MiCA (Markets in Crypto-Assets): Introduces new standards for crypto firms operating in Europe, with employee obligations for disclosures and operational safeguards. (MiCA regulation guide →)

Other regimes: Singapore’s Individual Accountability & Conduct rules and Australia’s Financial Accountability Regime follow similar principles, focusing on employee responsibility.

For fintech businesses, it is important to remember that regulations are not necessarily tied to a firm's geographical location. Most regulations apply if the company is serving the clients in a particular region, regardless of the business's location.

Core Components of Employee Compliance Programs

A strong compliance program translates regulatory requirements into clear expectations for employees. These components are the areas regulators review most often, and where fintech companies face the greatest risk if gaps appear.

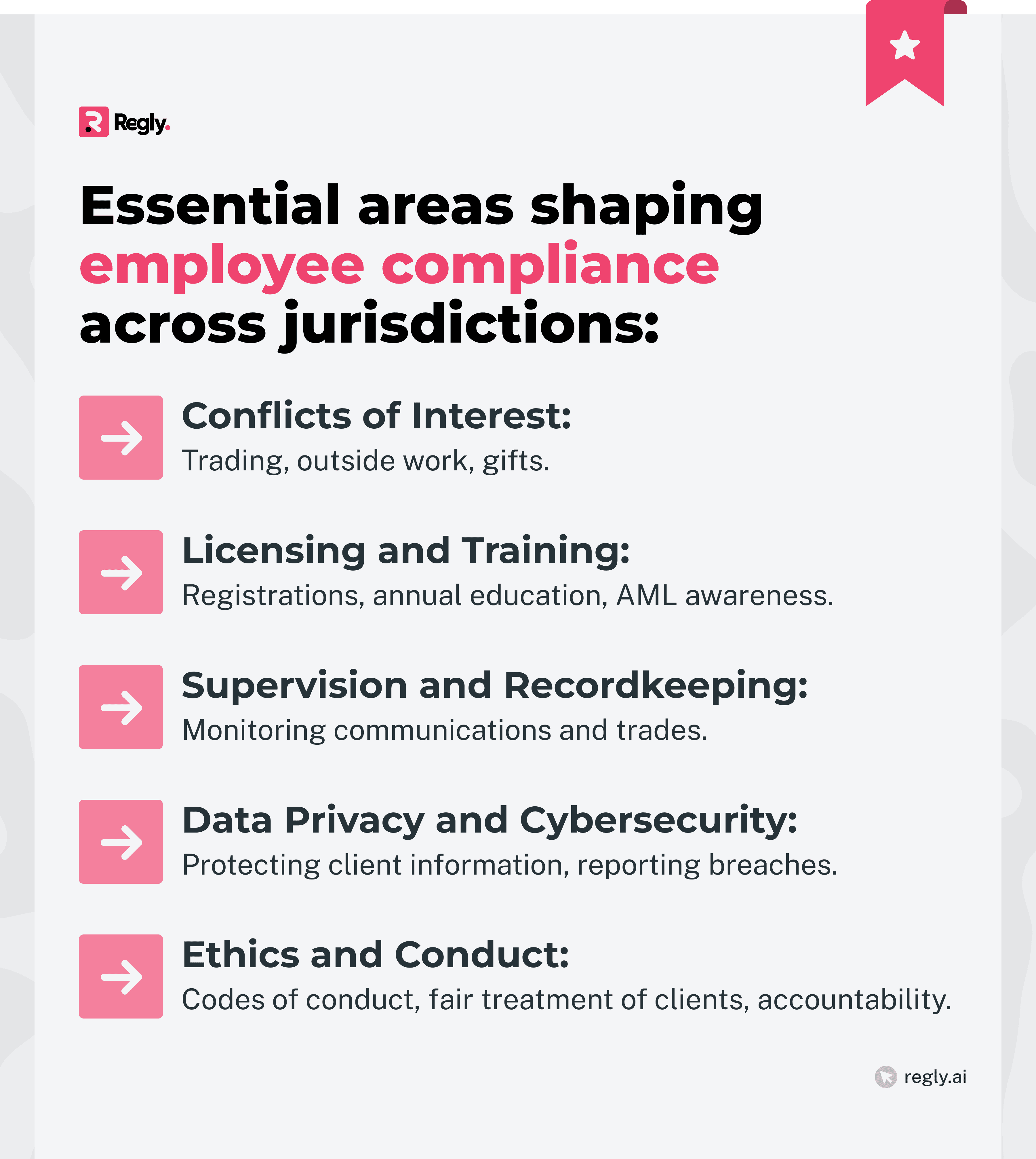

Conflicts of Interest

Employees must avoid activities that could compromise their professional judgment or create divided loyalties. Regulators expect firms to manage policies to make these conflicts visible and manageable.

Typical controls include:

Pre-clearance of personal trading and outside brokerage account monitoring with monitoring against restricted lists to prevent misuse of material nonpublic information.

Disclosure of outside business activities and private securities transactions so the firm can assess potential conflicts before approval.

Limits on gifts, entertainment, and political contributions to reduce the risk of bribery or undue influence.

For fintech firms, conflicts can arise quickly. Employees may trade crypto assets while the firm is developing related products, or they may hold advisory roles in startups that overlap with company activities. Without structured oversight, even unintentional conflicts can undermine client trust and trigger regulatory questions.

Regly ‘s employee compliance module helps fintechs monitor outside business activities →

Licensing and Training

Many financial roles require formal registrations, such as FINRA licenses for broker-dealer representatives or state-level money transmitter approvals. Beyond initial licensing, regulators expect employees to receive continuing education and role-specific training.

This includes:

AML and fraud prevention training tied to the Bank Secrecy Act and FINRA Rule 3310.

Data privacy training related to GDPR, CCPA, and Regulation S-P.

Cybersecurity awareness training to reduce the risk of employee-driven breaches.

Firms must document participation and verify comprehension, since regulators often request these records during exams.

Communications and Recordkeeping

Regulators expect every business-related communication to be captured and supervised. This covers email, chat tools, and messaging apps. Policies must make it clear which platforms are permitted for business use. Firms need technology that enables archiving and reviewing activity on those channels.

Data Privacy and Cybersecurity

Employees often handle sensitive data such as account numbers, identity documents, and transaction histories. Regulations like SEC Regulation S-P, GDPR, and CCPA require firms to safeguard this data with both technical controls and employee training.

Key measures include:

Restricting access to sensitive information on a need-to-know basis

Encrypting data at rest and in transit

Training employees to identify phishing attempts and respond quickly to incidents

A single employee mistake, such as downloading client files to an unsecured device, can result in data loss, regulatory penalties, and reputational damage. This makes privacy and security responsibilities a central part of employee compliance.

Ethics and Conduct Rules

Codes of ethics set the behavioral standards that go beyond technical compliance. They define how employees should act when dealing with clients, colleagues, and business partners. Typical provisions include acting with integrity, treating clients fairly, and avoiding abusive practices.

Employees are usually required to review and acknowledge these codes annually. Leadership also plays a critical role: when managers visibly follow and reinforce ethical standards, employees are more likely to take them seriously.

For fintech firms, conduct rules provide a foundation for building trust with regulators, partners, and customers. They show that the company values accountability at every level, not just in formal compliance processes.

Independent Contractors and Compliance Requirements

Many fintechs rely on independent contractors or consultants alongside full-time staff. If these individuals perform regulated functions, access customer data, or represent the company externally, they must generally follow the same compliance requirements as employees.

Under SEC and FINRA rules, for example, firms must supervise any person, employee, or contractor who advises clients, handles transactions, or interacts with the market on the company’s behalf.

Common scenarios where the same standards apply include:

Access to sensitive information: Contractors working with customer data or internal systems should follow the same data privacy and cybersecurity protocols. This includes breach reporting and role-appropriate training.

Client-facing roles: Contractors in sales, support, or advisory roles must adhere to the same communication standards, disclosure requirements, and conduct rules. Being off payroll doesn’t exempt them from fair dealing obligations.

Regulated functions: Contractors performing tasks such as trading or financial advising typically require the same certifications or registrations and should be supervised accordingly.

Company policies and ethics: Most firms extend their internal code of conduct to contractors via contracts. This includes obligations to avoid conflicts, follow firm policies, and report misconduct. Many codes explicitly state they apply to employees and contractors alike.

Regulators won’t accept “they were just a contractor” as a defense for compliance failures. Firms are responsible for anyone acting on their behalf. Business partners, including banks and custodians, also assess how well companies manage third-party compliance risks during due diligence.

Common Challenges in Employee Compliance

Even with policies and systems in place, fintech companies often struggle to translate rules into day-to-day behavior.

The most common challenges fall into a few clear categories:

Misconceptions About Who Owns Compliance: Some employees believe compliance is only the responsibility of the legal or compliance team. In reality, every role carries compliance obligations, from engineers handling sensitive data to sales staff interacting with clients.

Navigating Gray Areas in Fintech Innovation: Fintech employees often work with products that do not fit neatly into existing rules. A payments feature may involve money transmission licensing, while a crypto offering may touch securities or commodities regulations. These gray areas create uncertainty, and without guidance, employees may make decisions that regulators later challenge.

Small Company Resource Constraints: Early-stage fintechs rarely have large compliance departments. One or two people may be responsible for training, supervision, and reporting. Limited bandwidth means some tasks fall through the cracks, and employees may not receive the reminders or oversight they need.

Compliance Fatigue Among Staff: If employees feel compliance tasks are repetitive or disconnected from their work, they start treating them as box-checking exercises. This “compliance fatigue” erodes vigilance and makes it more likely that employees overlook essential requirements.

Fear of Reporting Mistakes: In some companies, employees hesitate to report potential compliance issues because they fear disciplinary action. This culture of silence prevents problems from being addressed early. It also creates a greater risk that regulators will be the first to discover a violation, rather than the company handling it proactively.

For fintech businesses, these challenges are practical realities. Addressing them requires clear communication, ongoing training, and tools that make compliance part of daily workflows rather than an afterthought.

Recent Developments and Enforcement Trends

Regulators continue to raise expectations around employee compliance. Recent actions show that oversight now extends beyond policies on paper, and businesses are judged on how employees actually behave and how well leadership supervises them.

Growth of Individual Accountability Regimes

A clear trend is the focus on individual responsibility.

In the UK, the Senior Managers and Certification Regime (SMCR) makes both executives and staff accountable for compliance breaches. Similar frameworks are emerging in Ireland, Singapore, and Australia.

While the US doesn’t have a direct equivalent, enforcement cases often target individuals alongside firms, especially when supervisors fail to act. This shift means fintech leaders must define responsibilities clearly and hold employees accountable for daily compliance obligations.

Crypto, AI, and Emerging Fintech Rules

New technologies are drawing fresh scrutiny. Crypto firms now face requirements under the EU’s MiCA regulation, while US regulators continue to apply existing securities and commodities laws to digital assets.

At the same time, agencies like the CFPB are beginning to assess how AI-driven credit and lending models affect compliance with fair lending and consumer protection rules. For employees, this means added training and stricter controls when working on emerging products.

Additional resources: | ||

|---|---|---|

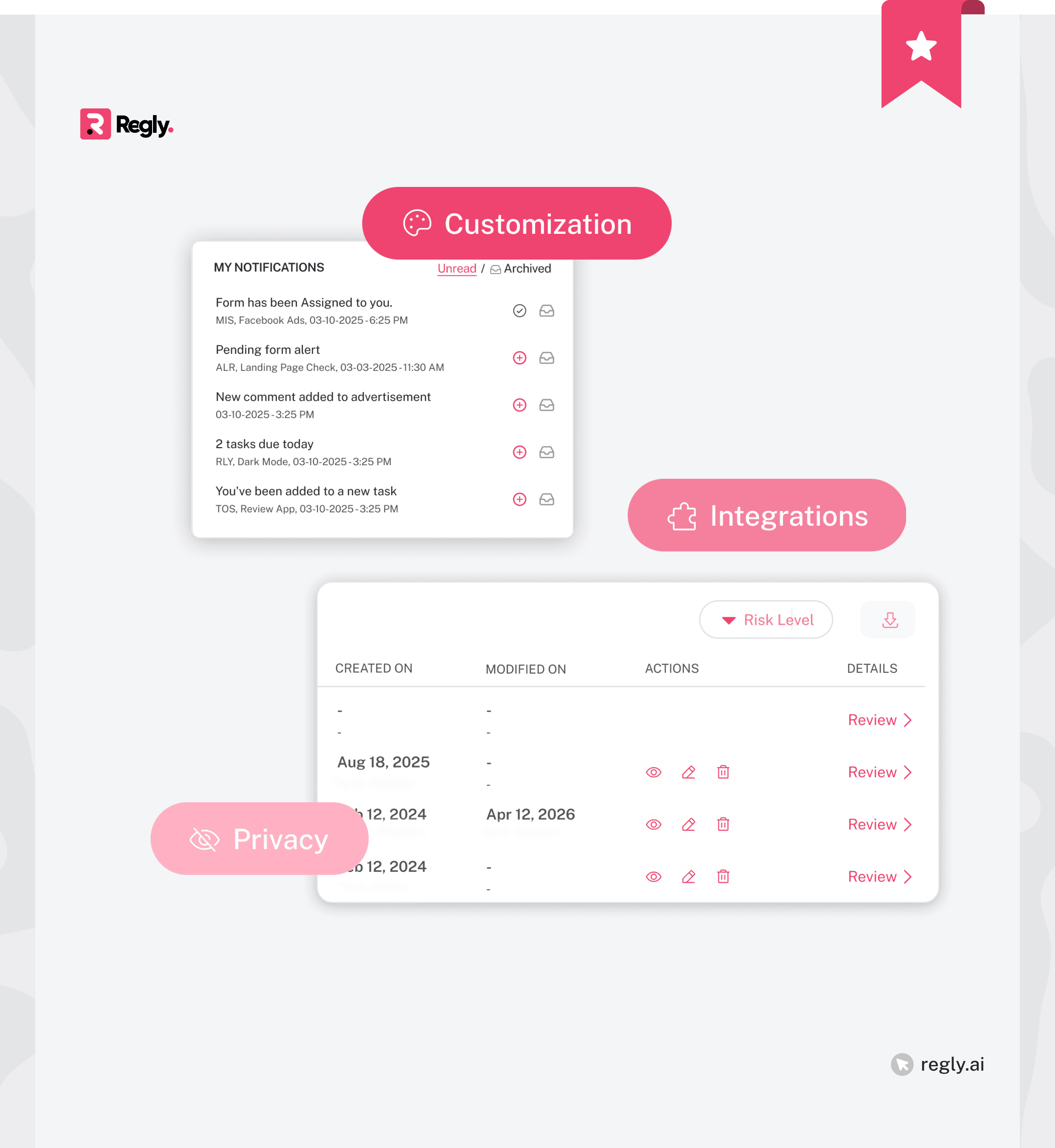

Rise of RegTech and Automation

The growing complexity of compliance has accelerated the adoption of technology solutions. Regulators expect firms to use effective tools to manage communication monitoring, personal trading reviews, and training records. Manual systems are increasingly seen as insufficient.

Regly supports this shift by embedding compliance tasks into daily workflows. The platform automates management of daily compliance tasks, flags risks before they escalate, and gives compliance teams a clear audit trail. For fintechs, this approach reduces reliance on spreadsheets and email chains, making compliance more practical and scalable.

Learn more about Regly’s employee compliance →

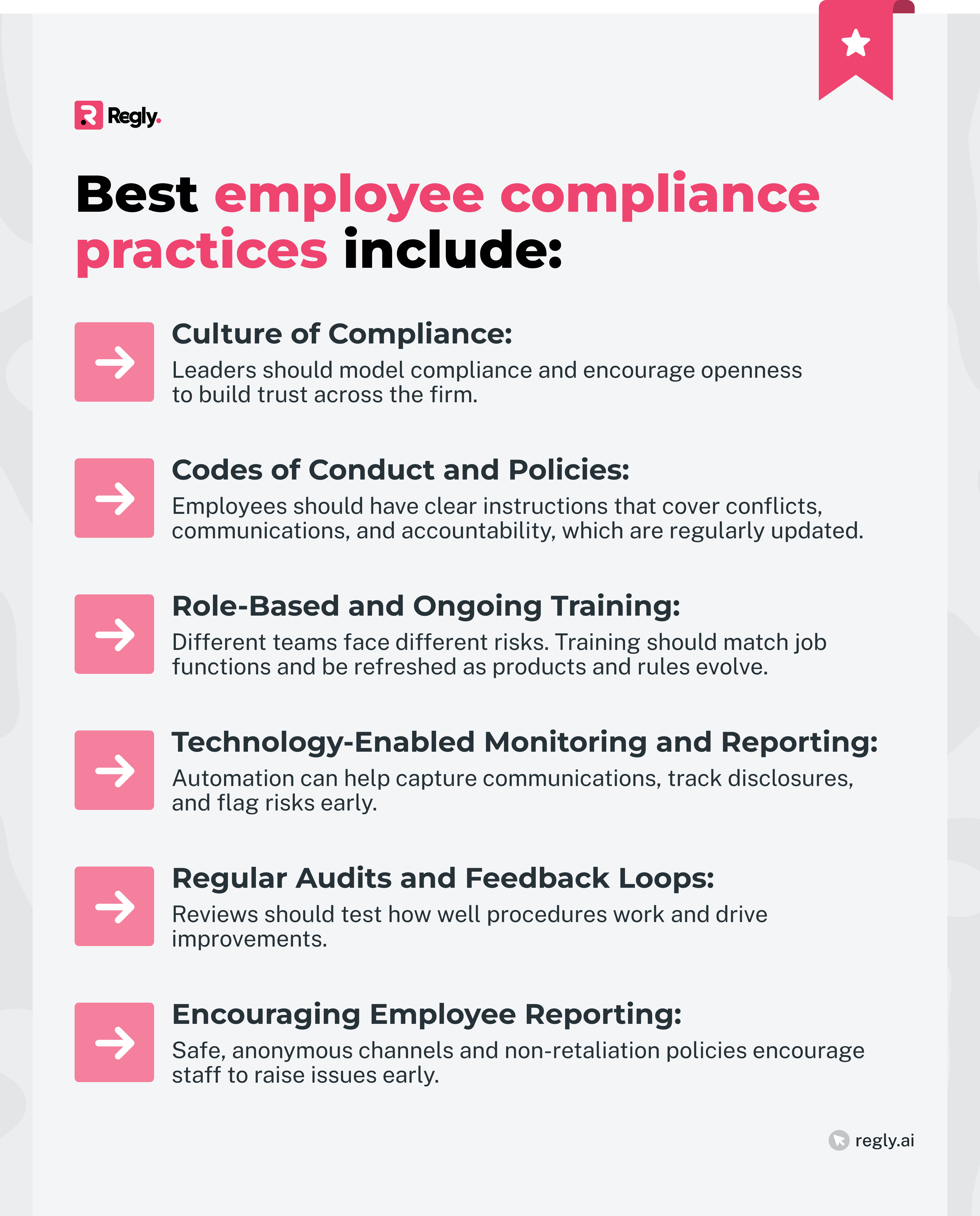

Best Practices for Strengthening Employee Compliance

Strong policies are only effective if employees can follow them in practice. Best practices in employee compliance go beyond checklists. They focus on building a culture where compliance is part of daily decision-making, supported by clear rules, effective training, and technology that reduces friction.

Leadership and Culture of Compliance

The tone from the top matters. When leaders emphasize compliance in meetings, apply policies consistently, and model ethical behavior, employees follow suit. A strong culture also encourages staff to speak up when they see issues.

Regly’s employee compliance centralizes employee management, attestations, and policy acknowledgments in one place →

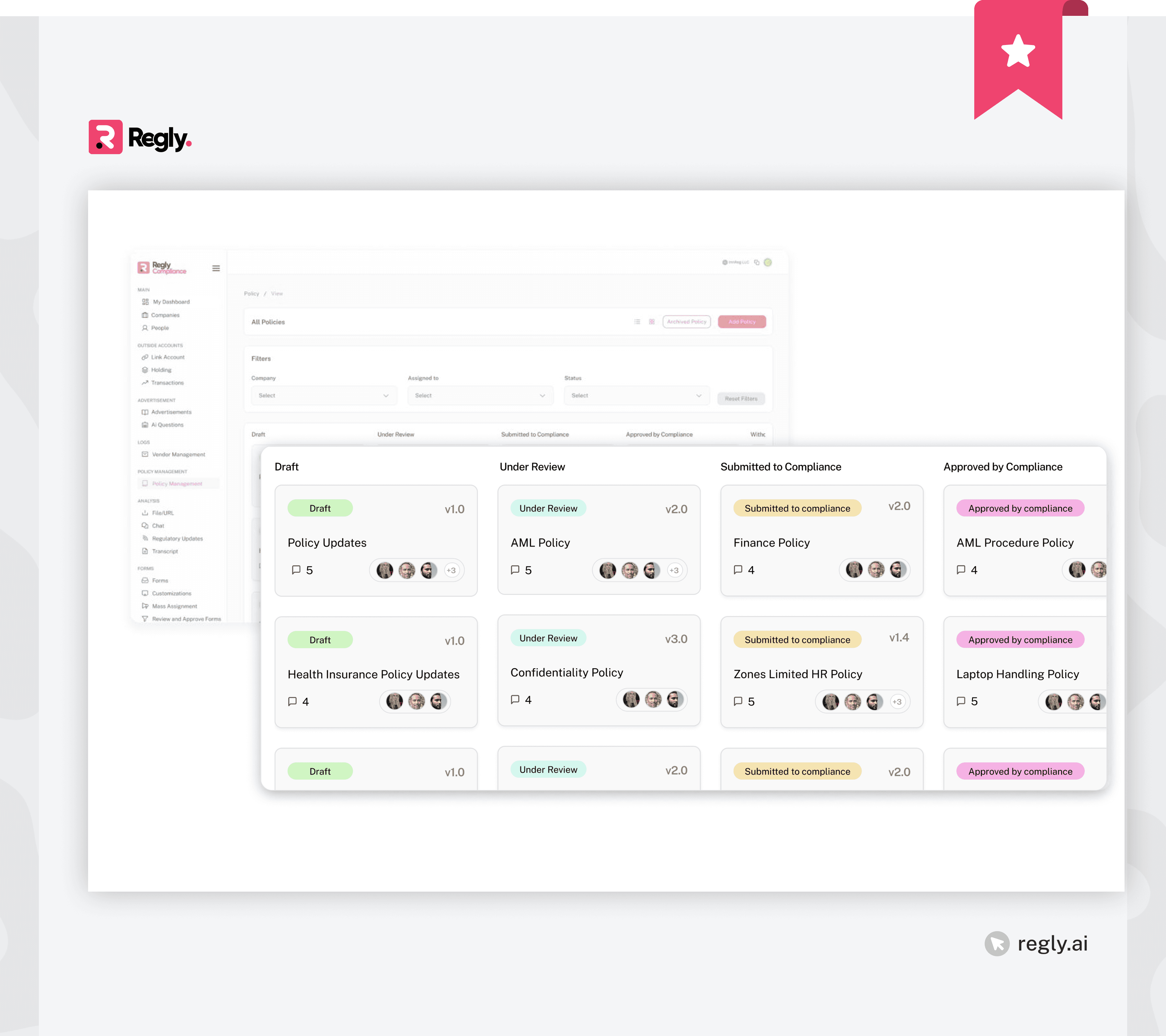

Clear Codes of Conduct and Policies

Written codes and handbooks provide employees with a reference point for expected behavior. They should cover conflicts of interest, communication standards, client interactions, and internal accountability. Updating and distributing these documents regularly keeps them relevant.

Regly’s policy management function allows compliance teams to publish updates, track acknowledgments, and generate records for audits →

Role-Based and Ongoing Training

Different teams face different risks. Engineers need data security training, while customer-facing staff need guidance on disclosures and fair treatment. Annual refreshers are not enough. Firms should tie training to new products, regulatory updates, and lessons from past mistakes.

Technology-Enabled Monitoring and Reporting

Manual reviews are no longer enough. Tools that capture communications, monitor personal trading, and log disclosures reduce the chance of oversight. Automated alerts allow compliance teams to intervene before minor issues escalate.

Regly embeds monitoring into daily workflows so compliance officers can spot risks early without adding unnecessary manual work.

Learn more about Regly’s advanced risk scoring →

Regular Audits and Feedback Loops

Testing controls is just as important as setting them. Internal reviews should check whether employees are following procedures and whether existing tools are effective. Findings should lead to updates in training or processes, not just static reports.

Encouraging Employee Reporting

Employees need safe channels to raise concerns. Anonymous hotlines, designated compliance contacts, and clear non-retaliation policies all support a healthier culture. Early reporting often prevents costly enforcement actions later.

—

Employee compliance is one of the most persistent challenges for fintech firms. Regulations are complex, employees face daily pressures, and even small lapses can have outsized consequences.

That’s why many companies are turning to technology to make compliance more practical. Regly was built with this in mind, drawing on more than a decade of fintech compliance expertise to automate routine tasks, flag risks, and embed compliance into everyday workflows.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.