Policy acknowledgement is one of those small but powerful parts of compliance that often gets overlooked. It’s how companies confirm that employees, partners, and vendors have read and accepted the rules that govern their work. When tracked properly, it becomes proof of accountability and a key part of compliance operations.

In this article, we’ll explore why policy acknowledgement matters, who’s responsible for managing it, and how fintech teams can track it efficiently. You’ll also find examples of policies that typically require acknowledgement and practical steps for keeping records audit-ready.

What Is Policy Acknowledgement?

Policy acknowledgement is a formal way of confirming that someone has read, understood, and agreed to follow a company policy. It’s how organizations document that employees, contractors, or partners are aware of their responsibilities. In regulated fintech, it’s also how teams show regulators that key policies are not just written but communicated and understood.

Think of it as closing the loop between writing a policy and applying it. You can publish the best AML or cybersecurity policy in the world, but if no one reads or accepts it, it doesn’t count for much. Policy acknowledgement makes that connection real and verifiable.

In practice, this can be as simple as an employee clicking “I acknowledge” in a system or signing a document during onboarding. The important part is tracking it, so you know who has reviewed which policies and when.

Why Does Policy Acknowledgement Matter in Regulated Fintech?

Policy acknowledgement matters because it shows that compliance isn’t just a policy on a shelf. It’s proof that your team understands the rules and takes them seriously in day-to-day work. Here are key reasons why policy acknowledgement is essential for a strong compliance framework:

Demonstrates Effective Supervision

In a regulated fintech, supervision is only as strong as the proof behind it. When employees acknowledge key policies, it shows that management is setting clear expectations and following up.

Policy acknowledgement helps leaders confirm that guidance isn’t just shared but received. It gives compliance teams confidence that supervision efforts are documented and consistent across roles, departments, and locations.

Strengthens Internal Controls

Strong internal controls depend on people knowing what those controls are. Policy acknowledgement helps make that happen. It’s part of a broader employee compliance initiative, and it confirms that employees understand how to handle sensitive data, report issues, and follow approval processes.

When everyone signs off on key policies, it creates a shared baseline for behavior and decision-making. That clarity helps prevent mistakes and keeps operations running smoothly, even as your fintech grows.

Mitigates Legal and Operational Risk

Policy acknowledgement gives your company a record that policies were shared and understood. That record can make a big difference if questions come up during an audit or investigation.

It also helps mitigate day-to-day risk. When people know what’s expected, they’re less likely to take actions that create compliance or operational problems. It’s a small step that can protect both the business and its people.

Improves Training and Accountability

Policy acknowledgement works hand in hand with training. When employees confirm they’ve reviewed a policy, it reinforces what they learned and reminds them how to apply it on the job.

It also builds a sense of ownership. People are more likely to take compliance seriously when they’ve personally signed off on the rules. Over time, this simple step helps create a team that understands and lives by the company’s standards.

Supports Culture and Transparency

When policy acknowledgement is part of everyday operations, it signals that compliance belongs to everyone, not just the compliance or legal team. It creates an open culture where people know what’s expected and feel comfortable asking questions.

That kind of transparency builds trust inside the company. It helps employees see policies not as red tape but as shared standards that protect both the business and its customers.

Enables Faster Audit Response

Audits move faster when you can quickly show that everyone has acknowledged key policies. Clear records save time and prevent last-minute document hunts.

Having everything organized in one place also helps compliance teams answer questions confidently. It shows that policies aren’t just written but tracked, reviewed, and managed with care.

Key Policies That Require Acknowledgement

Not every policy needs formal acknowledgement, but some really do. These are the ones that shape how your team operates, protects clients, and meets regulatory expectations.

Here are some of the most common policies that require acknowledgement in regulated fintechs.

Policy Type | Who Acknowledges It | Why It Matters |

|---|---|---|

Code of Conduct and Ethics | All employees and contractors | Sets expectations for ethical behavior and professional standards |

AML and KYC Policies | Compliance, operations, and customer-facing teams | Documents understanding of fraud prevention and customer due diligence |

Information Security and Acceptable Use | All employees and contractors | Protects data integrity and defines proper system usage |

Data Privacy and Confidentiality | All employees and contractors, especially those handling client data | Reinforces regulatory compliance and customer trust |

Conflict of Interest and Personal Trading | Employees and contractors with access to sensitive financial data or client relationships | Prevents bias, insider trading, and conflicts of interest |

Role- or Jurisdiction-Specific Policies | Employees/contractors under FINRA, SEC, or international frameworks (e.g., GDPR) | Aligns responsibilities with local and functional regulations |

1. Code of Conduct and Ethics

A well-written code of conduct lays the groundwork for every decision a fintech company makes. It defines acceptable behavior, outlines what ethical judgment looks like, and connects those expectations to daily work. From handling client data to avoiding favoritism or bias, it’s the reference point for doing business responsibly.

When employees acknowledge the code of ethics, they’re not just signing a form. They’re showing that they understand the standards that keep the business trusted and ethical. It’s a simple but meaningful step that helps build a strong, responsible culture.

2. Anti-Money Laundering (AML) and Know Your Customer (KYC)

AML programs and KYC policies sit at the core of every regulated fintech. They help companies prevent fraud, detect suspicious behavior, and protect the financial system from being used for illicit activity.

When employees acknowledge these policies, it shows they understand their role in keeping the business compliant. It means they know how to verify customer identities, recognize red flags, and escalate concerns when something doesn’t look right.

In fast-paced fintech environments, these acknowledgements also help build awareness. They remind teams that compliance is also about protecting clients and maintaining trust in a highly regulated space.

3. Information Security and Acceptable Use

Information security policies protect the data that keeps your fintech running. They cover how to handle client information, manage access, and use company systems responsibly. Acceptable use policies complement information security policies by establishing clear guidelines for how employees can use company technology and systems.

When employees acknowledge these policies, they’re confirming they know how to keep information safe. That means recognizing risks like phishing emails, weak passwords, or sharing files outside approved systems.

For fintech teams, this shared awareness builds confidence. It shows that everyone plays a part in protecting data and maintaining the trust of clients and partners.

4. Data Privacy and Confidentiality

Data privacy and confidentiality policies explain how a fintech collects, stores, and protects personal information. They set the rules for handling client data safely and responsibly while meeting regulatory requirements.

Acknowledging these policies helps employees stay mindful about what information they share, where they store it, and who can access it.

For fintechs, this shared understanding builds trust with customers and partners and shows that data protection is part of everyday work.

5. Conflict of Interest and Personal Trading

Conflict of interest and personal trading policies help employees make decisions that are fair and transparent. They outline situations in which personal gain might influence professional judgment and explain how to handle them appropriately.

Acknowledging these policies helps employees recognize potential conflicts early, such as trading securities tied to company clients or sharing insider information. It reminds everyone that protecting the integrity of financial markets starts with individual choices.

For fintech firms, these acknowledgements strengthen credibility with regulators and investors. They show that the company takes ethical behavior seriously and that every team member understands their responsibility in maintaining that standard.

6. Role-Specific or Jurisdiction-Specific Policies

Not every employee faces the same compliance requirements. Role-specific or jurisdiction-specific policies fill that gap by addressing rules that apply only to specific jobs, regions, or regulatory frameworks.

For example, a registered representative may follow FINRA communication rules, while a team handling European clients must comply with GDPR standards. Acknowledging these tailored policies confirms that each person understands the obligations tied to their role or market.

For growing fintechs, these acknowledgements keep operations consistent across multiple jurisdictions. They help teams stay aligned even when regulations vary from one region or function to another.

Who Tracks Policy Acknowledgement and Who Needs To?

Tracking policy acknowledgement is a shared responsibility across several teams. Each group plays a part in making sure policies are distributed, signed, and recorded correctly. Let’s look at who typically manages this process and why their role matters.

Compliance Teams

Compliance teams usually take the lead in tracking policy acknowledgement because it ties directly to regulatory oversight. They maintain records that show who has reviewed required policies and when those acknowledgements took place.

These teams also monitor follow-ups, especially when new policies are introduced or existing ones change. Keeping this process organized helps them respond quickly to regulator or auditor requests and spot potential training gaps before they become issues.

In fintechs, where regulations evolve quickly, a structured approach to tracking helps compliance teams stay confident that every policy update reaches the right people at the right time.

HR and Legal Departments

HR and legal teams play an important support role in policy acknowledgement. HR usually handles the process during onboarding, promotions, or role changes, making sure employees review and sign the right policies at the right time.

Legal teams help craft the language of those policies so they meet regulatory and contractual requirements. They also confirm that acknowledgement records are stored properly and available if a dispute or audit arises.

When HR and legal work closely with compliance, the organization gains a stronger, more consistent framework for communicating and maintaining policies across every level of the company.

Partner Banks and Vendors

Partner banks and vendors are often part of a fintech’s extended compliance ecosystem. They may need to acknowledge certain policies to confirm alignment on security, data handling, and regulatory obligations.

Tracking these acknowledgements helps maintain transparency between your company and third parties. It shows that everyone connected to your operations understands the same compliance standards and expectations.

For fintechs that rely on banking partners or service providers, keeping these records organized also simplifies audits and strengthens relationships built on trust and accountability.

Compliance Expectations and Legal Risk in Policy Management

Regulators expect fintechs to document that policies are shared and understood. Here’s how key agencies view acknowledgement and why it matters for maintaining compliance.

1. SEC and FINRA: Employee Supervision and Recordkeeping

The SEC and FINRA both focus heavily on how firms supervise their teams. It’s not enough to have written policies. Firms need to show that employees understand them and that managers are staying involved in compliance oversight.

Policy acknowledgement helps make that visible. It shows when each person reviewed key procedures, from trading rules to communication standards. During exams, these records help firms demonstrate that supervision is part of daily operations, not just a written promise.

For broker-dealers and investment advisors, keeping acknowledgements organized also supports internal reviews. It helps identify areas where extra training or guidance may be needed before regulators ever step in.

2. BSA and FinCEN: AML Training and Attestations

Under the Bank Secrecy Act (BSA) and FinCEN guidelines, fintechs must show that employees are trained to detect and report suspicious activity. Policy acknowledgement is one way to document that this training has taken place and that team members understand their AML responsibilities.

When employees acknowledge AML policies, it creates a clear record that they know how to identify red flags, escalate unusual activity, and follow internal reporting procedures. This proof of understanding can be critical during a regulatory exam or review.

For fintech companies offering money movement, lending, or crypto services, consistent acknowledgement tracking also supports broader risk management. It helps confirm that everyone, from front-line staff to executives, shares accountability in preventing financial crime.

3. CFPB and OCC: UDAAP and Consumer Protection Policies

The CFPB and OCC focus on protecting consumers from unfair, deceptive, or abusive acts and practices (UDAAP). Fintechs are expected to show that employees understand these principles and apply them consistently in product design, marketing, and customer service.

Acknowledging consumer protection policies helps document that awareness. It shows regulators that employees know how to handle complaints, communicate clearly, and avoid practices that could mislead customers.

For growing fintechs, regular acknowledgement also strengthens internal alignment. It reminds teams that compliance isn’t separate from customer experience. It’s part of building a fair, transparent business that earns trust over time.

4. State Requirements and Money Transmitter Obligations

State regulators often expect fintechs, especially those offering money transmission or lending services, to maintain clear records of policy distribution and employee acknowledgement. Each state may have its own rules on training, disclosures, or reporting, so keeping track of who has read what becomes essential.

Acknowledging these policies helps confirm that employees understand local licensing requirements, transaction monitoring rules, and consumer protection standards. It also gives compliance teams the documentation they need when states request proof of internal oversight.

For fintechs operating in multiple jurisdictions, managing these acknowledgements in a centralized system helps reduce confusion and maintain consistency. It keeps everyone aligned with state-specific expectations while maintaining a clear audit trail.

Common Compliance Challenges in Policy Management

Even the most well-written policies lose value if they aren’t properly managed. Many fintechs struggle to keep policy acknowledgement organized, especially as teams grow and regulations evolve. Below are some of the most common issues companies face when managing policy acknowledgements and how they can impact your compliance readiness.

Incomplete Tracking and Missing Audit Trails: When acknowledgements aren’t tracked consistently, gaps appear in your records. Missing or incomplete data makes it challenging to prove who reviewed which policies, which can slow audits and weaken compliance oversight.

Outdated or Uncontrolled Policy Versions: When multiple versions of a policy circulate without proper version control, employees may acknowledge the wrong one. This creates confusion and weakens your ability to prove compliance during audits.

Inconsistent Follow-Ups and Manual Processes: Relying on spreadsheets or email reminders makes it hard to track who has signed off. Missed follow-ups can leave gaps in acknowledgement records that are difficult to catch later.

Fragmented Ownership Across Departments: When compliance, HR, and operations each manage policies separately, no one has a full view of what’s current or complete. This lack of coordination often leads to duplicated efforts or missing records.

Limited Visibility Into Policy Status and Exceptions: Without centralized tracking, it’s hard to see which employees haven’t acknowledged a policy or to identify patterns of delay. Limited visibility makes it more challenging to address risks early.

Difficulty Proving Compliance During Audits: Incomplete or disorganized records can slow down audit responses. Regulators want to see proof that policies were shared, received, and acknowledged, and they expect this information to be easily accessible.

Lack of Integration With Training and Onboarding Systems: When policy acknowledgement isn’t tied to training or onboarding, new hires might miss important requirements. Integration helps keep everything connected and makes it easier for compliance steps to happen on time.

How to Track Policy Acknowledgement Effectively

There’s no single way to manage policy acknowledgement. The right approach depends on your team size, tools, and how fast your compliance needs evolve. Here’s how different methods work in practice and what to keep in mind as you grow.

Managing Policy Acknowledgement Manually

Many fintech teams start out managing policy acknowledgement by hand. It’s simple, familiar, and doesn’t require policy management software. HR or compliance might use shared folders, spreadsheets, or email confirmations to track who has signed what.

This setup can work for a small team, but it becomes harder to maintain as the company grows. Files get lost, reminders get missed, and it’s tough to keep every version straight. When regulators ask for proof, finding the right document can turn into a long search.

If you’re using a manual system, a few habits can make it smoother:

Store all signed policies in one organized location with limited access.

Use clear file names that include the policy title and date.

Review your records regularly to keep them current.

Archive outdated policies to prevent confusion.

Manual tracking is a practical starting point, but it often signals when it’s time to look for a more structured solution.

Streamlining Tracking Through Automation

As teams grow, manual tracking starts to slow things down. Automation helps by taking care of the repetitive parts so that compliance teams can focus on higher-value work.

With an automated policy management system, employees receive reminders to review and acknowledge policies without anyone having to chase them down. Every response is timestamped and stored automatically, which keeps records consistent and easy to find later.

In Regly, for example, compliance teams can:

Upload or update policies directly in one place

Assign acknowledgement tasks by role or department

Track progress in real time with a dashboard view

Export records instantly for audits or management reviews

Automation doesn’t replace oversight; it supports it. It gives compliance officers more visibility, fewer gaps, and confidence that the right people are always working from the right version.

Centralizing Policy Data for Visibility and Control

Once policies and acknowledgements start living in different folders or systems, it becomes harder to see the full picture. Centralizing everything in one platform keeps information organized and easy to review when you need it.

A shared dashboard lets compliance, HR, and legal teams work from the same source of truth. You can quickly see which policies are active, who has acknowledged them, and where there might be gaps.

Centralized tracking also makes daily work smoother. Instead of digging through files, teams can pull reports, check acknowledgement rates, and spot overdue tasks in minutes.

Policy Acknowledgement During Audits and Exams

Audits and exams often come down to proof. Clear records that show policies were shared, reviewed, and acknowledged. Having that information organized makes the process faster, less stressful, and far more credible.

What Regulators and Auditors Typically Request

When regulators review your firm, they want evidence that compliance isn’t just written down but practiced across the team. Policy acknowledgement plays a big part in that story. During an exam, auditors often ask for:

A list of all policies that require acknowledgement and how they’re distributed

Records showing who acknowledged each policy and when

Version histories to confirm that employees signed the correct edition

Proof that updates and reissues reached the right people

Samples of how policies are communicated, such as onboarding materials or internal messages

They’re looking for signs of consistency and follow-through. A clear, organized record tells regulators that compliance is part of your culture, not something that happens only when an audit is on the calendar.

How to Prepare Documentation in Advance

Preparing policy acknowledgement records doesn’t have to be complicated. A little structure goes a long way when audits come around. Here’s how to keep everything clean and ready:

Keep everything in one place. Store all acknowledgements in a central folder or compliance system. A single source of truth saves time when you need to retrieve records.

Label clearly. Use consistent file names that include the policy title and date. For example, AML Policy_Acknowledgement_March2025.pdf.

Track the right details. Each record should include the employee’s name, the policy title, the acknowledgement date, and the version number.

Set a routine review. Check your records every quarter to confirm new hires are included and updated policies were reissued.

Archive older versions. Keep them accessible but separate from current ones to avoid confusion.

Link acknowledgements to training. If a policy is tied to a training module, record completion dates together for full context.

When these steps become part of your regular workflow, documentation feels less like a chore and more like a built-in strength of your compliance program.

Handling Exceptions and Late Sign-Offs

Even with a solid process, there will always be a few late acknowledgements or missing records. What matters is how you handle them. A clear plan keeps small issues from turning into bigger ones during an audit.

Here are a few ways to manage exceptions effectively:

Track delays right away. When someone misses a deadline, log it. Note the reason, the date you followed up, and the outcome. This creates a simple audit trail.

Send gentle reminders. Sometimes it’s just a missed email or a busy week. A friendly follow-up helps close the loop quickly.

Reconfirm after updates. If a policy changes while someone’s acknowledgement is still pending, ask them to review the new version instead of signing the old one.

Document special cases. If an employee is on leave or a vendor is being onboarded, record why their acknowledgement is delayed. Transparency helps when regulators ask questions.

Use your platform to stay ahead. Tools like Regly flag incomplete acknowledgements automatically, helping teams follow up before gaps become problems.

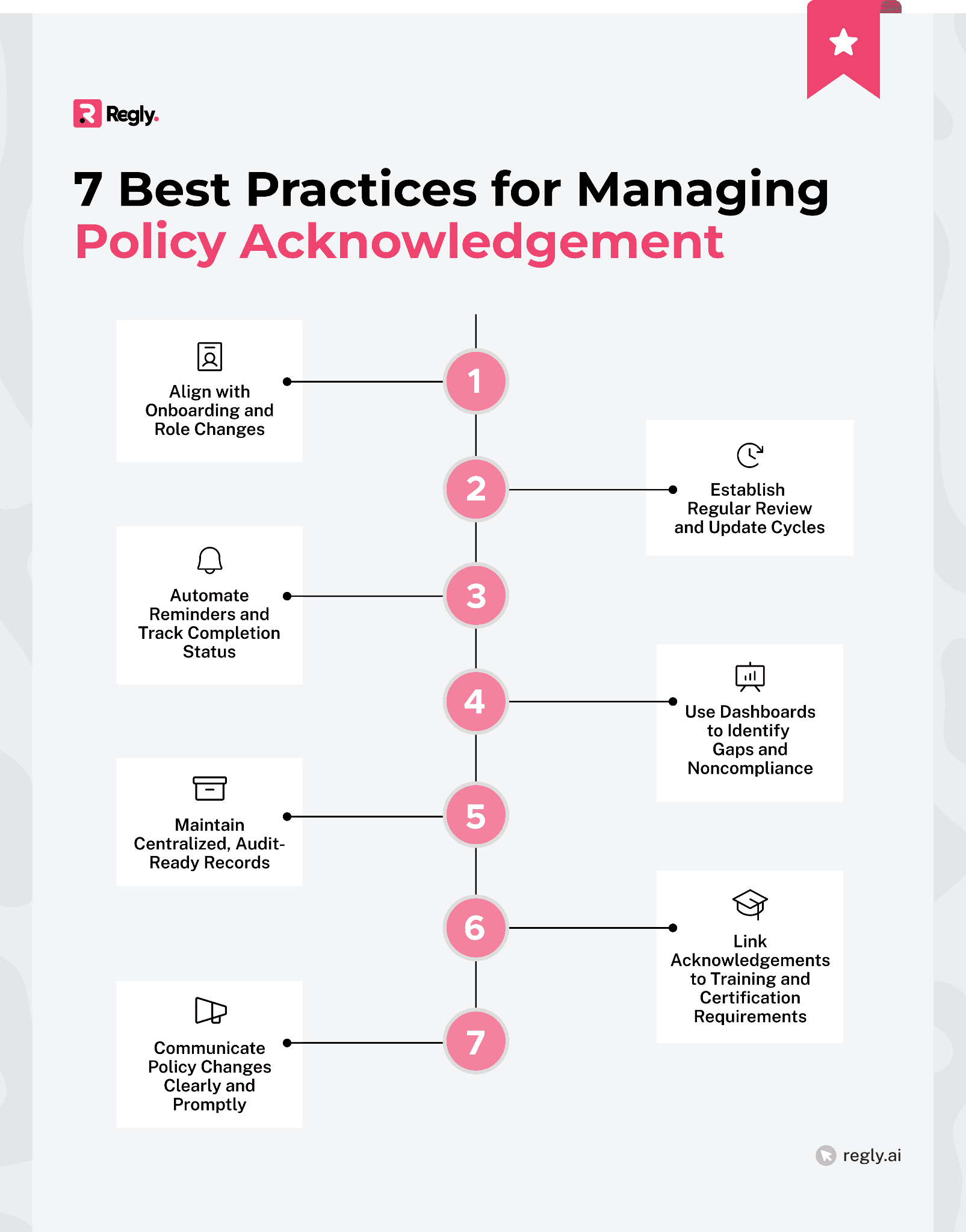

Best Practices for Managing Policy Acknowledgement

Strong policy acknowledgement doesn’t happen by chance. It comes from a few consistent habits that make tracking easier and compliance smoother. The following best practices help keep your process clear, organized, and ready for review at any time.

Align Acknowledgements With Onboarding and Role Changes

The best time to introduce policy acknowledgement is when people are already focused on learning, like during onboarding or a change in role. New hires expect to review important documents, so adding policy acknowledgements at that stage feels natural and helps set expectations early.

When employees move into new roles, especially regulated ones, have them re-acknowledge any policies tied to their new responsibilities. It’s a simple way to confirm they understand what applies to them now.

Connecting acknowledgements to these moments keeps compliance current and meaningful. It also helps new team members feel confident that they know what’s expected from day one.

Establish Regular Review and Update Cycles

Policies aren’t meant to sit untouched. Regulations shift, products evolve, and business models change. Setting a regular review cycle keeps your policies and acknowledgements relevant.

Most fintech teams review core policies once or twice a year. Others do it whenever there’s a major business change, like launching a new product or entering a new market. What matters is building a rhythm your team can stick to.

When you update a policy, reissue it for acknowledgement and clearly mark the new version. This helps everyone know which rules apply now and avoids confusion later. Regular reviews also show regulators that compliance is part of your ongoing operations, not a one-time task.

Automate Reminders and Track Completion Status

Keeping track of acknowledgements manually can get messy fast. Automated reminders make the process smoother and save valuable time. They help everyone stay on track without constant follow-ups from the compliance team.

With automation, employees get notified when it’s time to review or re-sign a policy. You can see who’s completed their acknowledgements and who still needs a nudge. The result is a process that runs quietly in the background while staying fully transparent.

Platforms like Regly make this simple. You can schedule reminders, track completion in real time, and focus your attention on the few cases that need follow-up. It’s a practical way to keep your records up to date and your team accountable.

Use Dashboards to Identify Gaps and Noncompliance

Dashboards turn policy acknowledgement data into something you can actually act on. Instead of digging through spreadsheets, you can immediately see who’s up to date, who still needs to sign, and which policies might be overdue for review.

A glance at a dashboard can reveal patterns, too. Maybe one department consistently lags behind or a specific policy causes confusion. Those insights help compliance teams focus their attention where it matters most.

Maintain Centralized, Audit-Ready Records

Centralizing policy acknowledgements keeps everything organized and easy to retrieve when you need it. Instead of searching across multiple folders or systems, you have one reliable source for every record.

A central repository should include the policy name, version, acknowledgement date, and signer information. Keeping it structured this way saves hours during audits and makes internal reviews faster.

Link Acknowledgements to Training and Certification Requirements

Policies and training work best when they go hand in hand. Linking acknowledgements to related training or certifications helps employees connect what they learn with what they’re expected to follow.

For example, after completing AML training, an employee can immediately acknowledge the AML policy. The timing reinforces understanding and makes the acknowledgement more meaningful. It also creates a complete record showing both education and confirmation.

Communicate Policy Changes Clearly and Promptly

Policies only work when people know what’s changed. Whenever you update a policy, share the changes right away and make it easy for employees to understand what’s new. Clear communication prevents confusion and keeps your team confident about what rules apply now.

Start by sending a short summary that highlights what’s different and why it matters. Pair the update with a new acknowledgement request, so you have a record showing that everyone has reviewed the latest version.

It also helps to keep old versions archived and accessible for reference. That transparency builds trust and shows that policy updates are handled with care, not hidden or rushed.

—

Policy acknowledgement might seem like a small step, but it carries real weight in compliance. It turns written policies into shared understanding and shows regulators that your team takes those responsibilities seriously.

By tracking acknowledgements consistently, reviewing policies on schedule, and keeping records organized, fintech teams build a stronger foundation for growth.

Tools like Regly make this easier by centralizing data, automating reminders, and giving compliance officers instant visibility into who has reviewed what. The result can be a smoother, more transparent process that supports accountability across the company.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.