Employee trade monitoring is one of the most important yet overlooked employee compliance functions in fintechs. It’s the process of tracking and reviewing employees’ personal trading activity to prevent insider trading, conflicts of interest, and misuse of material nonpublic information. For those operating in regulated markets, this is a regulatory expectation.

Founders and compliance officers often underestimate how early this obligation applies. Whether your firm runs a trading app, manages digital assets, or provides investment advice, regulators expect you to know what your employees are trading with sufficient supervisory proof. Failure to do so exposes firms to fines and reputational damage that far outweigh the cost of prevention.

This article explains what fintechs need to know about employee trade monitoring. It also explores how modern compliance technology can help automate monitoring tasks while keeping oversight grounded in real-world regulatory expectations.

Why Employee Trade Monitoring Matters for Fintechs

When employees have access to market-moving information or client data, even small lapses in oversight can create serious regulatory exposure.

Developers, analysts, and executives may all have access to sensitive insights about client portfolios, trading activity, or upcoming product launches. Without structured monitoring, firms risk breaches of confidentiality and, in severe cases, insider trading investigations.

Regulators expect firms to identify potential conflicts before they become enforcement cases, not after. Here’s why effective employee trade monitoring matters:

Regulatory expectation: SEC, FINRA, and other regulators require firms to track and review personal trading activity as part of supervisory obligations.

Risk management: Monitoring helps detect and prevent insider trading, front-running, and other conflicts of interest that can damage a firm’s credibility.

Cultural integrity: A clear oversight process reinforces accountability and builds a culture of compliance from the inside out.

Investor and client trust: Transparency in employee trading practices signals professionalism and responsible conduct, essential for attracting and retaining clients.

Operational maturity: A structured monitoring framework shows regulators that the firm is ready for growth and capable of scaling responsibly.

When compliance tools are designed by experts who understand how fintechs operate, trade monitoring becomes a practical part of day-to-day operations rather than an administrative burden.

What Regulators Require: The Rules That Matter

Regulatory expectations around employee trade monitoring are clear: fintechs must have systems in place to supervise personal trading activity, identify potential conflicts, and document their oversight.

The details vary by regulator and jurisdiction, but the goal is always to prevent insider trading, front-running, and misuse of confidential information.

US Overview

In the US, employee trade monitoring obligations primarily come from the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

SEC Rule 204A-1 (Investment Adviser Code of Ethics): Registered investment advisers must adopt a written code of ethics requiring “access persons,” i.e., employees with access to nonpublic client or trading information, to report their personal securities transactions and holdings. They must also obtain pre-approval before participating in IPOs or private placements.

Investment Company Act Rule 17j-1: Applies to mutual funds and similar entities. It requires firms to collect quarterly reports of personal trades, review them for potential conflicts, and maintain records for regulatory examination.

FINRA Rule 3210 (Accounts at Other Broker-Dealers): Broker-dealers must monitor accounts that employees open or maintain at outside financial institutions. Employees are required to get written consent from their employer before opening such accounts and to disclose any where they have a beneficial interest.

FINRA Rule 3110 (Supervision): Mandates written supervisory procedures to oversee associated persons, including reviews of personal trades. Weak supervision in this area has led to enforcement actions and fines against firms that failed to detect employee misconduct.

Regulators also expect firms to maintain evidence of monitoring in the form of:

Trade reports

Approvals

Account lists

Internal reviews

During exams, the absence of these records is viewed as a control failure, even if no misconduct occurred.

Global Frameworks

Outside the US, similar expectations apply under different regulatory names.

Market Abuse Regulation (MAR): The EU requires firms to prevent and detect insider trading. Employees with access to inside information, often called “persons discharging managerial responsibilities” (PDMRs), must disclose trades in the firm’s securities and refrain from trading during closed periods.

MiFID II (Markets in Financial Instruments Directive II): Mandates that firms monitor personal transactions to identify potential conflicts with client interests or unlawful behavior.

United Kingdom – FCA Personal Account Dealing (PAD) Rules: The United Kingdom’s Financial Conduct Authority expects firms to implement personal trading policies covering employees and connected persons, including disclosure requirements and restrictions on certain trades.

Monetary Authority of Singapore (MAS): Singapore encourages licensed entities to maintain internal codes of conduct and monitor personal trades to prevent market abuse.

Across jurisdictions, regulators focus less on the specific format of a monitoring program and more on whether the controls actually work. Firms must show that their compliance framework is proportionate to their operations, well-documented, and actively supervised.

Key Rules Fintechs Must Align With

Aligning internal policies with the strictest applicable standard is often the safest approach for fintechs working across markets or handling digital assets.

Here is an overview of the key rules fintechs must align themselves with when it comes to employee trade monitoring:

Jurisdiction | Primary Regulation | Key Requirement |

|---|---|---|

US | SEC Rule 204A-1 | Code of ethics; personal trade and holdings reports; pre-clearance for IPOs/private placements |

US | FINRA Rule 3210 | Disclosure and monitoring of external brokerage accounts |

EU | MAR & MiFID II | Monitoring of personal trades; insider trading prevention; reporting obligations |

UK | FCA COBS 11.7 (PAD Rules) | Policies for employee trade disclosure and restricted periods |

Singapore | MAS Guidelines on Market Conduct | Monitoring to prevent market abuse and misuse of information |

Who Falls Under Employee Trade Monitoring Policies

Employee trade monitoring isn’t limited to traders or investment professionals. Regulators expect fintechs to know precisely who within the company has access to sensitive information and to apply appropriate monitoring controls. The goal is to prevent the misuse of non-public data, no matter which department it comes from.

Most regulators use the term “access persons” to describe employees who are required to report personal trades. This group typically includes:

Portfolio managers, traders, and analysts involved in investment decisions

Employees who receive or have access to client trading data or investment strategies

Senior executives or board members with access to material nonpublic information (MNPI)

Compliance, operations, and IT personnel who can view or process confidential data

Beyond these access persons, different groups of distributed teams and third-party contractors are also covered under your employee trading policy:

Contractors and consultants: If they access internal dashboards, client systems, or development environments tied to trading data, their trades may fall under your monitoring program.

Executives and senior managers: Even if not involved in daily trading operations, they often hold insight into company strategy or upcoming launches that could impact markets.

Remote employees: Physical location doesn’t change regulatory exposure. Employees working abroad or on flexible schedules must still follow the same disclosure and monitoring requirements.

In practice, fintechs often cast a wider net. Even if an employee doesn’t directly make investment decisions, they might still handle sensitive information through data systems or client interactions. For that reason, many firms extend monitoring requirements to any employee who could indirectly access MNPI.

Common Employee Trade Monitoring Challenges

Building a reliable employee trade monitoring framework takes time, precision, and the right systems. The complexity of your framework increases as operations scale, teams diversify, and asset types expand beyond traditional securities.

Below are the five most common challenges compliance teams face and why they matter:

Tracking Trades Across Multiple Platforms and Brokerages

Fintech employees often hold multiple accounts across traditional brokerages, trading apps, and digital asset exchanges. This fragmentation makes oversight difficult.

Some platforms don’t provide automated data feeds or duplicate statements

Crypto and DeFi platforms may not support standardized reporting

Employees may forget or fail to disclose all accounts, especially if trading personally or through family members

Without centralized visibility, compliance officers risk missing trades that could create conflicts or regulatory issues. Automated data aggregation tools or integrations can reduce this blind spot, but they require thoughtful setup and regular validation.

Manual Reporting and the Limits of Spreadsheets

Many early-stage fintechs still rely on manual processes: employees self-report trades or upload statements quarterly. While simple, this approach is slow and prone to human error. Missing reports, delayed reviews, or inconsistent record formats can all weaken oversight.

Manual monitoring also tends to be reactive. By the time compliance identifies a potential issue, the trade has already happened. Moving toward automation helps compliance teams catch irregularities in real time and shift from reaction to prevention.

Limited Resources in Small or Fast-Growing Fintechs

Most fintechs start lean. Compliance teams are often small and multitasking across registration, AML, and reporting duties. As a result, personal trade monitoring can slip down the priority list.

However, regulators don’t adjust expectations for company size. Even small firms are expected to maintain supervisory records and detect potential conflicts. Partnering with compliance technology providers or consultants can help fill capability gaps without the cost of hiring an entire internal team.

Employee Privacy Concerns and Data Sensitivity

Monitoring personal trades requires access to sensitive employee information: account details, holdings, and transaction history. Some employees may be uncomfortable sharing this level of data.

Transparency helps here. Firms should clearly communicate why monitoring exists, what data is collected, and how it’s used. Written consent during onboarding, combined with secure storage and access controls, balances privacy with compliance needs.

Blind Spots Around Crypto and Decentralized Trading

Crypto and digital asset trading create new challenges for traditional compliance models. Employees can transact anonymously or across multiple wallets, often outside the reach of standard brokerage reporting.

Fintechs operating in or around digital assets should treat these activities as part of their monitoring scope. This means:

Requiring disclosure of wallet addresses or exchange accounts tied to employees

Applying pre-clearance rules to tokens or coins linked to firm activities

Training employees on how insider trading principles apply in crypto markets

Regulators have already pursued enforcement actions where employees traded on confidential token listing information. Ignoring this space leaves fintechs vulnerable to both regulatory and reputational risk.

In short, effective employee trade monitoring requires more than a policy on paper. It takes structured processes, automation where possible, and a culture that supports transparency across all asset classes and platforms.

Misconceptions Fintech Teams Often Have

Even experienced founders and compliance leads sometimes misunderstand what regulators expect from employee trade monitoring. These misconceptions can delay program development or create false confidence that existing measures are enough.

Below are five common assumptions fintech teams make and why they can be risky:

“We’re too small for regulators to care.”

Many early-stage fintechs assume that trade monitoring applies only to large or established firms. In reality, regulators hold all registered entities to the same supervisory standards.

Even with a small team, firms must maintain records of employee trades, document reviews, and demonstrate oversight during exams. Starting early helps avoid expensive retroactive fixes when the firm scales.

“Good people don’t need monitoring.”

Hiring trustworthy employees doesn’t replace the need for structured supervision. Even honest team members can accidentally violate internal policies, for instance, trading during a blackout period or forgetting to pre-clear a transaction.

A documented monitoring process protects both the firm and the employee by detecting potential issues before they escalate.

“Crypto trading isn’t a compliance concern.”

Some fintechs treat digital asset trading as separate from traditional compliance requirements. However, regulators increasingly view crypto activity through the same lens as securities trading.

Employees who trade tokens or coins based on non-public information about listings or partnerships can trigger insider trading or market manipulation allegations. Including crypto activity in trade monitoring frameworks is now considered best practice.

“Only firm stock or client assets matter.”

Employee trade monitoring isn’t limited to the company’s own shares or directly managed products. It extends to any personal trade that could create a conflict of interest or the appearance of one.

That includes securities of business partners, competitors, or assets discussed in internal research or client reports. Firms that monitor only direct holdings leave major gaps in their compliance oversight.

“We’ll fix problems when they happen.”

A reactive approach is risky. Regulators expect firms to prevent and detect potential conflicts, not just address them after the fact. Waiting until a violation occurs can lead to both financial penalties and reputational harm.

Implementing proactive measures like pre-trade approvals and automated alerts shows regulators that the firm is managing compliance actively, not retroactively.

Recognizing and correcting these misconceptions early helps fintechs build compliance programs that are practical, credible, and scalable instead of reactive responses to regulatory pressure.

How to Build a Strong Employee Trade Monitoring Program

An effective employee trade monitoring program combines policy, process, and technology. For fintechs, the goal is to make compliance part of everyday operations rather than a separate or reactive function.

The following six steps outline how to build a program that meets regulatory expectations while remaining practical and scalable.

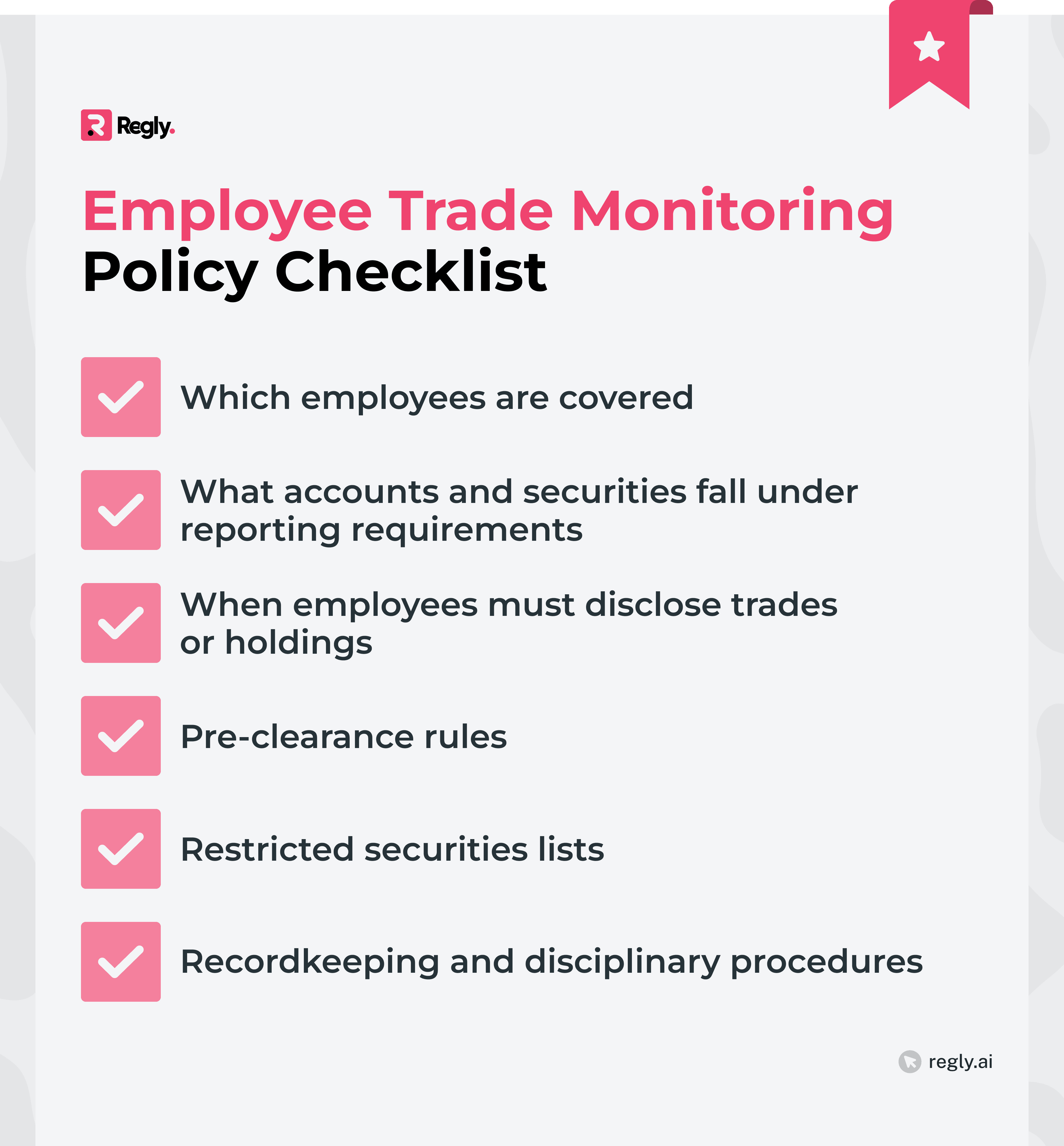

Step 1: Create a Clear Personal Trading Policy and Code of Ethics

Every monitoring framework starts with a written policy. This should outline:

Which employees are covered (“access persons”)

What accounts and securities fall under reporting requirements

When employees must disclose trades or holdings

Pre-clearance rules and restricted securities lists

Recordkeeping and disciplinary procedures

The policy should also include your firm’s Code of Ethics, which defines standards of conduct, handling of material nonpublic information (MNPI), and expectations for compliance with applicable regulations. Firms registered with the SEC or FINRA are required to have these written policies in place.

Step 2: Identify Access Persons and Assign Risk Tiers

Not all employees pose the same level of risk. Segment staff into tiers based on their access to client data, internal systems, or confidential financial information.

High-risk roles: Traders, portfolio managers, analysts, executives, and developers with access to client or trade data.

Medium-risk roles: Operations and compliance personnel who process trade information but don’t make investment decisions.

Low-risk roles: Administrative or support employees with no access to MNPI.

This risk-based approach helps compliance teams focus resources where they matter most.

Step 3: Require Disclosure of All Personal and Household Accounts

Regulators expect firms to know where employees trade. Require all covered individuals to disclose any account where they or their immediate family have a beneficial interest. This includes:

Brokerage and investment accounts

Robo-advisor or trading app accounts

Crypto wallets and exchange accounts

Obtain this information during onboarding and update it at least annually. For broker-dealers, FINRA Rule 3210 specifically mandates prior written approval before employees open outside accounts.

Step 4: Set Up Pre-Clearance and Restricted Lists

Pre-clearance allows compliance teams to review proposed trades before execution. This is one of the most effective preventive controls for avoiding conflicts of interest.

Require employees to submit pre-trade requests for securities on a watch or restricted list

Deny or flag trades involving securities where the firm holds confidential information or client positions

Set expiration windows for approvals (for example, 24-48 hours)

Maintain a restricted list that includes issuers the firm advises, assets under review, or securities linked to MNPI. Keep this list updated and confidential within the compliance team.

Step 5: Use Technology to Automate Trade Monitoring and Alerts

Manual oversight isn’t sustainable as a fintech grows. Teams can use compliance software to collect, review, and flag trades automatically. Modern tools can:

Aggregate data feeds from multiple brokerages or exchanges

Detect trades in restricted securities

Generate alerts for late reporting or suspicious activity

Produce audit-ready reports for regulators

Platforms like Regly, built by compliance professionals with fintech experience, automate these processes while maintaining flexibility for evolving regulatory needs. Automation saves time and mitigates the risk of human error, letting teams focus on analysis instead of data gathering.

Step 6: Maintain Thorough Records and Periodic Compliance Reviews

A strong employee trade monitoring program isn’t static. Recordkeeping is critical. Keep evidence of:

All employee account disclosures

Trade reports and approvals

Reviews and follow-up actions

Training and policy acknowledgments

Conduct internal reviews at least annually to assess the program’s effectiveness. Review whether controls are keeping pace with business growth and regulatory updates. Document these reviews since regulators often ask for proof of self-assessment during exams.

Using Technology to Automate Employee Trade Monitoring

Manual trade tracking may work for a small team, but it quickly becomes unsustainable as a fintech scales. The volume of trades, number of accounts, and complexity of reporting requirements grow too fast for spreadsheets or email-based approvals to keep up.

Technology bridges that gap by automating monitoring, reducing manual work, and improving accuracy across the board.

What Effective Automation Looks Like in Practice

Modern compliance automation tools simplify what used to take days or weeks. A strong platform should:

Centralize account and trade data from all brokerages, trading apps, and digital asset exchanges

Flag potential issues automatically, such as trades in restricted securities or late reports

Record every approval, review, and exception for audit readiness

Streamline communication between compliance teams and employees, reducing back-and-forth over disclosures

Automation turns monitoring into a continuous process rather than a quarterly scramble. Instead of chasing missing reports, compliance teams can focus on investigating actual risks.

Features to Look For in Modern Compliance Software

When evaluating trade monitoring solutions, fintechs should prioritize:

Integration capabilities: The ability to connect with multiple brokers and platforms

Flexible reporting: Customizable dashboards and exportable compliance reports for regulators

Automated reminders: Notifications for overdue submissions or pending approvals

Role-based access: Permissions that protect sensitive employee data while maintaining transparency

Scalability: Systems that can adapt as new asset types or business lines are added

The best solutions combine automation with configurability, allowing compliance officers to tailor workflows to their firm’s structure and regulatory exposure.

How Regly’s Expert-Built Platform Supports Scalable Oversight

Regly was designed by compliance professionals who have worked with over 100 fintechs. The platform reflects real regulatory workflows instead of relying on generic automation. It helps compliance teams manage employee trading oversight efficiently by:

Tracking employee trading activity and outside financial accounts in one place

Assigning and managing forms, attestations, and disclosures with just a few clicks

Automating reminders and completion tracking to close gaps in employee reporting

Using an AI form builder that allows compliance teams to describe a form in plain language and instantly generate a template for review

Balancing Automation with Compliance Judgment and Context

Automation can enhance efficiency, but it doesn’t replace the need for professional oversight. A compliance officer’s experience is still essential to interpret alerts, assess context, and make informed decisions.

The most effective fintechs use automation to handle repetitive tasks while keeping human review for areas that require judgment, like approving restricted trades or investigating anomalies. This balanced approach makes compliance both scalable and credible:

Compliance Function | Best Handled by Automation | Best Handled by Compliance Officers |

|---|---|---|

Trade data collection | Aggregating trade data from multiple brokerages and exchanges | Verifying completeness of data feeds and resolving exceptions |

Account disclosures | Sending reminders and tracking completion automatically | Following up with employees who fail to disclose or clarify ownership |

Trade reviews | Flagging trades in restricted securities or outside pre-clearance windows | Assessing whether a flagged trade truly presents a conflict of interest |

Recordkeeping and reporting | Generating and storing audit-ready reports | Deciding what documentation to highlight during regulatory exams |

Form management | Assigning and collecting attestations or certifications at scale | Reviewing and approving policy updates or exception requests |

Issue escalation | Triggering alerts for late filings or potential breaches | Investigating root causes and determining corrective actions |

Best Practices for Fintech Compliance Teams

Building a compliance culture around employee trade monitoring takes more than having the right policy or technology. It requires consistent execution, ongoing education, and collaboration across departments.

The following best practices help fintech compliance teams maintain control while staying adaptable to growth and regulatory change:

Move from Reactive to Proactive Monitoring

Many fintechs begin with a reactive approach of reviewing trades after they’ve happened or responding only when issues arise. Proactive monitoring changes that.

Use pre-trade clearance to stop potential conflicts before execution

Apply automated alerts to catch exceptions in real time

Conduct periodic pattern reviews to detect recurring behaviors that might signal emerging risks

Regulators increasingly expect early detection and documented preventive action. Shifting from reaction to prevention also demonstrates maturity during audits and exams.

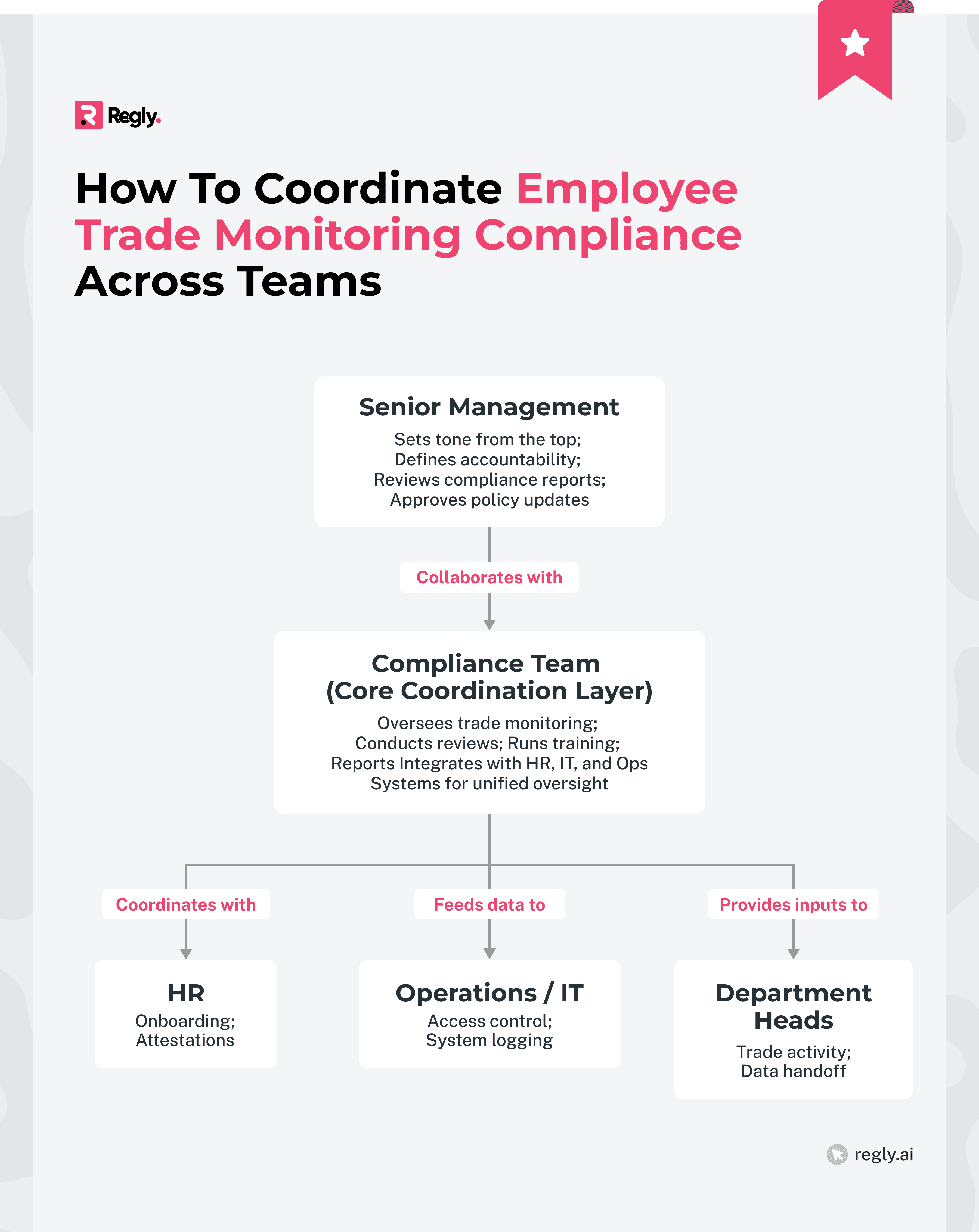

Coordinate Between Compliance, HR, and Operations

Employee trade monitoring is most effective when it’s integrated into broader business processes.

Work with HR to include disclosure obligations in onboarding and exit checklists

Partner with operations and IT to control system access and data visibility for employees who handle client information

Align with senior management to maintain tone-from-the-top support for compliance priorities

Cross-functional coordination helps prevent policy gaps and reinforces that compliance is part of every team’s responsibility, not just the compliance department’s.

When fintechs follow these best practices consistently, employee trade monitoring becomes a scalable, reliable function that protects both the firm and its reputation while keeping compliance aligned with business growth.

Schedule Regular Internal Audits and Attestation Cycles

Routine internal reviews keep the program healthy. These reviews don’t just confirm that procedures exist; they verify that they’re actually being followed.

Conduct quarterly reviews of pre-clearance logs, disclosures, and restricted lists

Use employee attestations to confirm understanding and compliance with the Code of Ethics

Track results in a central repository for easy reference during regulatory exams

Technology platforms like Regly make this process more efficient by automating form distribution and collecting attestations in bulk, helping compliance officers focus on analysis instead of administration.

Train Employees and Reinforce Ethical Culture

Policies work only when employees understand them. Regular training helps staff recognize what counts as MNPI, when to pre-clear trades, and how reporting timelines work.

Incorporate compliance training into onboarding for new hires

Schedule annual refreshers or brief policy updates as regulations evolve

Use practical examples and anonymized case studies from the fintech sector to make training relatable

A culture that values transparency reduces the likelihood of accidental breaches. When employees see compliance as part of doing business, adherence improves naturally.

Key Takeaways

Employee trade monitoring is now a critical aspect to safeguard your business. When employees have access to market-sensitive information, firms must know how that information is handled and where potential conflicts could arise.

A strong trade monitoring framework combines three things: clear policies and codes of ethics, efficient processes, and modern technology that automates routine work and leaves no page unturned.

That’s exactly where Regly fits in. Built by compliance professionals with over a decade of fintech experience, Regly’s platform brings together policy management, form tracking, and personal trading oversight in one place. That means firms like yours spend less time chasing reports and more time building a business that regulators, investors, and clients can trust.

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.