How to Create a Practical Employee Compliance Training Program

Published on

Jan 12, 2026

19

min read

Employee compliance training is one of the simplest ways to mitigate regulatory risks while running a fintech company. Keep in mind that every team touches compliance in some way. Customer support talks to users. Engineers build features that handle sensitive data. Marketing crafts messages that regulators might review later. When people understand the rules that apply to their work, the company can stay on solid ground.

Fintech teams move fast, which means risks shift just as quickly. An effective compliance training program keeps pace by giving employees clarity on what matters most so they can make confident decisions without slowing down processes.

This guide will walk you through how to build a practical employee compliance training program. You’ll learn what topics to cover, how to tailor content for different roles, and how to keep everything current as your fintech evolves.

What Is Employee Compliance Training?

Employee compliance training teaches your team how to follow the rules that apply to your business.

In a fintech company, those rules touch everything from how customer data is handled to what you can say in a marketing campaign. Training gives employees the knowledge and confidence to make good decisions in their day-to-day work.

Compliance training turns policies into plain language. Instead of long documents or legal terms, employees can get clear explanations of what they should do. It sets a shared standard across the company so people are aligned, even when teams work in different departments or time zones.

Training can take many forms. Some companies use short videos or quizzes. Others prefer live sessions or workshops for high-risk topics. The format matters less than the outcome. Employees should walk away understanding how the rules connect to their responsibilities.

Why Does Employee Compliance Training Matter for Fintech Companies?

A strong training program gives your team the context they need to handle responsibilities that come with operating in a regulated industry. Each benefit supports both daily operations and long-term growth.

It mitigates regulatory and operational risk: Fintech companies work with sensitive data, financial transactions, and consumer communications. A single misstep can trigger audits, partner reviews, or enforcement actions. Training helps employees understand the rules behind their work, which can lower the chance of avoidable violations.

It keeps teams aligned during rapid growth: Companies often hire, and responsibilities change quickly. Without structured training, employees learn rules informally or rely on outdated assumptions. A consistent program creates a shared understanding across product, customer support, engineering, marketing, and leadership.

It strengthens relationships with banks, partners, and regulators: Most partners want to know how your company manages compliance at the employee level. During due diligence, they might ask for training logs, content, or schedules. A documented program shows that your team is prepared to operate in a regulated environment.

It builds confidence and clarity for employees: People do better work when expectations are clear. Training turns complex rules into practical guidance, helping staff understand what to do, what to avoid, and when to ask for help.

It supports customer trust and brand integrity: Customers expect financial companies to protect their information and interact with them responsibly. When employees know how to follow privacy, security, and communication rules, the entire user experience becomes safer and more consistent.

Together, these elements create a foundation that helps fintech companies move quickly without exposing themselves to unnecessary risk.

What Should an Effective Employee Compliance Training Program Cover?

An effective training program teaches employees the rules that shape their daily work and connects those regulations to real situations so they know how to handle tasks responsibly. For fintech companies, that means covering several core topics to build a strong compliance foundation.

Aspect | What It Covers | Primary Teams |

|---|---|---|

AML and KYC | Red flags, verification steps, escalation | Support, onboarding |

Cybersecurity | Safe access habits, phishing awareness | All employees |

Data Privacy | Handling personal data, sharing rules | Product, engineering, data |

UDAAP and Marketing Rules | Clear claims, correct disclosures | Marketing, partnerships |

Communications & Disclosures | Approved messaging, proper documentation | Support, marketing |

Anti-Money Laundering (AML)

AML training helps employees understand how to spot and mitigate financial crime risks. It explains the red flags they might see in customer behavior, transactions, or account activity, and shows them how to escalate issues quickly.

Teams should learn the basics of your AML program, including customer identification, transaction monitoring procedures, and reporting obligations. Employees do not need to become investigators, but they should know what looks unusual and who to notify when something feels off.

Learn how Regly helps with AML Screening →

Know Your Customer (KYC)

KYC training helps employees understand why identity verification matters and how it protects the company from fraud and regulatory issues. It covers the steps required to verify customers, what information needs to be collected, and how to spot inconsistencies.

Teams should also learn when to escalate issues, such as mismatched data, suspicious documents, or repeated failed verification attempts. Clear guidance helps staff move through reviews confidently while keeping risk in check.

See how Regly’s KYC module helps customer onboarding →

Cybersecurity

Cybersecurity training teaches employees how to protect company systems and customer data in their everyday work. It covers topics like strong passwords, multi-factor authentication, safe handling of sensitive information, and how to recognize phishing attempts.

Employees also learn what to do when something feels off, whether it is a suspicious email, an unusual login alert, or a possible data exposure. Simple habits and quick reporting go a long way in preventing small issues from becoming larger problems.

Data Privacy Regulations

Privacy training helps employees understand how personal data is collected, used, shared, and stored. It explains the rules that apply to your company, like GLBA for nonpublic personal information (NPI) or CCPA for California residents, and shows teams how those laws shape their daily work.

Employees learn what counts as sensitive information, when consent matters, and how to respond to customer questions about their data. Training also covers practical habits like using the right access controls, sharing information safely, and looping in compliance before using new tools or vendors.

Fair Marketing and UDAAP

Training on fair marketing and Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) helps teams understand how to communicate with customers in a clear and honest way. It covers what counts as misleading, deceptive, or abusive, and shows employees how small wording choices can create regulatory problems.

Marketing, sales, and partnership teams also learn how to make accurate claims, use the right disclosures, and flag materials for review when something feels uncertain. This helps the company promote its products confidently in alignment with regulatory expectations.

Disclosures and Communications

This training helps employees understand when disclosures are required and how they support transparent communication with customers. It covers the types of information that must be shared, how to present it clearly, and when to involve compliance before publishing or sending anything.

Teams learn how emails, chats, marketing materials, and product messages can all create regulatory obligations. With clear guidance, employees can communicate confidently while avoiding mistakes that lead to misunderstandings or review issues later.

Ethics and Conflicts of Interest

Ethics training helps employees understand how to make fair and responsible choices when working with customers, partners, or sensitive information. The focus is on practical judgment: knowing when something feels off and understanding why certain choices protect both the company and the people it serves.

Conflicts of interest deserve their own attention. Employees need to recognize when personal relationships or outside interests might cloud their judgment at work. Training should spell out what to do when those situations come up, including who to talk to and what kinds of actions raise red flags.

It covers topics like honesty, transparency, and responsible decision-making in everyday situations.

Whistleblower Policies

Whistleblower training shows employees how to speak up when something feels wrong. It explains what kinds of issues should be reported, how the reporting process works, and what protections are in place for anyone who raises a concern.

This training helps build a culture where people feel safe bringing up problems early, whether it is a potential violation, a security risk, or behavior that puts the company at risk. When employees know where to go and what to expect, issues can be addressed before they grow into larger challenges.

Complaint Handling Procedures

Complaint handling training shows employees how to respond when a customer raises a concern or reports a problem. That means listening carefully, documenting what happened, and getting the issue to the right team for resolution.

Employees also learn why complaints matter from a regulatory perspective. Patterns in customer feedback can signal product issues, communication gaps, or operational risks. When teams know how to capture details accurately and escalate quickly, the company can address problems before they spread.

How to Tailor Employee Compliance Training for Different Roles

Different teams interact with compliance in their own ways, so training should reflect the work they actually do. Tailored content helps employees see how the rules connect to their specific responsibilities and makes it easier to apply those concepts in real situations.

Customer-Facing Teams

When creating training for customer-facing teams, focus on the situations they handle every day. Start by mapping the interactions that carry risk, such as onboarding conversations, identity verification, account troubleshooting, and complaint handling. Build short modules around each scenario so employees can connect the rules to real tasks.

Use clear examples to show what proper communication looks like. Scripts, approved phrases, and red flag indicators give employees practical tools they can use immediately. It also helps to include short exercises where they practice identifying risky statements, incomplete disclosures, or suspicious customer behavior.

Finally, give them a simple escalation path. Training should teach them exactly when to pause an interaction, who to notify, and what information to collect. The more straightforward the process, the easier it is for teams to follow it during busy customer interactions.

Product, Engineering, and Data

When creating training for product, engineering, and data teams, anchor the content in the decisions they make during development. Start by outlining the regulatory areas that affect their work, such as data privacy, cybersecurity controls, vendor management, and recordkeeping. Build short lessons that explain why these rules matter and how they influence technical design choices.

Use real examples from your product to show where risk appears. This might include how user data flows through the system, what access controls should look like, or how API integrations with partners impact compliance obligations. When developers see concrete scenarios instead of abstract rules, they understand how to apply compliance during planning, coding, and deployment.

Make escalation part of their workflow. Training should explain when to involve compliance during feature design, how to document decisions, and what to do if they discover a potential issue in testing or production. Clear checkpoints help teams flag risks early without disrupting product velocity.

Marketing and Partnerships

When building training for marketing and partnerships teams, center the content on how public claims and external relationships create regulatory exposure. Start by showing them the rules that guide promotional language, disclosures, and performance claims. Short examples of approved versus risky statements help teams understand where the boundaries are.

Walk through real materials they use every day, such as landing pages, email campaigns, social posts, and partnership decks. You should also highlight the parts that often trigger compliance review, like implied guarantees or unclear fee descriptions. This gives them a practical checklist to apply before sharing content internally or externally.

Partnership teams have their own set of considerations. Bank sponsors, payment processors, and other financial institution relationships come with specific regulatory expectations. Training should cover what needs to stay accurate, what can't be promised, and at what point in a contract discussion or integration compliance needs to be looped in.

Executives and Board Oversight

Training for executives and board members should focus on strategic responsibilities rather than day-to-day tasks. Start by outlining the company’s key regulatory obligations, major risk areas, and the decisions that require leadership involvement. This helps senior leaders understand where their oversight carries the most weight.

Use high-level examples to show how product changes, new markets, or operational gaps can affect the company’s regulatory posture. Training should highlight how their choices influence resource allocation, governance, and the tone set across the organization.

Executives also need a clear view of what information they should expect from the compliance team. This includes reports on incidents, audits, risk assessments, vendor findings, and upcoming regulatory changes. When leaders know what to look for, they can support compliance more effectively and make decisions with fewer blind spots.

What Are the Common Mistakes That Undermine Employee Compliance Training?

Even well-designed programs can miss the mark if they are not built around real workflows. These common mistakes often weaken training in fintech environments.

Training is too generic to guide real decisions: Employees may hear high-level rules without seeing how those rules apply to product builds, customer conversations, or marketing claims. Without role-specific examples, people struggle to translate the material into practical actions.

Content is overloaded and difficult to absorb: Long presentations, dense policy summaries, and back-to-back modules make it hard for employees to stay engaged. Training becomes more about checking a box than learning something they can use.

Training is treated as an annual requirement instead of an ongoing process: Fintech companies evolve quickly. When training happens only once a year, employees rely on outdated information as products, partners, or processes change. This often leads to avoidable mistakes that surface during audits or reviews.

Role differences are overlooked: A single training program for the entire company misses the specific risks tied to customer support scripts, engineering decisions, marketing language, or data handling. This creates uneven understanding across teams.

Feedback, misunderstandings, and repeated mistakes go unnoticed: If the company does not track questions, quiz results, or incident patterns, it loses the insights needed to improve training. Small gaps can grow into larger risks when they are not addressed.

No reinforcement is built into the workflow: Employees forget most of what they learn without refreshers. When training lacks follow-up, reminders, or simple job aids, the guidance fades quickly and becomes hard to apply.

How to Build a Practical Employee Compliance Training Program

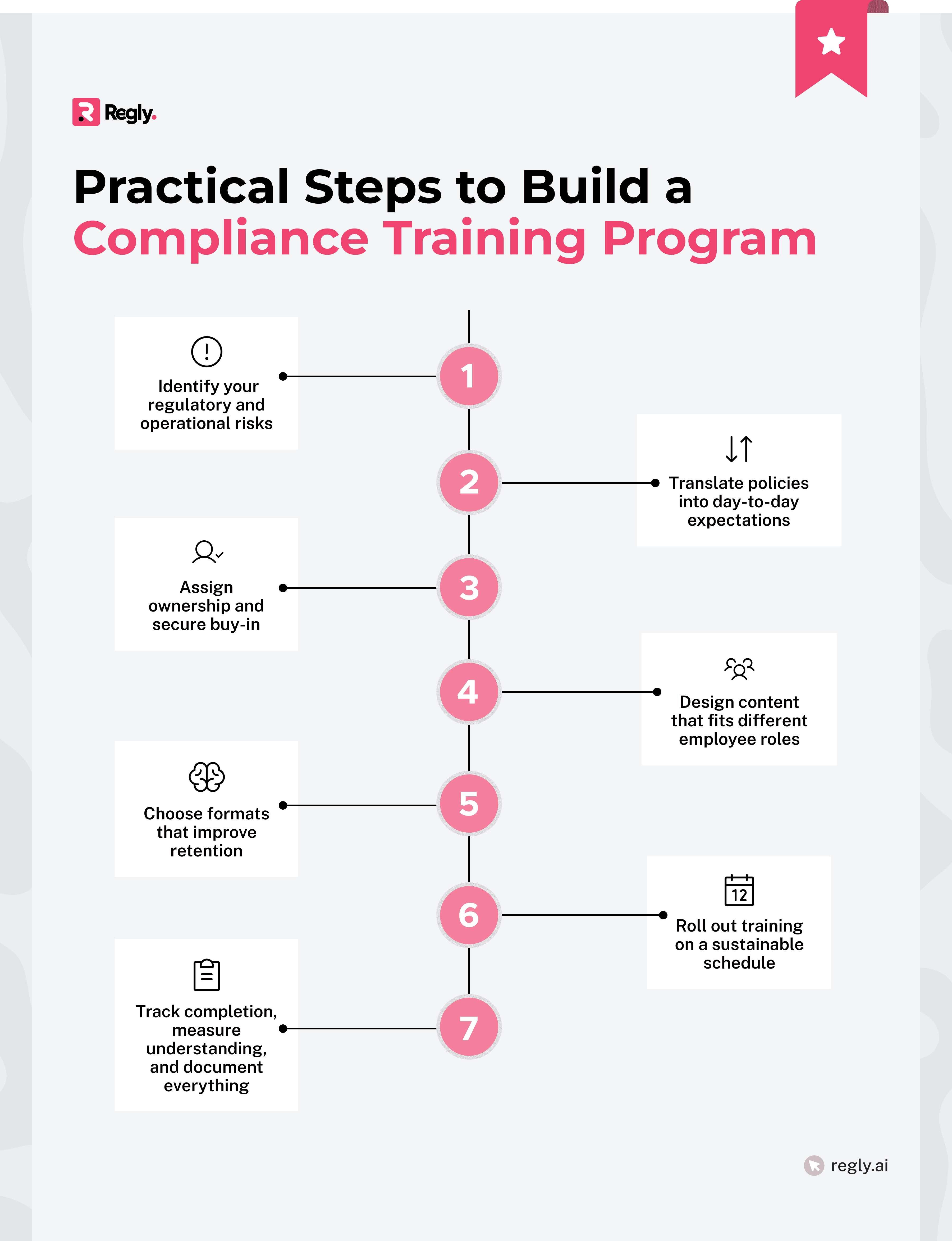

A practical training program fits into daily workflows and gives employees guidance they can use right away. The goal is to make compliance part of regular operations rather than a once-a-year obligation.

Step 1: Identify Your Regulatory and Operational Risks

Start by mapping the rules that apply to your business and the workflows where mistakes are most likely to happen.

Look at your products, customer interactions, data flows, and partner requirements to understand where risk shows up in daily work. Then talk to teams across the company to learn where they feel uncertain or where past issues have occurred. These conversations often uncover blind spots that policies alone do not show.

The goal is to build training around real risks, not assumptions. And once you have a clear picture of your regulatory and operational exposure, you can prioritize the topics that matter most and shape your training program around them.

Step 2: Translate Policies Into Day-to-Day Expectations

Policies often read like legal documents, so the first step is turning them into straightforward guidance employees can use in real situations. Break each policy into clear actions people should take, actions they should avoid, and moments when they should ask for help. Then bring those concepts to life with short examples that match your company’s real workflows.

Show customer-facing teams what proper disclosures look like, give engineers scenarios for secure data handling, and walk marketing teams through how to review claims. When employees see how the rules fit into their actual work, they are much more likely to follow them.

The goal is to make policies feel practical. If people can easily explain what the rule means for their job, you are on the right track.

Step 3: Assign Ownership and Secure Buy-In

A training program without clear ownership tends to drift. Someone needs to own content creation, updates, and completion tracking. At a small company, that might be one person. At a larger one, it's often split across compliance, HR, and team leads.

Getting managers involved early makes a real difference. When leaders understand why the training matters and how it supports what their teams are trying to do, they're more likely to reinforce it in the day-to-day. Something as simple as mentioning a training takeaway in a team meeting or nudging people to finish their modules goes a long way.

Buy-in also builds when employees see the training as something that actually helps them. Be upfront about why each module exists, keep the content grounded in real work, and connect the dots to outcomes people care about: smoother audits, fewer avoidable mistakes, and a product that doesn't create surprises down the line.

Step 4: Design Content That Fits Different Employee Roles

Different teams face different risks, so the training should reflect that. Start by grouping employees based on the tasks they handle, such as customer support, engineering, marketing, or leadership. Each group should receive content that speaks directly to the decisions they make every day.

Use real scenarios from each team’s workflow. Show customer-facing staff how to handle tricky conversations, walk engineers through data handling examples, and highlight the marketing claims that need extra care. People learn best when the material mirrors the situations they actually encounter.

Keep each module focused and easy to apply. When employees see how the training connects to their responsibilities, they stay engaged and naturally adopt safer habits.

Step 5: Choose Formats That Improve Retention

People learn better when the format matches how they work. Short videos, quick quizzes, and scenario-based exercises help employees stay engaged without overwhelming them. Live sessions can be helpful too, especially for complex topics where questions are common.

Mixing things up helps. A short video paired with a checklist, or a live session followed by a knowledge check, gives employees multiple ways to absorb and apply what they've learned.

The format should also match your team’s schedule and environment. Remote teams often do better with self-paced content they can fit around their schedules. On-site teams might get more out of occasional in-person workshops where they can talk through scenarios together. Whatever you choose, make the materials easy to find and easy to come back to later.

Step 6: Roll Out Training on a Sustainable Schedule

A good training program fits into your team’s workload without becoming a burden. Start by setting a schedule that covers onboarding, annual refreshers, and quick updates when rules or products change. This helps employees stay current without feeling overwhelmed.

Break the content into manageable pieces. Short modules that are spread throughout the year work better than long sessions that employees rush through. Smaller lessons are easier to remember and easier to keep up to date.

Finally, communicate the schedule clearly. Let teams know what to expect, how long each module will take, and where to find the training. When the plan is predictable and reasonable, participation stays high.

Step 7: Track Completion, Measure Understanding, and Document Everything

Tracking training progress is just as important as delivering it. Start by keeping clear records of who completed each module, when they completed it, and which topics were covered. This helps you show regulators, partners, or auditors that your training program is active and consistent.

Go beyond simple completion data. Use short quizzes, scenario responses, or follow-up questions to see whether employees understand the material. These insights help you identify knowledge gaps that need attention in future sessions.

Keep your documentation organized and easy to access. Store training logs, attendance records, updated content, and version histories in one place. Good documentation supports smoother audits and gives your team a clearer view of how the program is performing over time.

Tools That Support Employee Compliance Training

The right tools make it easier to deliver training, track progress, and keep materials up to date. These systems help compliance teams create a program that fits into daily workflows while staying audit-ready.

Learning Management Systems

Learning management systems provide a central place to host training, assign modules, and track completion. They help you organize content into clear paths for different roles and make it easy for employees to access materials whenever they need them.

These tools also simplify reporting. With built-in dashboards and automated reminders, compliance teams can see who has completed their training, who needs follow-up, and which modules may need refreshing. This makes the entire program easier to manage as the company grows.

Content Libraries and Microlearning Platforms

Content libraries and microlearning tools give you ready-made materials that cover common compliance topics. They help reduce the time spent creating training from scratch, especially for foundational subjects like cybersecurity, privacy, or ethics.

Microlearning platforms break information into short, focused lessons that employees can complete quickly. This format works well for busy teams and helps reinforce key concepts over time. Pairing these tools with company-specific examples gives employees both the context and the practical guidance they need.

Policy and Procedure Management Tools

Policy and procedure management tools keep your compliance documents organized and easy for employees to use. They help teams find the right policy quickly, understand the latest updates, and apply the guidance in their daily work.

Platforms like Regly support this by giving compliance teams a single place to create, update, and share policies. When a document changes, employees can see the new version right away, along with any notes or context they need. This goes a long way in helping align training materials, checklists, and workflows with current expectations.

These tools also help you track acknowledgments and maintain clean records for audits. When employees know exactly where to find policies and how to follow them, training becomes more effective and easier to maintain.

Workflow and Evidence Tools for Compliance Teams

Workflow and evidence tools help compliance teams manage tasks, track follow-ups, and collect the documentation needed for audits or partner reviews. They keep processes organized so nothing gets lost in email threads or scattered spreadsheets.

Tools like Regly support these workflows by giving teams a central place to assign tasks, record actions, and store evidence as work gets done. This creates a clear audit trail that shows how policies are followed across the company.

With organized workflows and real-time tracking, compliance teams can stay ahead of deadlines and respond faster when auditors or partners ask for proof of how programs operate.

Audit-Ready Documentation Systems

Audit-ready documentation tools help you keep records organized so you can respond quickly when regulators, partners, or auditors request information. They make it easier to store training logs, policy versions, incident notes, and evidence from daily operations in one reliable place.

Platforms like Regly support this by creating a structured environment where documents, tasks, and updates stay linked. When a policy changes or training is completed, the record is captured automatically. This gives compliance teams a clear history of what happened, when it happened, and who was involved, which makes audits and partner reviews far less stressful.

With clean, consistent documentation, your training program becomes easier to manage and much easier to demonstrate when someone asks how your compliance operations work.

Learn more about why audit trail matters in compliance →

How Can You Keep Employee Compliance Training Current and Effective?

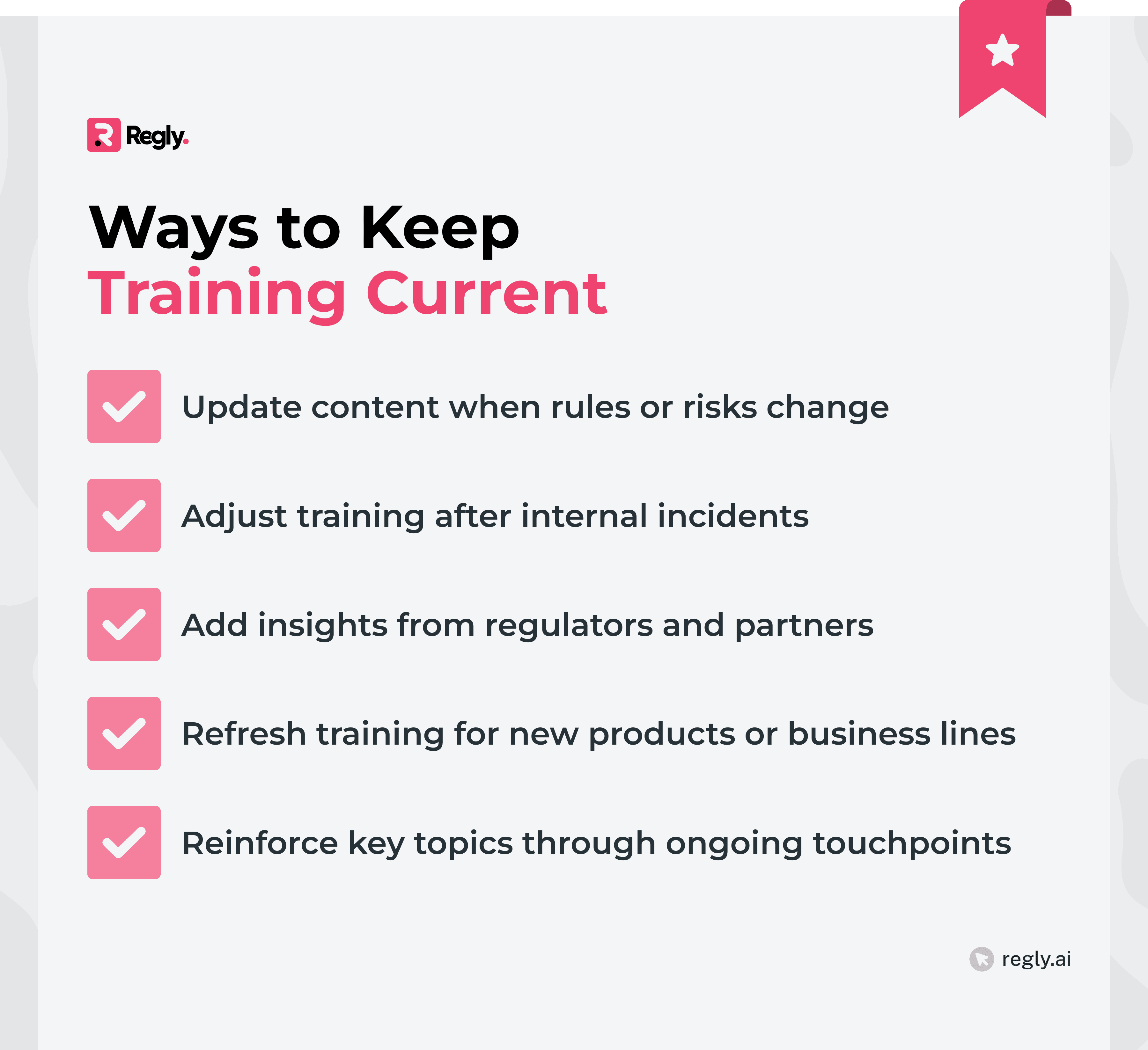

A good training program grows with your company. Rules change, products evolve, and new risks appear as the business scales. Keeping training current helps employees stay confident and aligned with real expectations.

Update Content When Rules or Risks Change

Training should evolve as your company grows and the regulatory environment shifts. When a rule changes or a new risk appears, update your materials quickly so employees stay aligned with what matters now. Short refreshers or quick announcements can help teams adjust without waiting for the next full training cycle.

Stay ahead of product updates, new workflows, and feedback from employees. These signals often reveal where changes are needed. When updates are timely and clear, employees can apply those new expectations right away.

Respond to Internal Incidents and Violations

Incidents and violations offer valuable insight into where training needs improvement. When something goes wrong, review what happened, identify the gap, and update the relevant module so employees understand how to avoid similar issues in the future.

Use real examples from your company’s experience presented in a safe and constructive way. These scenarios help employees connect the dots between training and real decisions. Quick follow-up sessions or short reminders can reinforce the lesson while the details are still fresh.

Incorporate Regulator and Partner Feedback

Feedback from regulators, auditors, and bank partners is a direct window into what they expect from your compliance program. When they highlight gaps or suggest improvements, use that input to update training so employees understand exactly what those expectations look like in practice.

Review findings from exams, partner reviews, or due diligence requests and turn the key points into simple lessons or quick refreshers. This helps your team meet the standards that matter most and reduces the chance of repeat issues during future reviews.

Align With New Products or Business Lines

As new products or features roll out, your training needs to grow with them. Each launch introduces new risks, new customer interactions, or new data flows, and employees need guidance before these changes reach users.

Work with product and engineering teams early in the development cycle. Identify the compliance touchpoints, such as new disclosures, new approval steps, or updates to data handling workflows. Turn these insights into short modules or quick updates that prepare employees to support the new offering with confidence.

Keeping training aligned with product changes helps teams move faster and mitigates the risk of surprises once something goes live.

Integrate Training Into Ongoing Compliance Operations

Training works best when it becomes part of everyday operations rather than a once-a-year event. Build simple touchpoints into your workflows, such as quick reminders during team meetings, short refreshers after policy updates, or prompts within tools employees use daily.

Make it easy for teams to revisit key topics. Store training materials, checklists, and job aids in a place where employees can find them quickly. When training supports real work in real time, employees stay aligned with expectations and feel more confident handling compliance responsibilities.

Ongoing integration also helps compliance teams spot patterns early. Questions, common mistakes, or repeated escalations can guide future updates and keep the program relevant as the company grows.

—

Employee compliance training gives your team the clarity they need to work responsibly in a fast-moving fintech environment. When training reflects real workflows and stays current with new risks, employees are better equipped to make sound decisions and support safe operations.

An effective program is built on simple principles. Keep the content practical. Tailor it to each role. Update it when your business or the regulatory landscape changes. Most importantly, make training part of everyday work instead of a one-time requirement.

Regly helps teams put these principles into practice by centralizing policies, documentation, workflows, and training support in one place. This makes it easier for compliance programs to stay organized, audit-ready, and connected to how employees actually work.

With the right structure and tools, training becomes a reliable part of your compliance foundation, not a burden. It supports growth, strengthens trust, and helps your company operate with confidence.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.