Gifts and Entertainment Policies: Compliance Risks and Controls

Published on

Jan 15, 2026

14

min read

In financial services, small tokens and friendly gestures can carry regulatory weight. A client dinner. A bottle of wine. A pair of event tickets. Each might seem routine until a regulator asks about it.

Gifts and entertainment policies exist to draw a clear line between goodwill and undue influence. For fintechs navigating legacy frameworks, that line can get blurry fast.

Regulators care about these interactions because they can distort decision-making. A well-structured policy helps prevent conflicts of interest, controls reputational risk, and keeps firms aligned with rules that vary by regulator and business model.

This article explores how gifts and entertainment policies work in practice, what they should include, where most firms get it wrong, and how to design one that fits a modern fintech operation.

What Is a Gifts and Entertainment Policy?

A gifts and entertainment policy sets internal rules for how employees can give or receive anything of value in the course of doing business. That includes meals, tickets, holiday gifts, promotional items, travel, and any other benefit tied to a business relationship.

In regulated financial services, this isn’t just an HR guideline: it’s a compliance control. The policy aims to reduce conflicts of interest, prevent bribery, and help confirm that business decisions aren’t swayed by personal perks.

The policy usually defines gift and entertainment thresholds, approval processes, and recordkeeping requirements. It also sets expectations for transparency and appropriate behavior in client and vendor interactions.

Gifts and entertainment policies are often one component of a firm's overall employee compliance framework, covering personal trading, outside business activities, attestations, and more.

Learn how Regly’s employee compliance module can help you centralize gift and entertainment controls →

Gifts vs. Entertainment: Key Distinctions That Affect Policy Design

Not everything of value is treated equally under regulatory rules. One of the most important distinctions in any gifts and entertainment policy is the line between a gift and a business entertainment expense.

A gift is typically something of value given without the giver being present. That includes items like wine, electronics, flowers, gift cards, or event tickets.

Entertainment involves shared experiences where the giver attends. This could mean taking a client to dinner, a ballgame, a conference, or a golf outing, provided the business context is legitimate and the cost is reasonable.

See how you can draft, distribute, and manage your gifts and entertainment policies using Regly’s policy management module →

Why It Matters in Financial Services and Fintech

Regulators care about gifts because these practices can tilt judgment. When financial decisions are influenced by gifts or perks, large or small, the risk isn’t just theoretical. It’s measurable!

In regulated industries, gifts and entertainment are a proxy for bias. They can incentivize recommendations, steer business, or pressure internal teams. That’s why financial regulators treat them as a compliance priority, not a soft policy issue.

This matters even more in fintech. Most fintechs don’t operate in a regulatory vacuum. They’re broker-dealers, registered investment advisors (RIAs), money services businesses, crypto custodians, bank partners, or tech firms working with regulated entities. Each of those roles comes with different rules and real scrutiny.

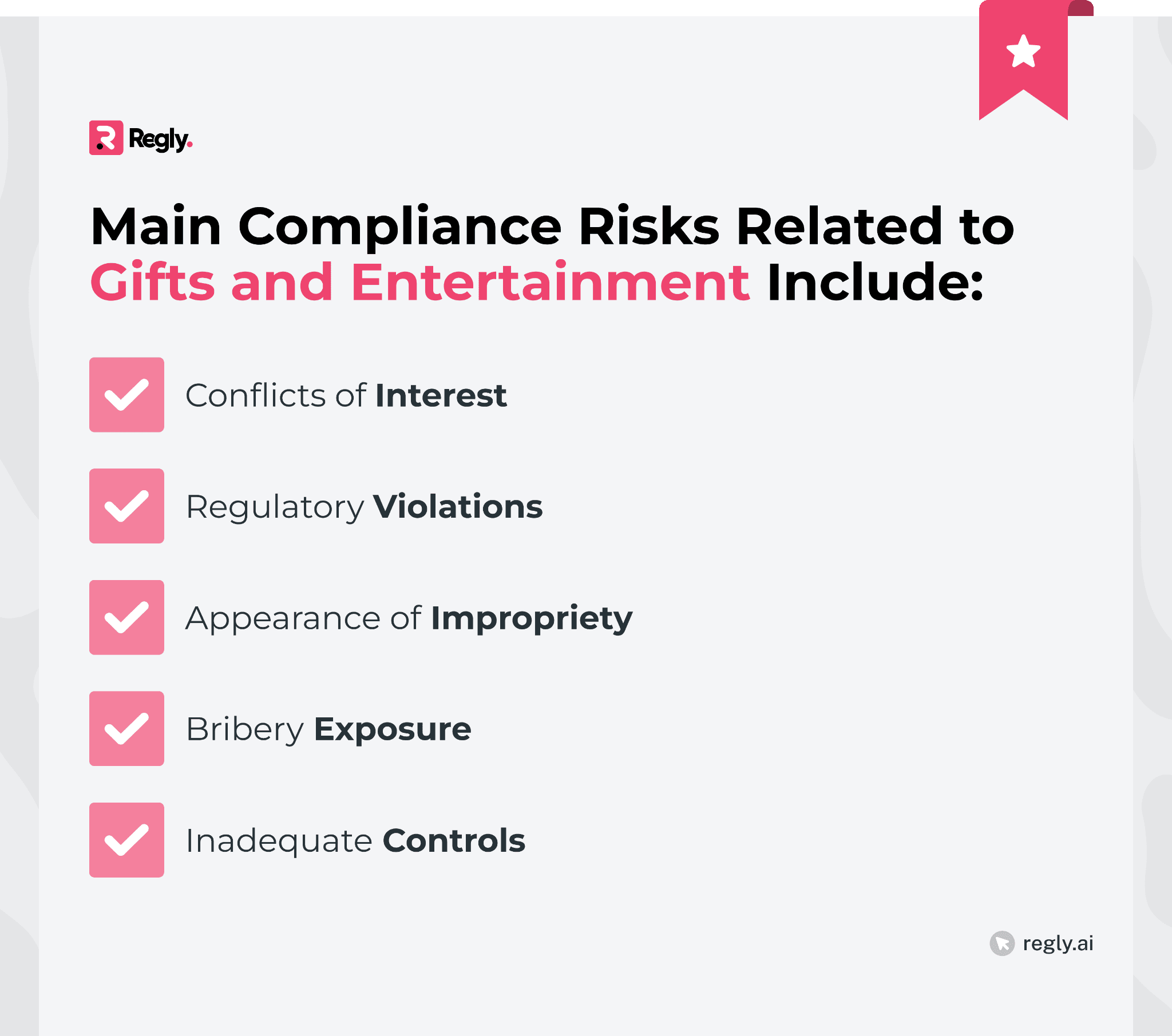

Core Compliance Risks Related to Gifts and Entertainment

Gifts and entertainment might feel like marketing or relationship-building, but regulators evaluate them as potential conflicts of interest. The bigger the perceived influence, the bigger the compliance risk.

1. Conflicts of Interest

This is the baseline concern. Gifts and entertainment can create a sense of obligation, sometimes subtle, sometimes overt. That pressure can affect judgment in vendor selection, trade routing, product recommendations, or client onboarding.

2. Regulatory Violations

The Financial Industry Regulatory Authority (FINRA), the Securities and Exchange Commission (SEC), the Municipal Securities Rulemaking Board (MSRB), and bank regulators have specific rules around gift limits, documentation, and fair dealing.

Exceeding thresholds or failing to log activity can result in easy exam findings, disciplinary actions, and real financial penalties.

3. Appearance of Impropriety

Even when no actual bias exists, perception matters.

Clients, investors, or regulators may interpret undisclosed perks as favoritism or improper influence. That perception can lead to reputational damage and a formal inquiry.

4. Bribery Exposure

Gifts that coincide with large deals, vendor contracts, or product placements can raise bribery red flags.

This includes potential exposure under additional laws like the Bank Bribery Act or even the Foreign Corrupt Practices Act (FCPA) if the recipient is a foreign official.

5. Inadequate Controls

Lack of tracking, unclear policy definitions, and inconsistent approval processes create gaps.

These are exactly what examiners probe. Without proper documentation, it’s difficult to prove that gifts and entertainment were within policy, even if they were.

If you're building or running a fintech firm, this isn’t theoretical. These risks show up in audits, regulatory exams, enforcement cases, and internal compliance reviews.

Learn more about policy management →

Which Regulators Care and What They Require

Not all regulators approach gifts and entertainment the same way. The rules depend on your business type, whether you’re a broker-dealer, registered investment advisor, bank affiliate, or municipal broker or dealer.

SEC: Fiduciary Duty and Anti-Fraud Standards

The SEC doesn’t set a fixed dollar limit on gifts or entertainment. Instead, it expects registered investment advisors to meet fiduciary obligations, acting in the best interest of clients and avoiding conflicts of interest.

Under the Investment Advisers Act of 1940, the focus is on whether a gift or entertainment benefit could bias recommendations, impair objectivity, or otherwise violate anti-fraud provisions.

Key expectations include:

Firms must adopt policies to identify and manage conflicts created by gifts, hospitality, or other benefits.

The advisor’s Code of Ethics (Rule 204A-1) should address personal benefits and the conditions under which gifts may be accepted or offered.

The SEC may scrutinize gifts or entertainment during routine exams, especially when reviewing third-party relationships (e.g., fund distribution, referral arrangements, vendor selection).

Advisors are also subject to Section 17(e)(1) of the Investment Company Act if they manage registered funds. This prohibits receiving compensation, including gifts, in connection with the purchase or sale of portfolio securities, unless it’s clearly disclosed and permitted.

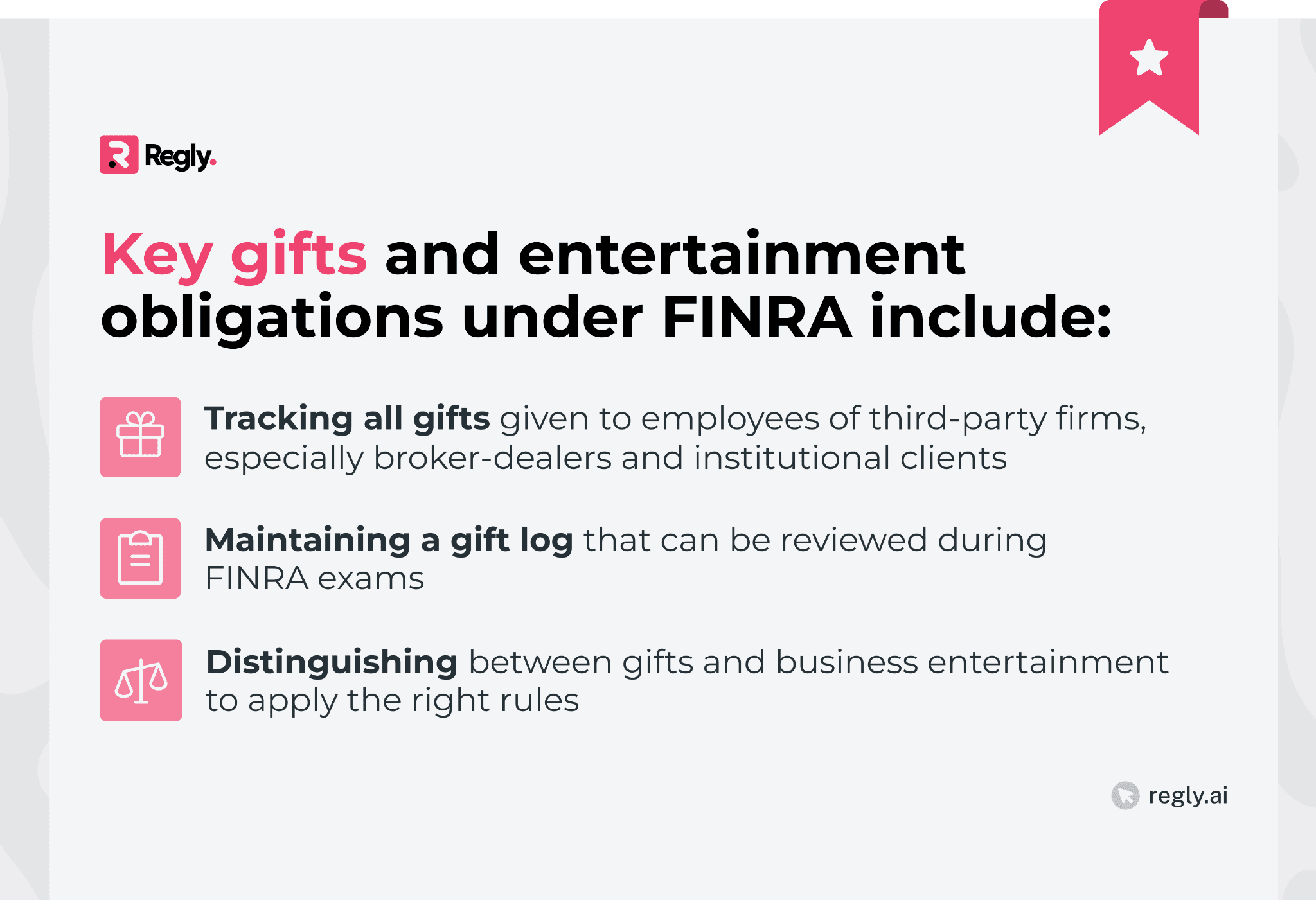

FINRA: $100 Rule and Pending Updates

FINRA Rule 3220 limits gifts from member firms (and its associates) to a maximum of $100 per person, per year, if those gifts are “in relation to the business of the recipient’s employer.” This rule has been in place for decades, and it’s currently under review.

The $100 cap applies to gifts, not entertainment. That means if you send someone a bottle of wine or a gift card, it counts. But if you host them at an event where your representative is present, it’s generally categorized as entertainment, which is evaluated under separate guidance.

In 2025, FINRA proposed increasing the gift limit to $250 or $300 per person per year, to reflect inflation and current business norms. That proposal is still pending final approval, but is likely to pass in some form.

Regardless of the dollar amount, FINRA expects firms to prevent gifts that could appear excessive, frequent, or tied to specific business outcomes. Even entertainment, while not subject to the $100 rule, can raise flags if used inappropriately or without internal oversight.

MSRB: Municipal Advisor Limitations

The Municipal Securities Rulemaking Board (MSRB) applies similar gift restrictions to those found in FINRA’s rules, but within the context of municipal securities activity.

MSRB Rule G-20 limits gifts to $100 per person, per year, if the gift is related to the municipal securities business of the recipient's employer. This applies to both municipal securities dealers and municipal advisors.

Key compliance expectations include:

Tracking gifts provided to municipal finance professionals, elected officials, or other parties tied to municipal transactions

Maintaining a log that distinguishes gifts from normal business meals or entertainment

Avoiding gifts that could be interpreted as pay-to-play or as attempts to improperly influence deal awards

MSRB rules carve out a few exceptions. “Infrequent gifts of personal nature,” promotional items of nominal value, and legitimate business entertainment are generally allowed, provided they’re not excessive or tied to specific business wins.

For fintechs operating in muni markets or partnering with regulated advisors, this rule often applies indirectly. Any perceived attempt to influence municipal decision-makers, even via hospitality, can invite scrutiny.

Bank Regulators: Bank Bribery Act and OCC Guidance

For banks and their partners, gifts and entertainment rules fall under the Bank Bribery Act (18 U.S.C. § 215). This federal law prohibits bank employees from soliciting or accepting anything of value in connection with bank business if the intent is to influence or reward official action.

Regulatory agencies like the Office of the Comptroller of the Currency (OCC), Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) expect banks to implement internal policies that reflect this standard.

The guidance allows for “reasonable” gifts and entertainment in specific circumstances, such as:

Modest business meals or occasional hospitality tied to legitimate business discussions

Gifts based on personal relationships, not business (e.g., a wedding gift between longtime friends)

Promotional items of minimal value with no strings attached

But there’s little tolerance for ambiguity. If something could appear to influence lending decisions, vendor selection, or product placement, regulators will treat it as high-risk, especially when documentation is lacking.

Fintechs working with sponsor banks, Banking-as-a-Service (BaaS) partners, or regulated lenders should understand that these institutions often flow down stricter internal gifting rules via contract. If your product touches bank business, you may be subject to controls even if you’re not directly regulated.

Regulator | Regulatory Standard | Gift Limit (Per Person/Year) | Entertainment Standard | Key Policy Focus |

|---|---|---|---|---|

SEC (RIA) | Fiduciary Duty / Anti-Fraud | None (Internal Policy Required) | Must Avoid Conflicts | Conflicts of Interest, Objectivity |

FINRA (BD) | Rule 3220 | $100 (Pending Update to $250/$300) | Must Be Reasonable & Tied to Business | Dollar Threshold, Documentation |

MSRB | Rule G-20 | $100 | Legitimate Business Entertainment | Dollar Threshold, Influence Municipal Decisions |

Bank Regulators | Bank Bribery Act | Prohibited (Internal Policy Required) | Reasonable & Modest | Influence Official Action |

Global Snapshot: Brief Comparison With FCA

The UK’s Financial Conduct Authority (FCA) doesn’t impose a strict dollar or pound limit on gifts or entertainment. Instead, FCA-regulated firms are expected to manage conflicts of interest through internal policies and oversight.

The standard is principles-based. Firms must show that any gifts or hospitality:

Are appropriate and proportionate to the business relationship

Do not impair objectivity or create improper influence

Are recorded and subject to monitoring or approval where required

Unlike FINRA or the MSRB, the FCA leaves more room for firms to define materiality and thresholds. But that flexibility comes with accountability. During supervisory reviews, firms must demonstrate that their gifts and entertainment policies are effective in practice, not just well-worded on paper.

This matters for fintechs operating in or expanding into the UK. It also matters for US firms with UK-based partners or employees, since inconsistent standards can create cross-border friction or risk.

Common Compliance Challenges

Violations usually don’t come from bad actors. They come from unclear definitions, poor tracking, or simple oversight.

The most common compliance challenges include:

Tracking Aggregate Gifts per Recipient: Most gift caps apply per recipient, not per sender. Without centralized tracking, different teams can unknowingly breach annual limits. A few small gifts from different departments can quietly add up to a compliance problem.

Confusion Around What Counts: Employees often misunderstand what qualifies as a gift versus entertainment. Items like delivered meals, digital gift cards, or logo-branded merchandise fall into gray areas. If the policy isn’t specific, people will guess, and guesses create risk.

Client-Specific Rules: Many institutional clients have their own gift acceptance policies, often stricter than regulatory limits. What’s allowed internally might still put a relationship at risk externally. Sales and business development teams need visibility into both sides before offering anything of value.

Gifting in Hybrid and Remote Environments: Remote teams often use digital perks (Uber Eats credits, mailed swag, or event vouchers) to stay connected with clients and vendors. But distributed gifting is harder to track and easier to overlook in reporting. Virtual interactions don’t exempt firms from compliance expectations.

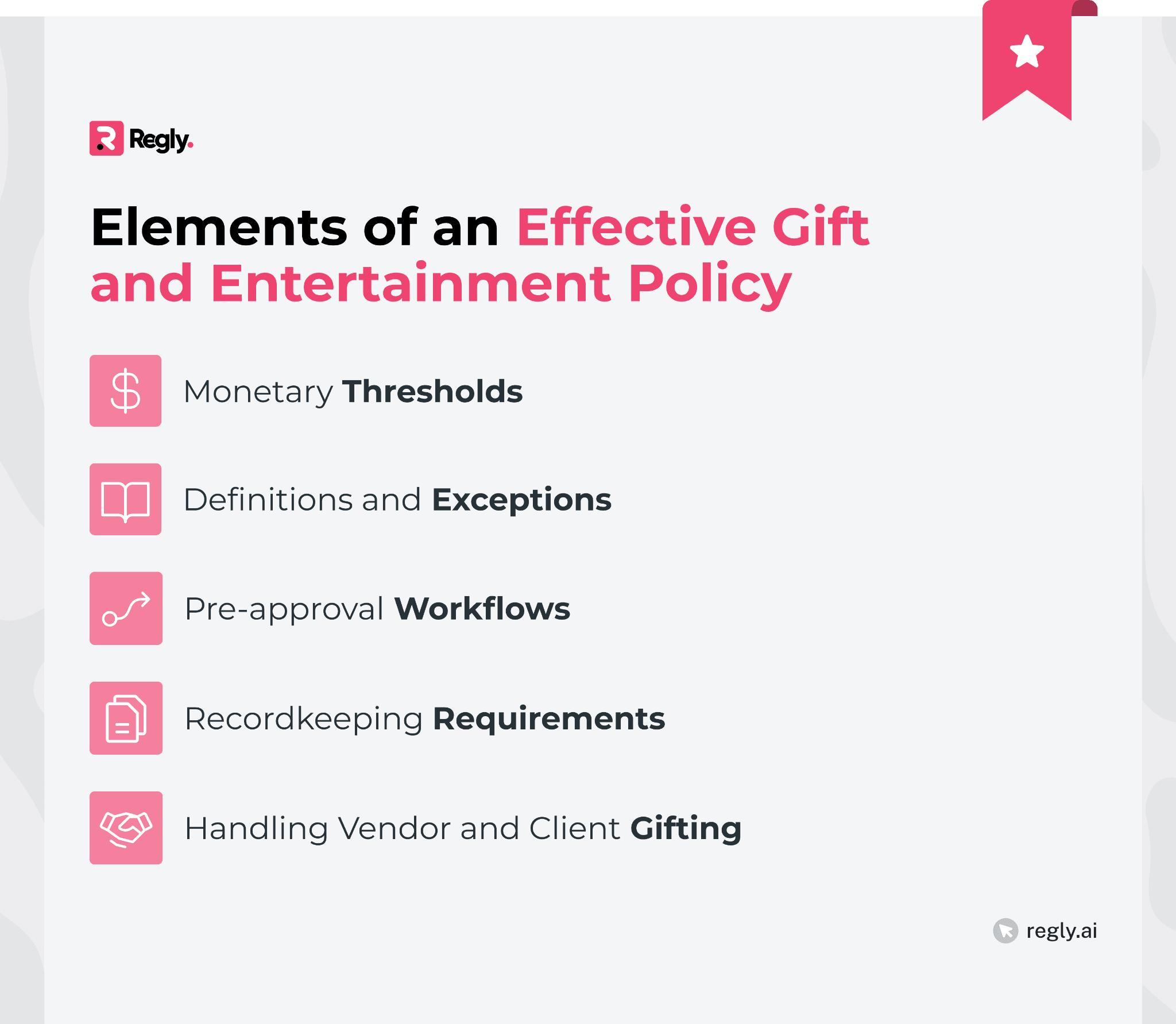

Gifts and Entertainment Policy Design: What to Include and Why

Most policies fail not because of what they say, but because of what they skip. A well-designed gifts and entertainment policy defines terms, sets limits, assigns responsibilities, and lays out clear workflows.

Monetary Thresholds

Most regulators don’t prohibit gifts outright. They expect firms to set reasonable monetary thresholds that reflect their business context and control risk.

The most common benchmark is FINRA’s $100-per-recipient annual cap, which many firms adopt as a default, even those not subject to FINRA rules. Others add stricter limits for high-risk functions like procurement or sales.

Entertainment usually isn’t subject to fixed dollar caps but should still be bound by internal guidelines. For example, firms may require pre-approval for meals over $250 or event tickets over $500, especially when clients or public officials are involved.

Definitions and Exceptions

Clear definitions help mitigate misunderstandings and enforcement gaps. Your policy should define what qualifies as a “gift,” what counts as “entertainment,” and what’s excluded from either category.

Common exceptions include:

Promotional items of nominal value (e.g., branded pens or mugs)

De minimis hospitality, like coffee or snacks during meetings

Gifts given based on personal relationships, not business context

Stating these exceptions explicitly gives employees guardrails and gives compliance teams a defensible position during audits or exams. Be cautious with gray areas like charitable donations, raffles, and holiday gifts. If they’re allowed, document how they're handled.

Pre-Approval Workflows

A gifts and entertainment policy isn’t complete without a process for approvals. Pre-approval requirements help reduce risk before gifting occurs, not after the fact when remediation gets harder.

Most firms set thresholds that trigger a manager or compliance review. For example:

Gifts over $50 may need a manager's sign-off

Entertainment over $250 may require compliance with pre-clearance

Any gift to a public official should route through legal or compliance immediately

Workflows should be documented, repeatable, and integrated into your existing tools. Whether through a ticketing system, a compliance portal, or Slack-based forms, ease of use increases adoption and auditability.

Recordkeeping Requirements

Documentation is often the difference between a clean audit and a regulatory issue. Regulators expect firms to track gifts and entertainment consistently, especially when thresholds or pre-approvals apply.

At a minimum, records should include:

The giver and the recipient

Description of the item or event

Date and estimated value

Business rationale and any approvals

Centralizing this information allows compliance teams to monitor patterns and flag outliers. Some firms integrate recordkeeping into expense tools, while others maintain separate logs managed by legal or compliance. Either approach works, as long as the data is reliable and accessible during reviews.

Handling Vendor and Client Gifting

Gift policies should cover both giving and receiving. Too many policies focus on client entertainment but overlook vendor relationships, where influence risk often runs higher.

Vendor gifts can affect procurement decisions or raise concerns about preferential treatment. Likewise, gifts from clients, especially institutional ones, can create subtle pressure to prioritize service or access.

To manage this, many firms:

Apply the same thresholds and approval rules across both client- and vendor-facing teams.

Prohibit personal gifts from vendors unless tied to a disclosed, pre-approved context.

Require escalation for anything offered during requests for proposals (RFPs), contract renewals, or pricing discussions.

Your policy should explicitly name these situations. That makes it easier for teams to act early, not after the fact.

Best Practices for Implementing a Gifts and Entertainment Policy

Best practices include more than setting limits. They cover how the policy is introduced, reinforced, and monitored in real-world scenarios.

A strong framework should include:

What Good Policy Language Looks Like

Policy language should be clear, direct, and scenario-specific. Overly broad phrasing leads to confusion and inconsistent application.

Good language anticipates real situations, not theoretical edge cases. If your policy isn’t usable in the moment, during a dinner, a vendor call, or a client handoff, it’s not effective.

For example:

“Gifts over $100 require written pre-approval from Compliance.”

“Entertainment must involve the host’s presence and a legitimate business purpose.”

Training and Cultural Reinforcement

Training isn’t just a check-the-box task. It’s how you drive behavioral alignment.

Most firms benefit from:

Role-Specific Training: Tailor content for sales, procurement, and executive teams.

Examples and Gray Areas: Walk through real or anonymized scenarios that spark discussion.

Embedded Nudges: Use prompts inside expense tools or approval workflows to reinforce thresholds and documentation steps.

Monitoring and Escalation

A policy without oversight is performative. Regulators expect firms to monitor gift and entertainment patterns and have a plan for investigating violations.

This often includes periodic audits of gift and entertainment logs (while keeping audit trails), flagging high-frequency spend or outlier transactions, and escalation paths when spending occurs outside policy.

Escalation should be proportional. For example, a missed log might trigger a coaching conversation, while a six-figure vendor gift received mid-contract could require disclosure, clawback, or disciplinary action.

When and How to Review or Revise Your Policy

As regulatory expectations evolve and your business model changes, what was once sufficient can quickly become outdated. Annual reviews create space to assess whether the policy still fits your risk profile and operational reality.

Policy changes often follow expansion into new markets, shifts in client types, or findings from audits and compliance incidents. These inflection points make it clear when existing rules no longer cover emerging risks.

To revise effectively, involve compliance, legal, and other relevant business leads from the start. The result is a policy that reflects real-world needs and one that people are more likely to follow because they had a hand in shaping it.

How Technology Improves Control and Oversight

Most policy failures come from breakdowns in execution. Manual tracking invites errors, inconsistent enforcement, and blind spots. Technology closes those gaps by making gift and entertainment policies easier to follow, easier to monitor, and harder to ignore.

Compliance Automation Platforms

Modern platforms let firms track approvals and reporting in one place. This removes the guesswork from what’s allowed and routes requests through the right internal checks.

Platforms like Regly support policy management by simplifying policy creation, distribution, and tracking.

Logging and Alerting

Gifts and entertainment tools with real-time logging and threshold alerts prevent accidental breaches. If a team sends multiple gifts to the same client, the system flags it before the limit is hit.

This helps compliance teams focus on outliers rather than manually reviewing every submission. The goal isn’t perfect foresight but visibility with enough lead time to course-correct.

AI-Assisted Monitoring

AI-enabled tools help surface behavioral anomalies and contextual risks that standard logs miss. For example, repeated spending around contract renewals, sudden spikes in vendor gifting, or high-value entertainment with no client rep present.

AI doesn’t replace judgment, but it sharpens where you look. The biggest risks often hide in patterns, not single events.

—

Gifts and entertainment policies aren’t about eliminating human interaction. They’re about putting clear boundaries around it so that goodwill doesn’t blur into risk.

For fintechs operating in regulated environments, these policies function as a frontline control. They reduce conflicts, reinforce ethical culture, and help firms pass regulatory scrutiny without friction or surprise.

The strongest policies are the ones that actually get used. That means they’re written in plain language, mapped to real-world behavior, enforced through practical workflows, and backed by smart tooling. Not every perk is a problem, but every undocumented one might be.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.